Go Back

FAQs

-

To date I have been unable to upload STP from my MYOB data file and I have lodged a request for this to be checked yet I have not been advised that this is now available.

Import MYOB file development is under process.

-

Is the employee YTD financial information stored online on the GovReports server or simply passed on to the ATO?

YTD financial information will be transmitted to ATO. However, for future reference and reconciliation, data will be stored in a secure hosting server for five years.

-

Are you planning on releasing a desktop version of IAM Payroll for small business?

No, IAM is a cloud based system which means it can be accessed anywhere any time via any device.

-

What does the full IAM cost?

We offer 3 flexible options based on your needs, IAM-STP, IAM- Business and GovReports Lodgment Platform. Visit our page https://www.govreports.com.au/stp/ for more details.

-

Has there been, or will there be a webinar for agents?

We have conducted few STP webinars for Agents, Micro and Small Business and we plan to have several webinars based on the requests. The recordings of our previous webinars are available which you can watch at your convenience. Click here.

-

Whilst I'm small and not micro business. What constitutes micro and are they exmpt from STP reporting?

Any business with 20 or less employees have STP reporting obligation from July 2019.

-

Would you give the pricing?

It depends whether you are a business or an Agent and your needs. Our STP subscription packages start as little as $8.25 per month. Click here.

-

Is there anywhere I can have practice of STP reporting?

We have free trial version until June 30, 2019. Visit this link https://www.govreports.com.au/stp/

-

What about Paid Parental leave?

Parental leave paid by the employer has to be reported.

-

I was advised that GovReports IAM - STP is not ready to be launched yet until next month?

IAM-STP is ready to use and you can lodge directly to ATO. We also provide a trial version until June 30 from the date you register.

-

What gateway do you use and is the information encrypted for security?

Data submitted are encrypted and transmitted through a secure hosting server. ISO standards maintained to transmit the data via SBR2 gateway.

-

Any CPE points associated with the webinars you conduct?

We can send certificate of attendance to you to get CPE points.

-

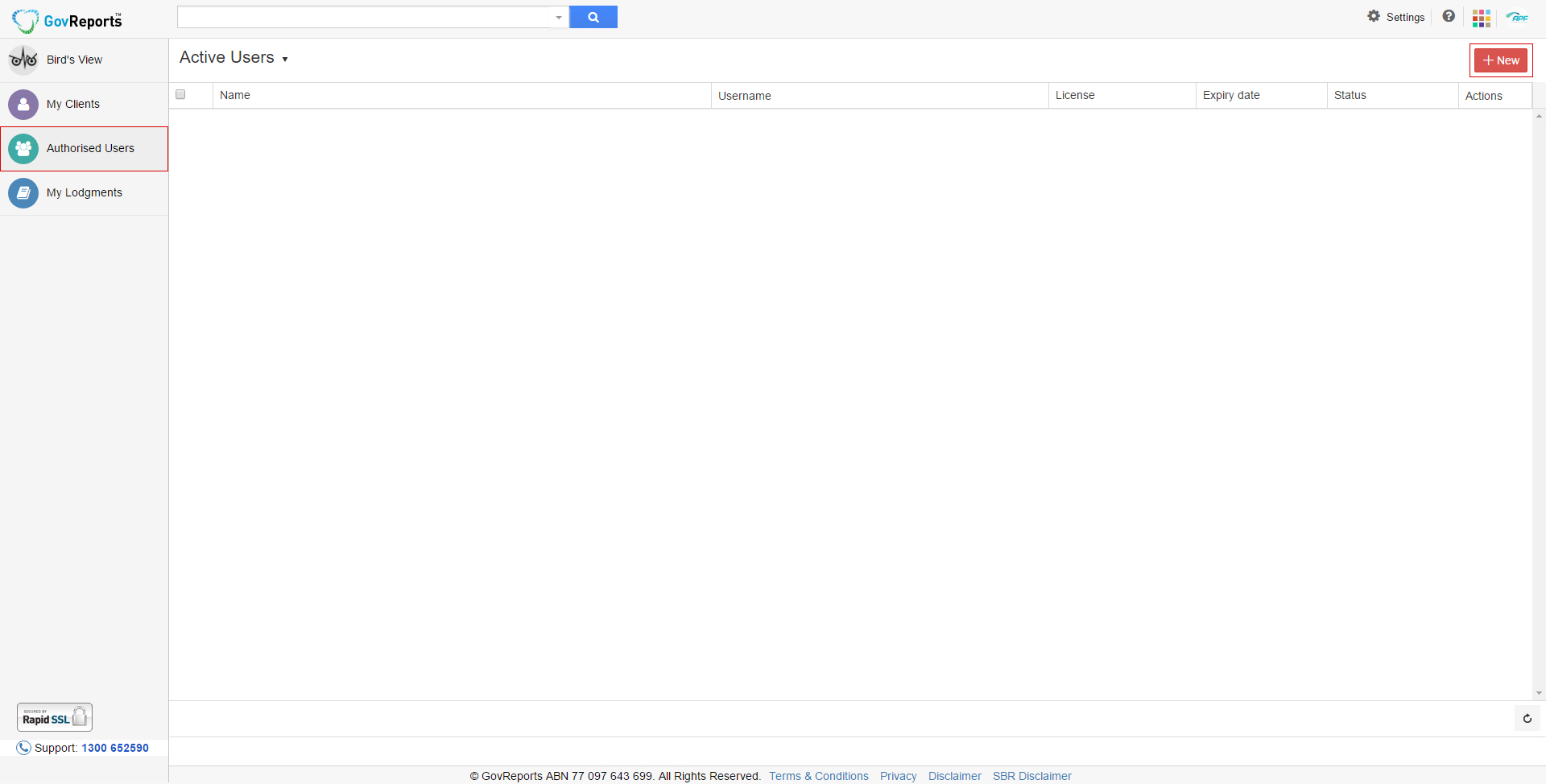

Hi, as a BAS Agent, am I able to register and complete STP reports for multiple clients?

Yes, you can.

-

Pricing for small businesses using it themselves and pricing for Accountants who will lodge on their behalf?

Please refer to our 'Plans and Pricing' here https://www.govreports.com.au/#Pricing.

-

Is it mandatory for the Award be noted on the employees payslip?

It is not mandatory. There is no provision to put the awards.

-

Do you have to enter every pay into I AM Or can you just enter quarter figures?

Every pay has to be reported whenever you are in a Payroll event.

-

Can we access a demo account?

Yes, we have a demo training account for IAM-STP and IAM-Business. Visit this link to try our demo account of your choice https://www.govreports.com.au/stp/.

-

Are there bank feeds on IAM ledger?

There are no bank feeds in IAM Ledger subscription. But it is available in IAM Business subscription.

-

If a client has closely held employees as well as standard employees, how do you enter?

The payments made while running a Payroll Event has to be reported in STP irrespective of closely held employees or standard employees.

-

Further to my question - directors only take out the wage when money is available?

Director payments need to be reported as long as it is in Pay run.