Go Back

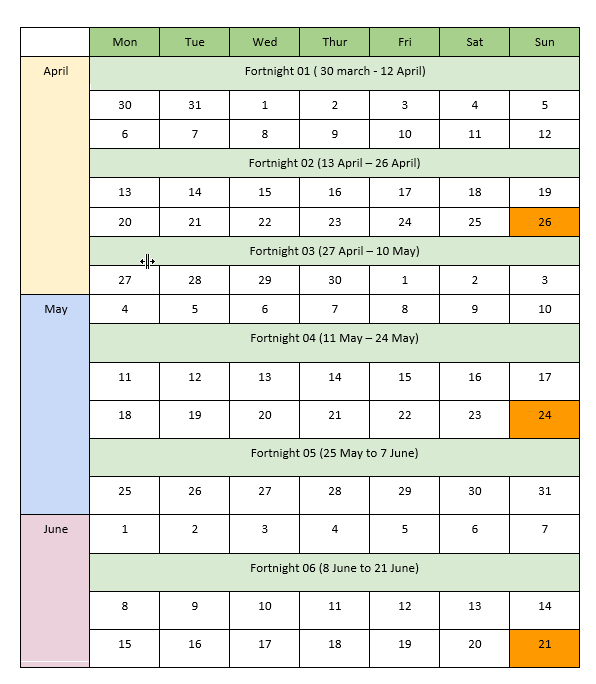

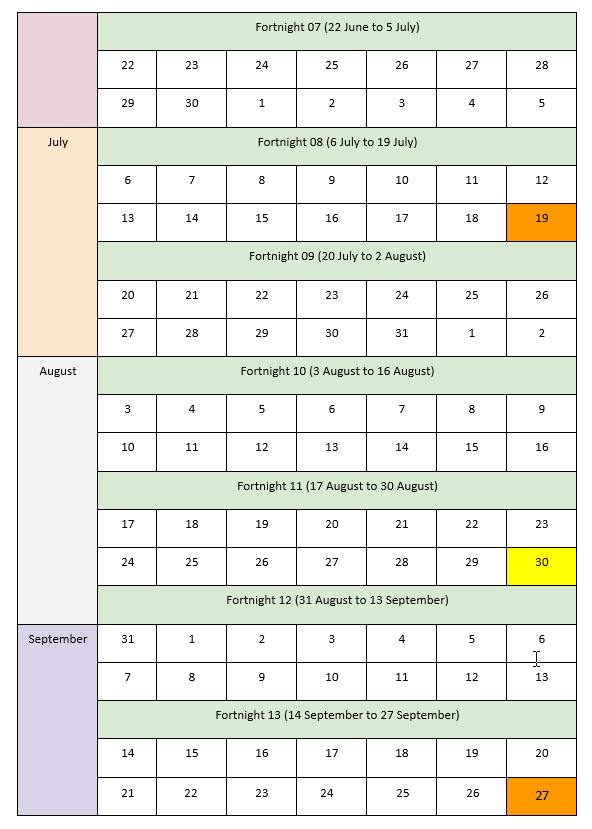

JOBKEEPER-START-FNXX where "XX" refers to the fortnightly periods from which the payment first started. For example, JOBKEEPER-START-FN01 to indicate the payment applies from the 1st (30/03 to 12/04) of the 13 JobKeeper fortnights. It indicates the first JobKeeper fortnightly period for which the subsidy is payable.

JOBKEEPER-FINISH-FNXX where "XX" refers to the first fortnightly period to which the payment no longer applies. For example, if an employee ceases working on 04/06, then JOBKEEPER-FINISH-FN06 indicates the 6th of 13 JobKeeper fortnights was the first fortnight for which the subsidy will not be reimbursed to the employer. The allowance amount should be reported as zero. It indicates any exit of eligibility or termination of the employee.

JOBKEEPER-TOPUP The JobKeeper payment is a minimum amount of $1,500 per fortnight. It applies equitably to all employees, regardless of any factor. Some employees may receive no additional top-up as they are paid in excess of these amounts. Others may only see a small top-up, whilst some may see a substantial increase in their pay. It cannot apply to terminated employees. The top-up payment must be passed onto the employee and this will be visible in the STP Pay Event reports.

ATO has introduced tier rates for eligible employees

https://www.ato.gov.au/General/JobKeeper-Payment/payment-rates/

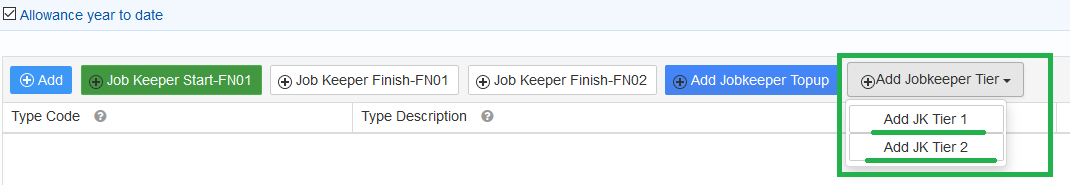

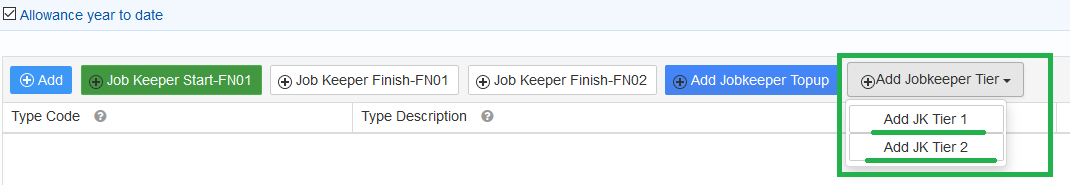

Add Jobkeeper tier for all eligible employees and eligible business participants under allowances section

From 28 September 2020, you must do all of the following:

To claim for fortnights in the JobKeeper extension:

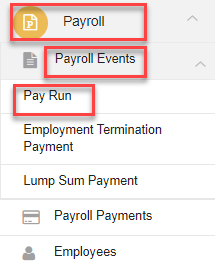

To prepare STP payroll events with JobKeeper payment entries by preparing the payslip

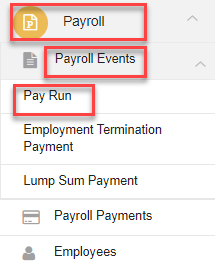

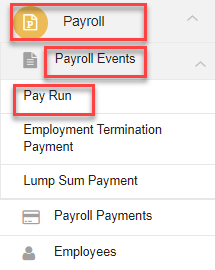

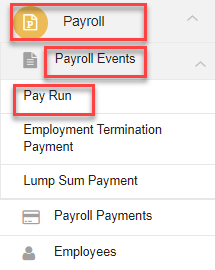

1. From the menu bar on the left, go to Payroll -> Payroll Events -> Pay Run

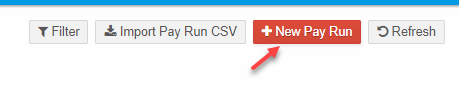

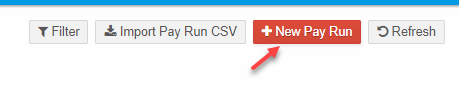

2. Select "New Pay Run" on the top right corner

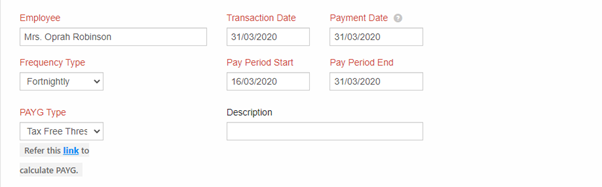

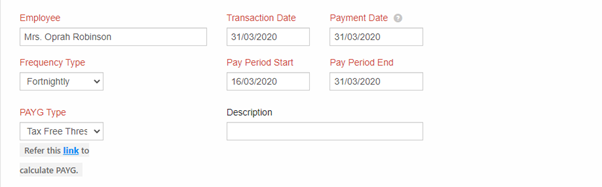

3. Complete the Employee Basic details and Wage details :

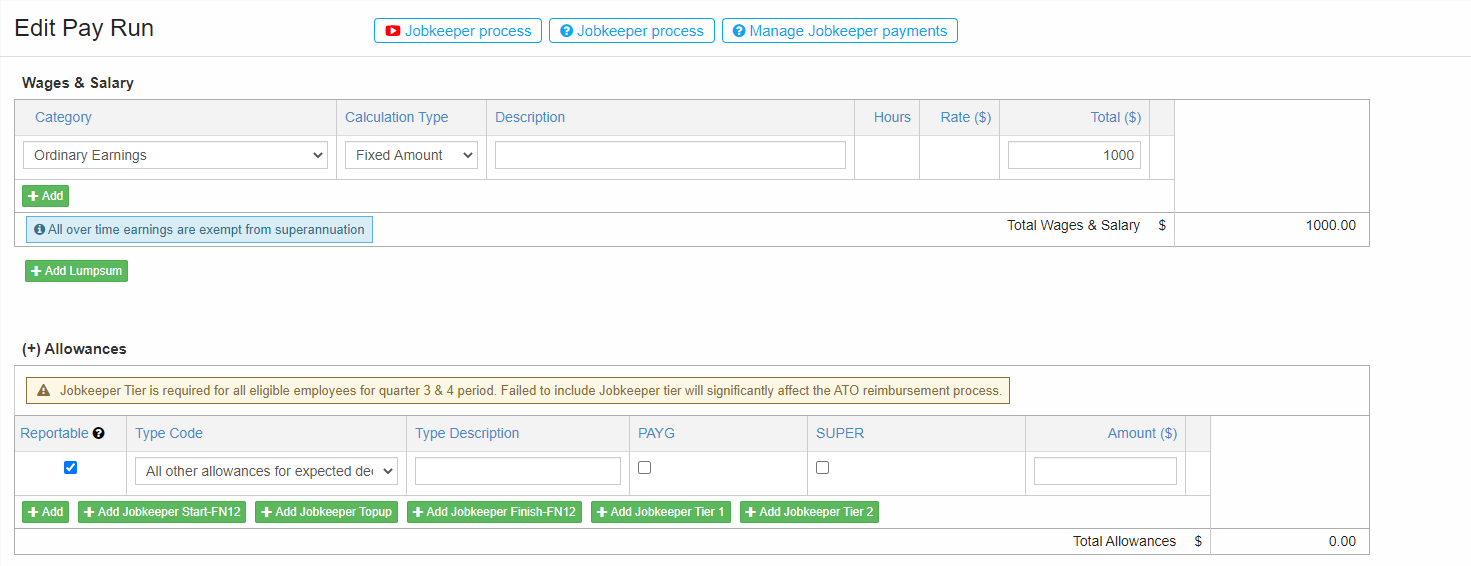

Wages and Salary details with gross payment must be entered. In this case, the frequency type is "Fortnightly".

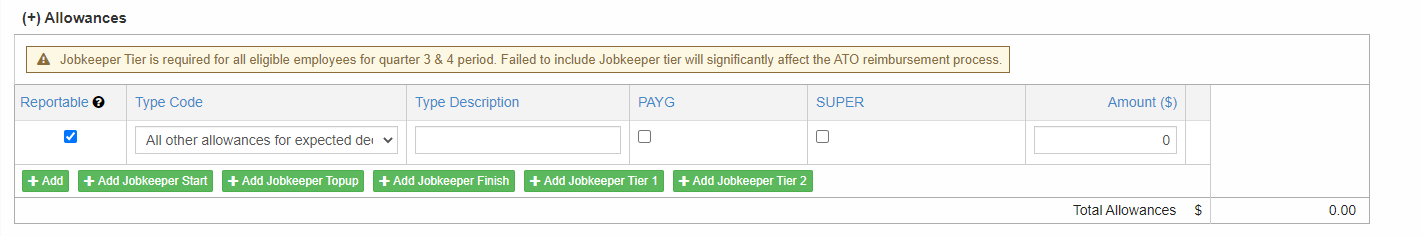

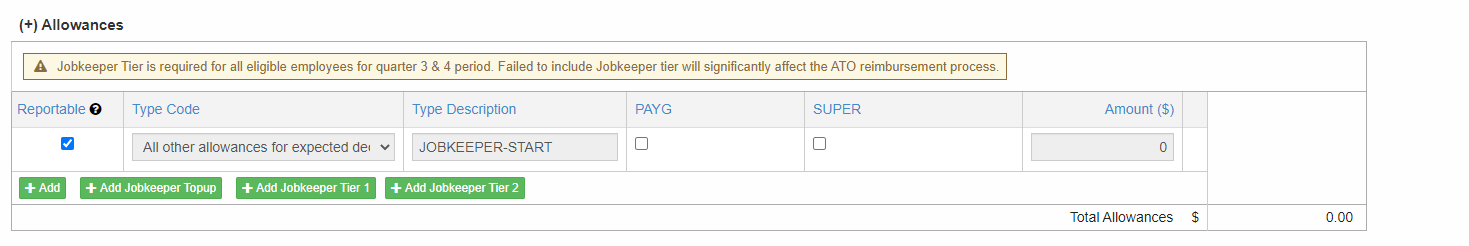

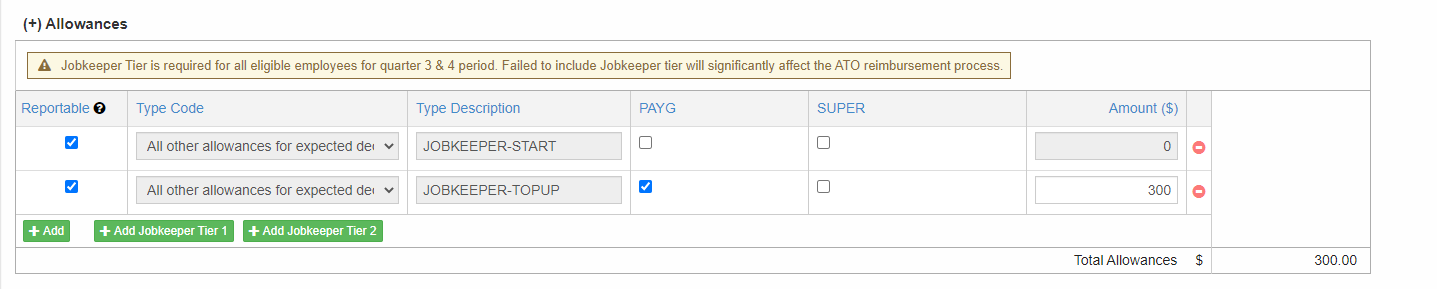

4. Enter the "Allowances" which includes "JobKeeper Allowances".

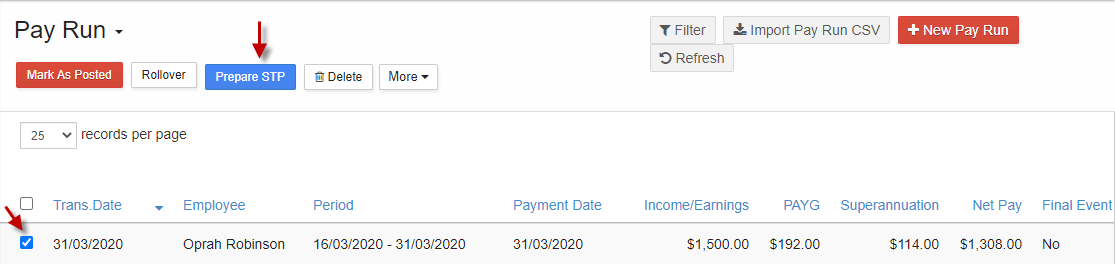

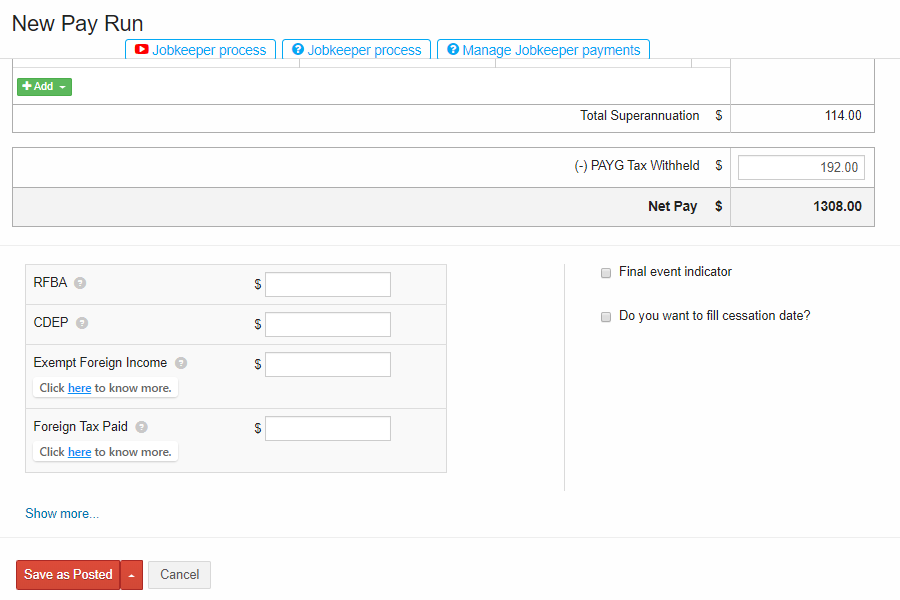

6. Confirm lodging the payslip.

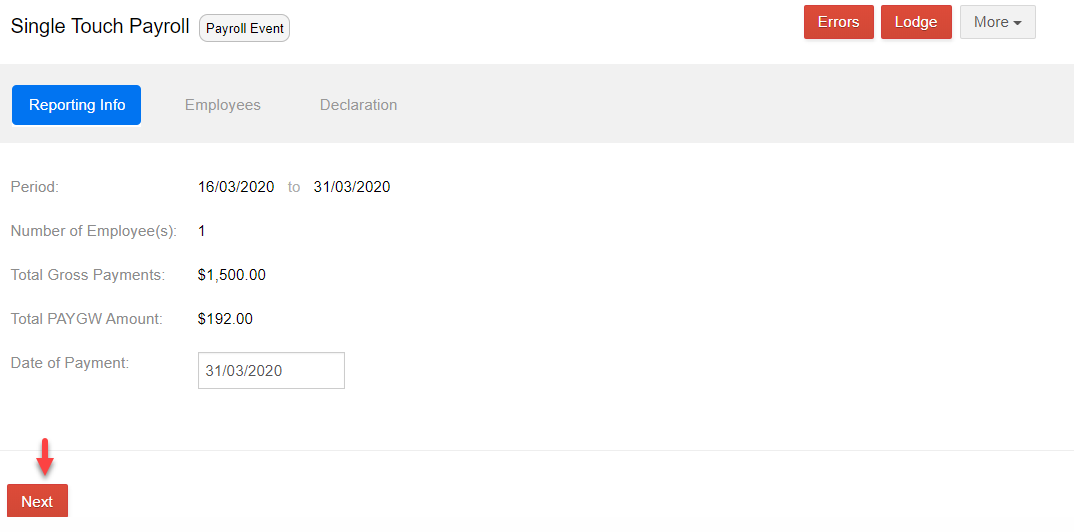

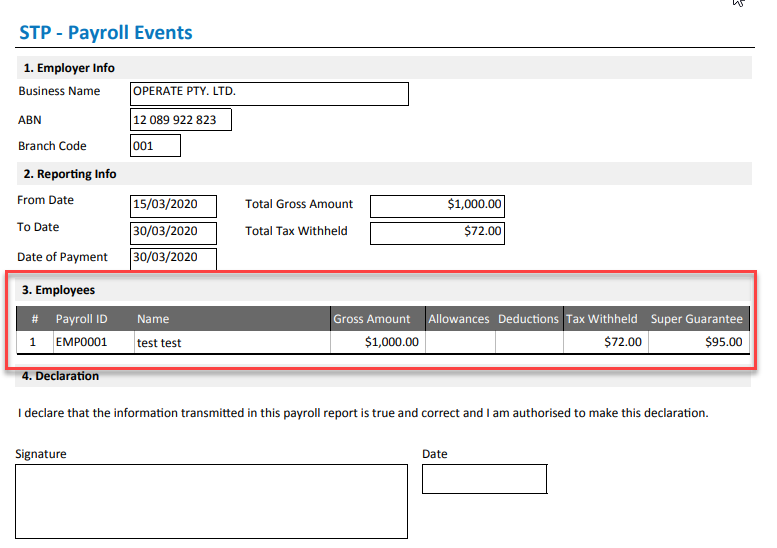

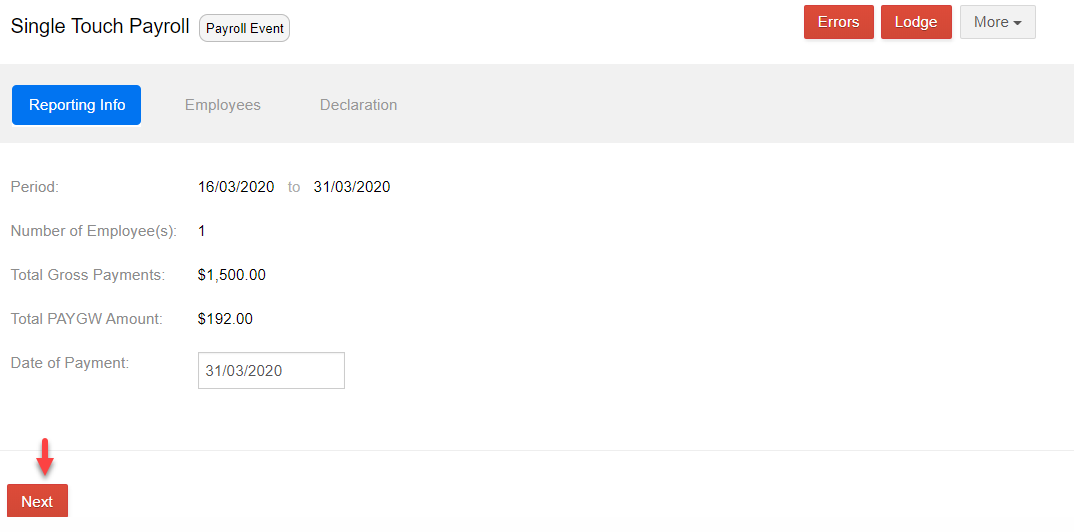

7. Review "Reporting Info" and select "Next".You can see that the Jobkeeper allowance topup amount has been added to the Total Gross Payments as the checkbox on "Reportable" under Allowances was ticked when creating the pay slip.

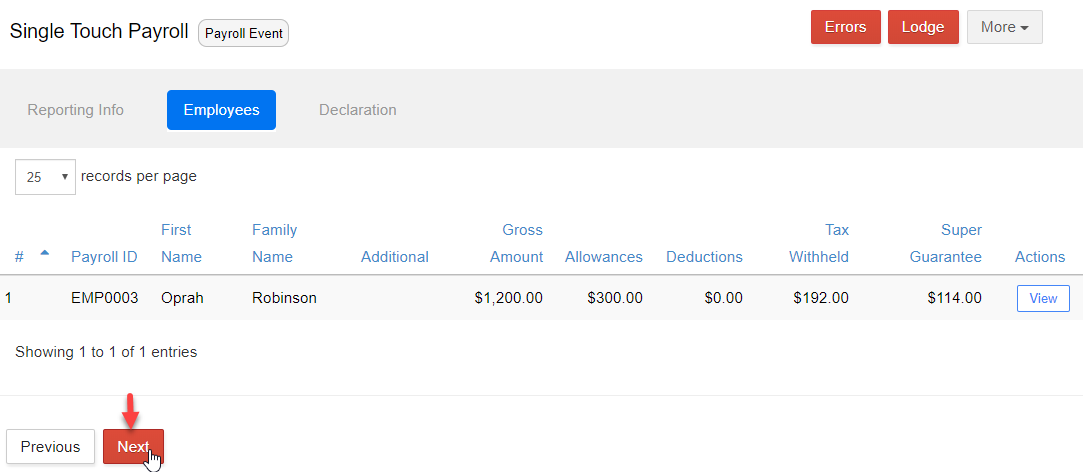

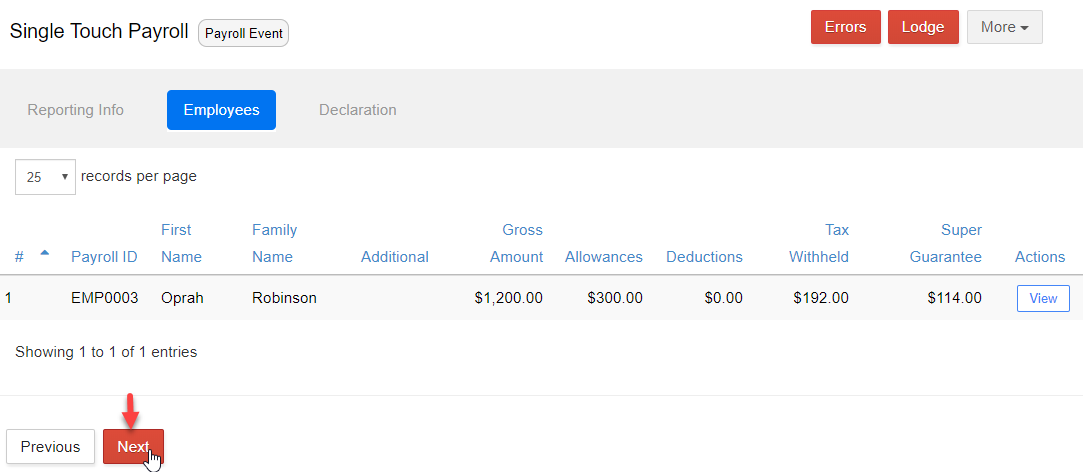

8. Verify the Employee payslips included and select "Next"

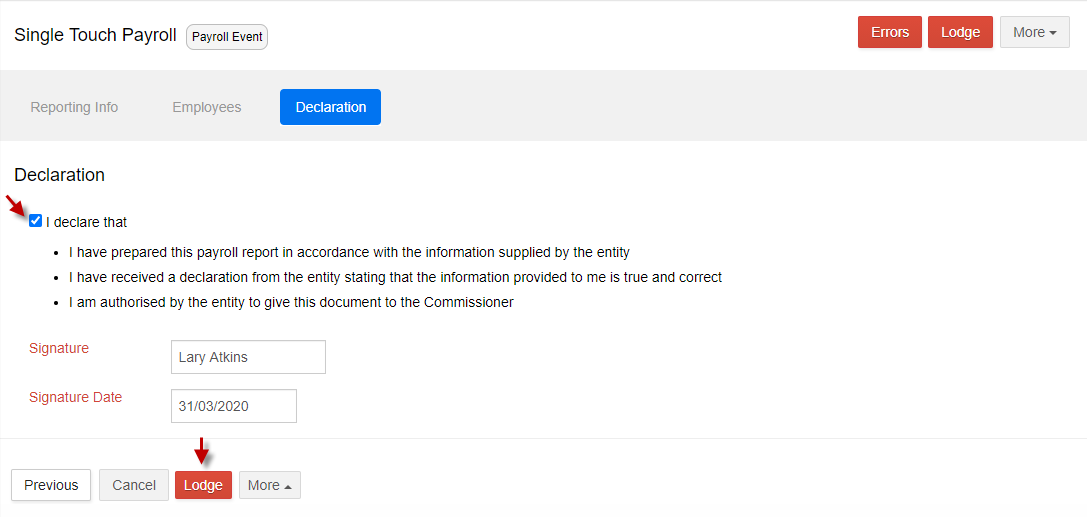

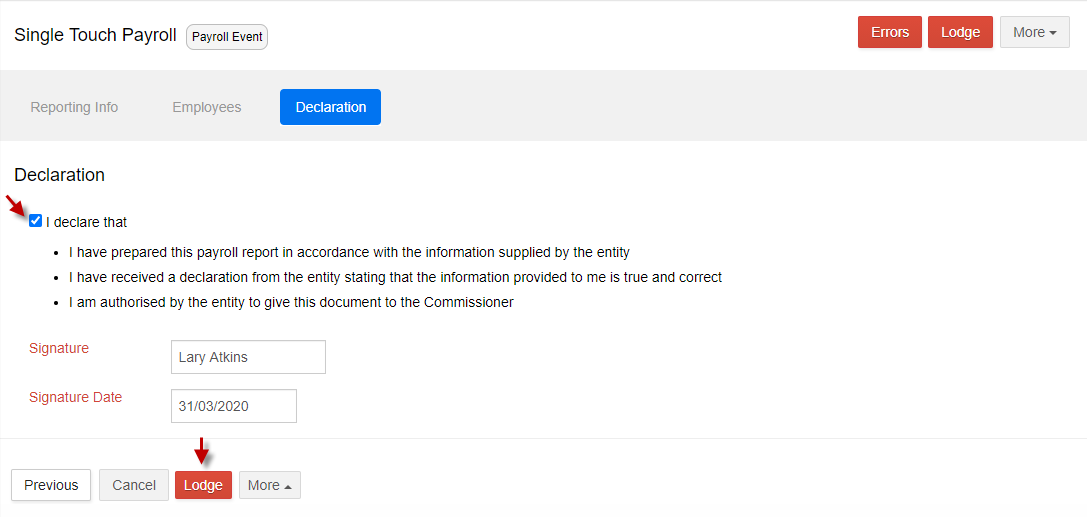

9. Make a Declaration and Lodge.

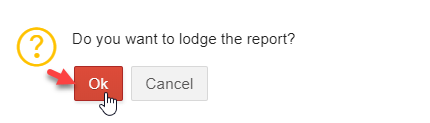

10. Confirm to make the lodgment.

1. For the payslips you have already lodged but missed to add Jobkeeper payments, you can do Full File Replacement.

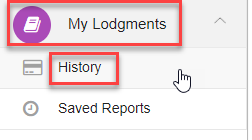

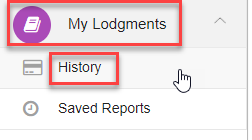

2. Go to My Lodgments -> History

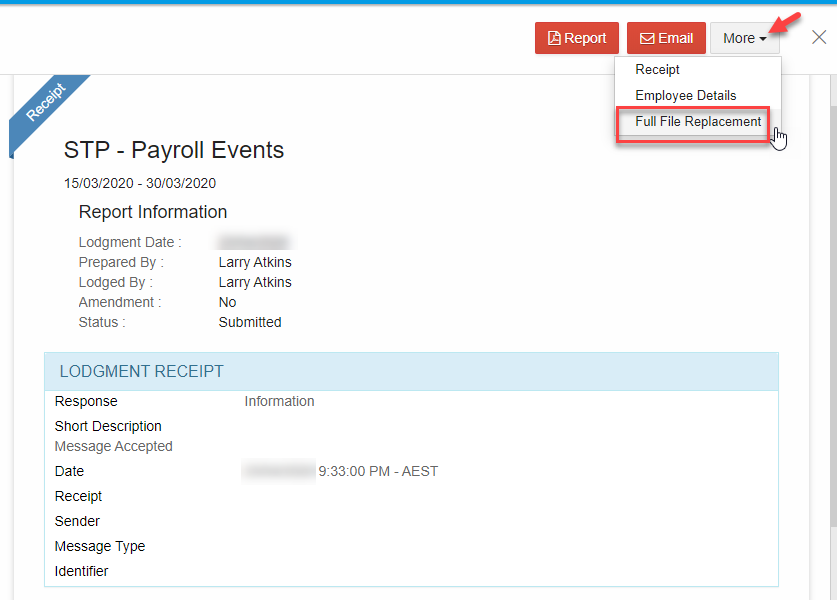

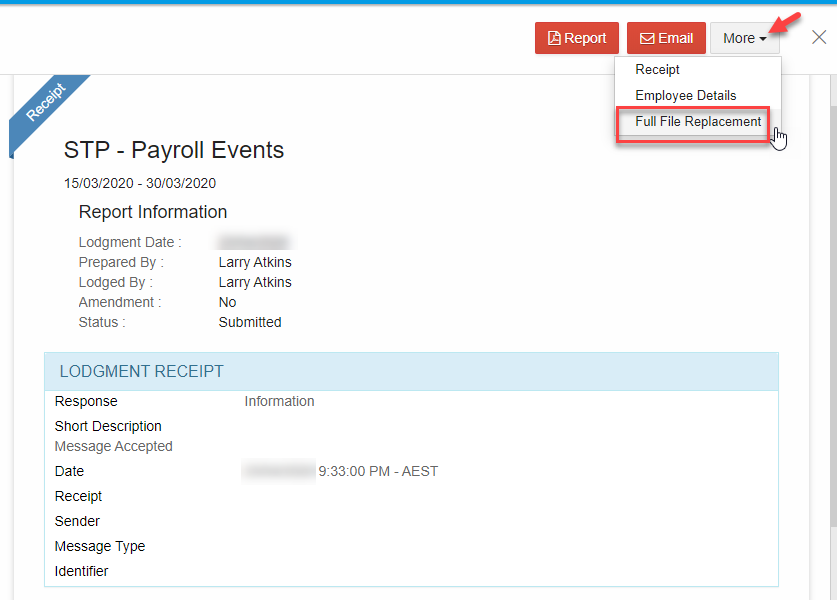

3. Click "Open" on the lodgment report which consists of payslips you wish to add Jobkeeper allowances. On the top right corner, select "Full File Replacement".

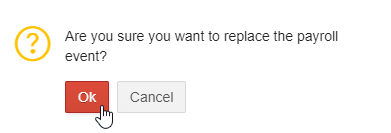

4. Confirm to make "Full file Replacement".

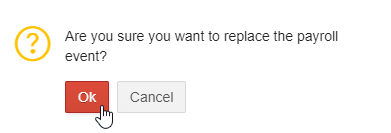

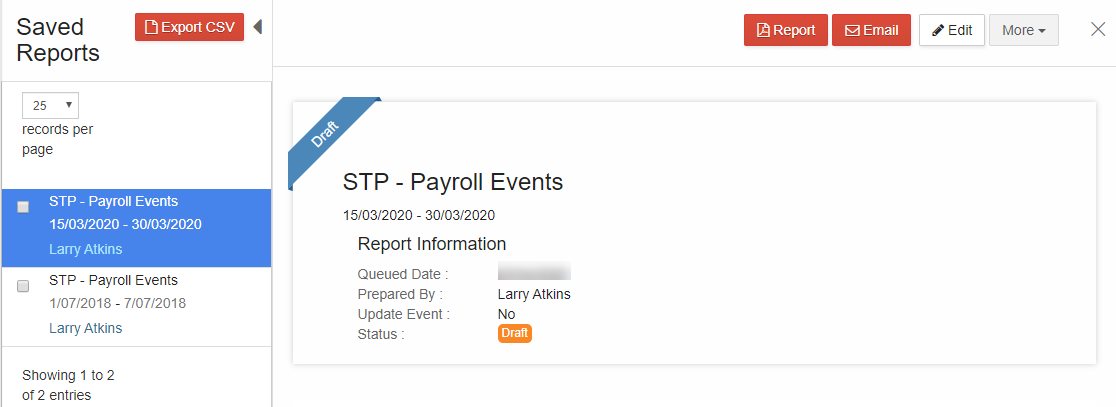

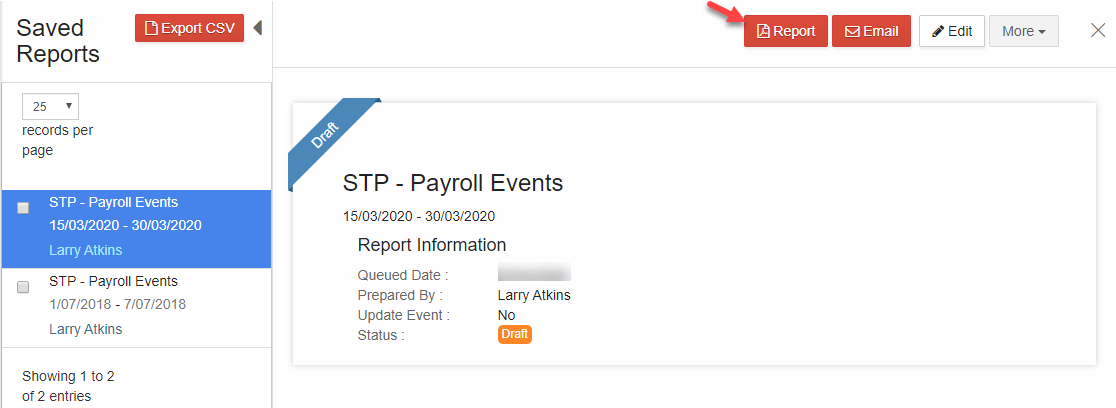

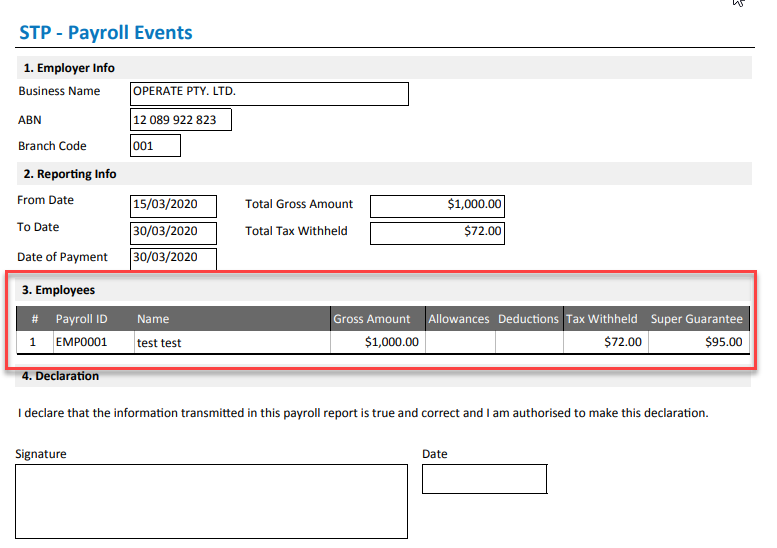

5. The report will be moved to "Saved Reports" in "Draft" format.

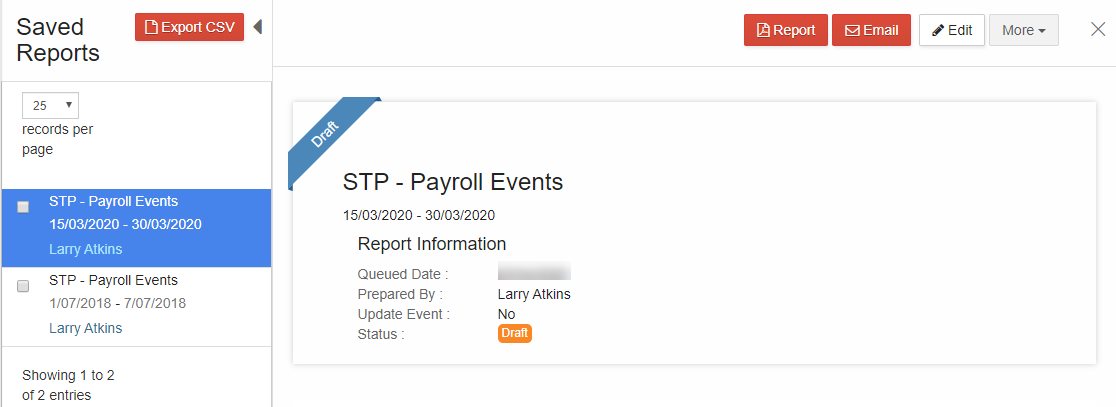

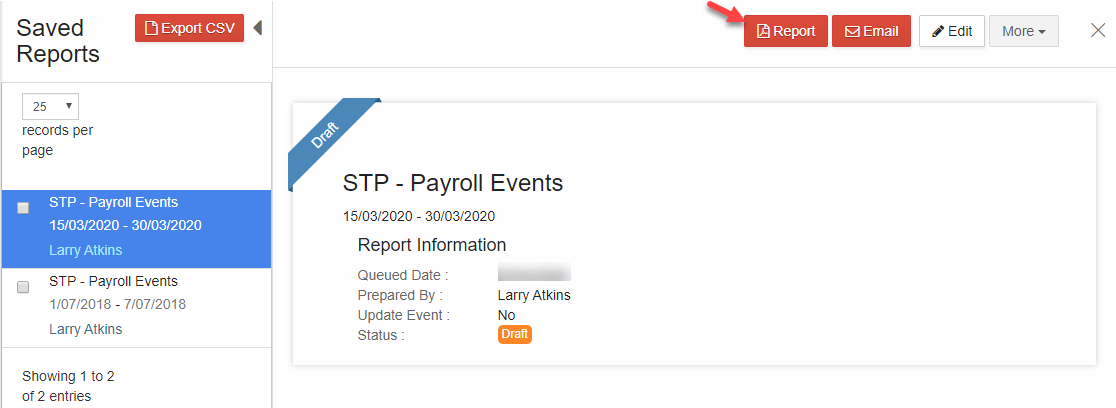

6. You can view the payslips involved in the lodgment by clicking the "Report" button.

7. You can see the employee wage details and allowances, if any.

8. Now, to add Jobkeeper allowances, go to Payroll -> Payroll Events -> Pay Run. The payslips involved will have the lodgment status as "Published".

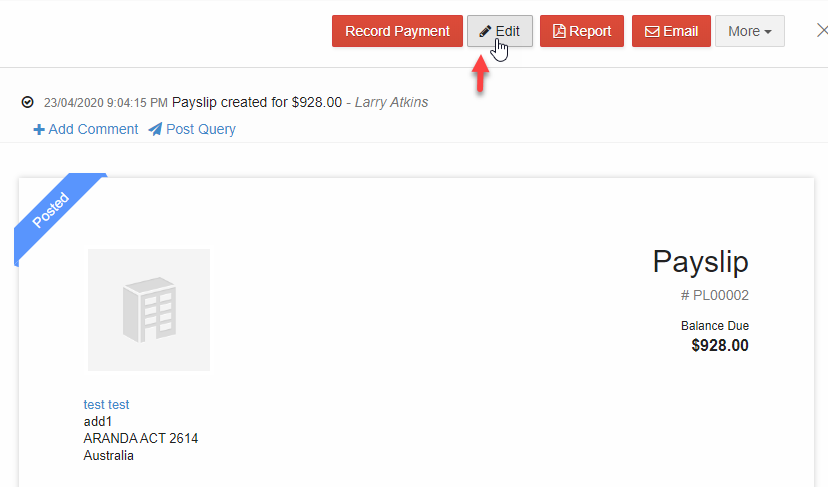

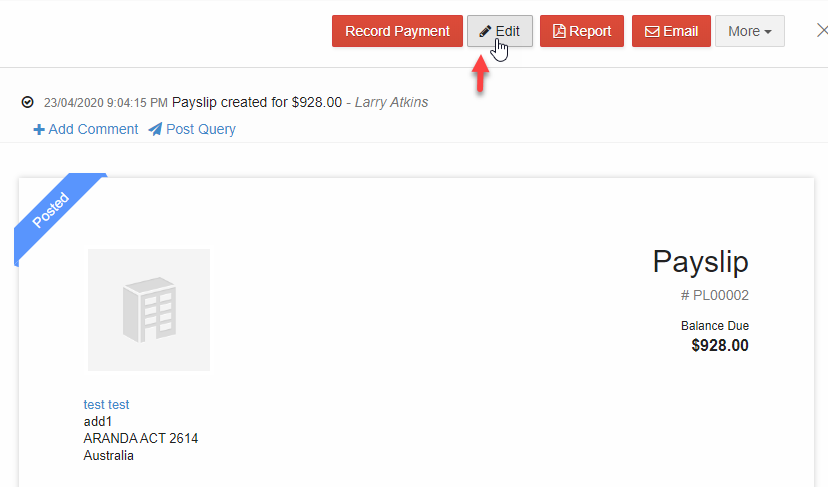

9. Open the payslip you wish to add Jobkeeper allowances. Click "Edit" on the top right corner.

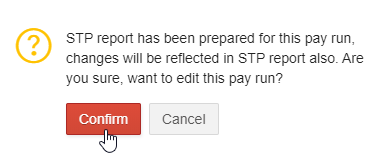

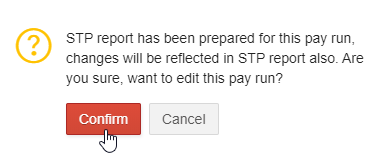

10. Confirm to edit the payslip.

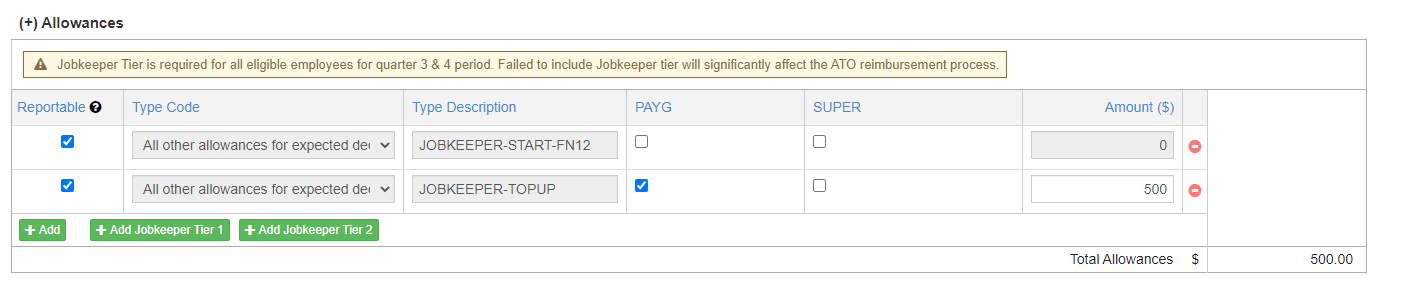

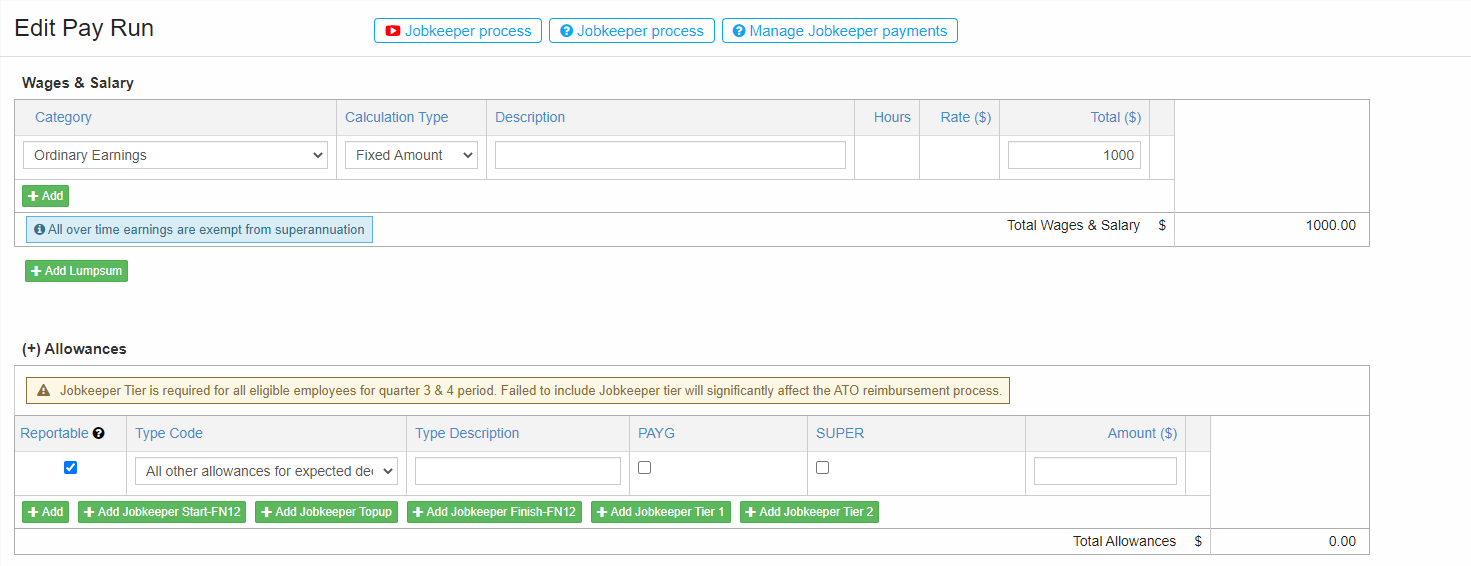

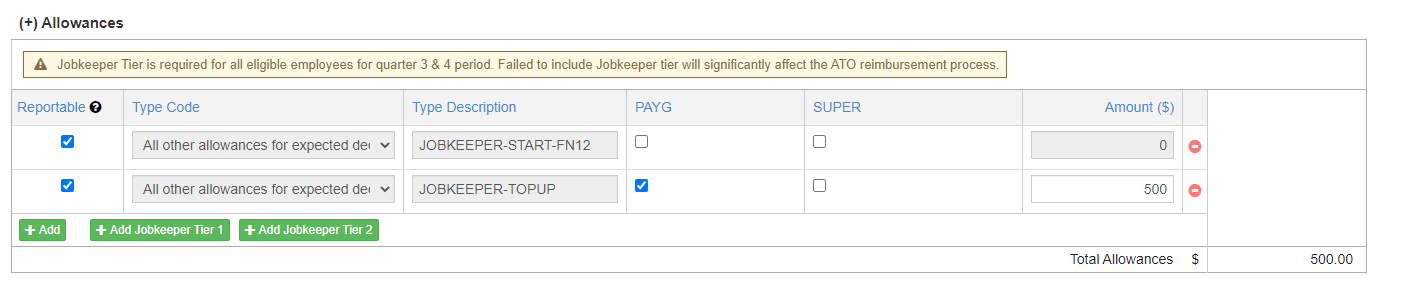

11. Click "Add Jobkeeper Start-FN01" and "Add Jobkeeper Topup"

12. Enter the Jobkeeper Topup amount as required. You can see that the checkbox on PAYG and Reportable are ticked. It means that the entered top-up amount is added to the Total gross payment and the corresponding PAYG is calculated and added in Total PAYG. Ticking the "Reportable" checkbox means that the allowance amount will be added to the Total gross payment figure in reporting info while generating the report.Untick items are maintained for payroll purposes only and not for reporting.

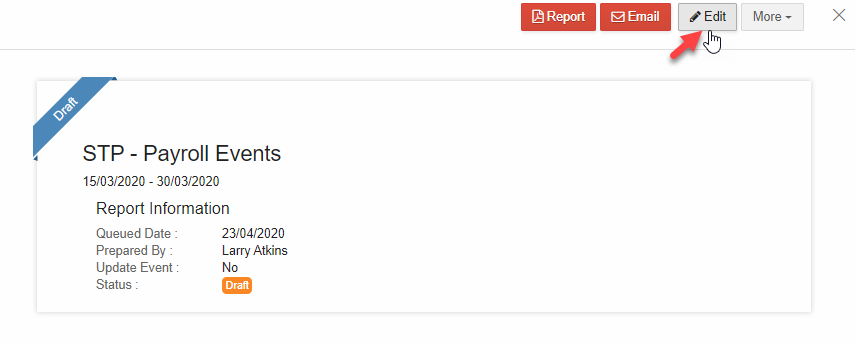

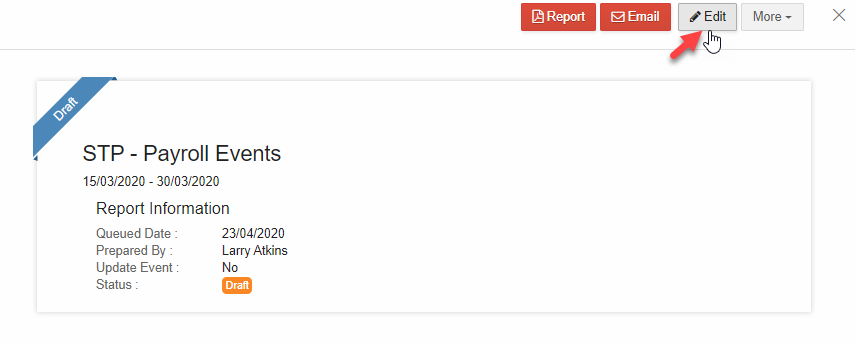

13. After the payslip has been updated, go to My Lodgments -> Saved Reports. Open the report that has been moved from History due to Full file Replacement. Select "Edit" on the top right corner.

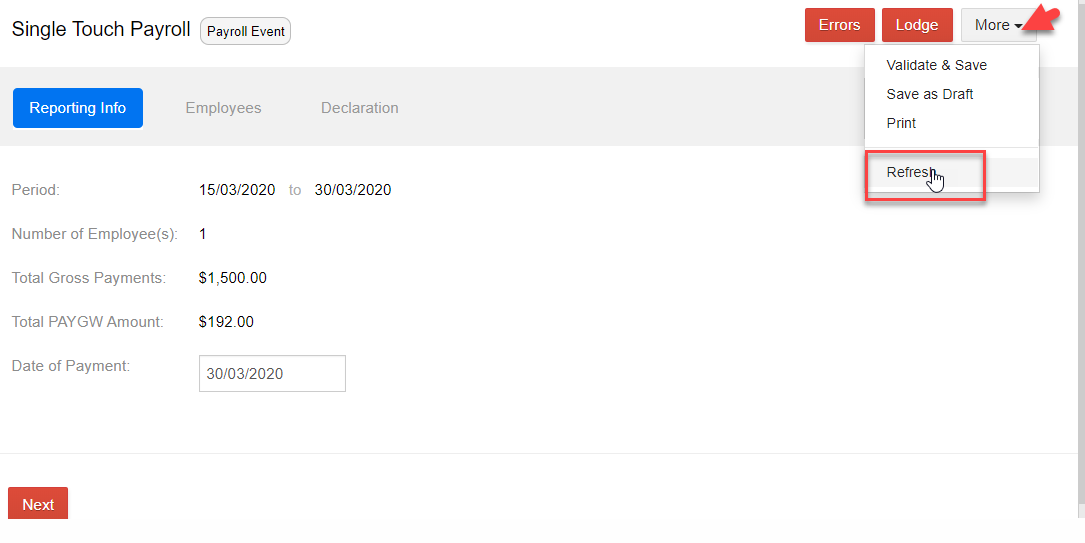

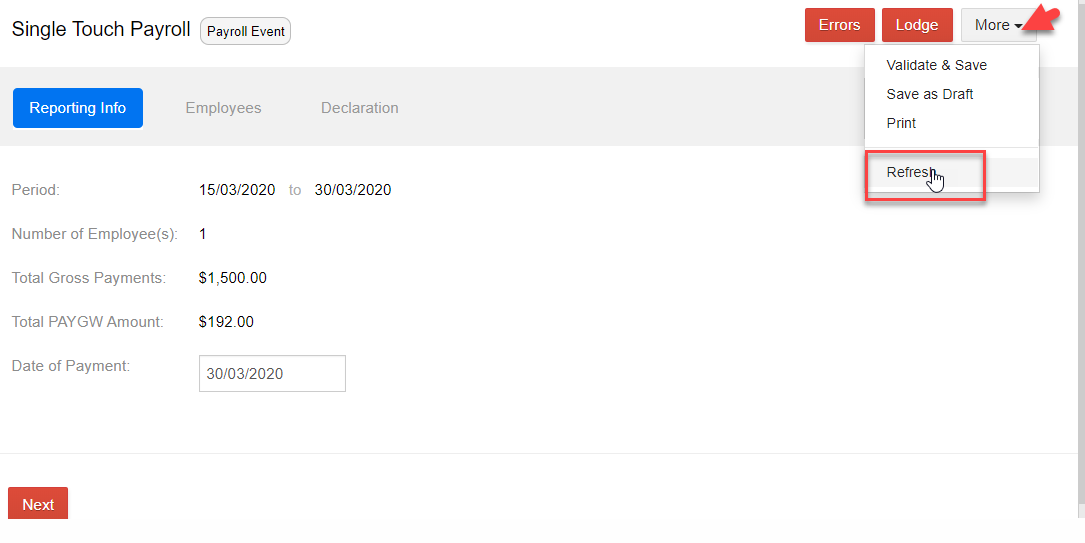

14. On the top right corner, select More -> Refresh

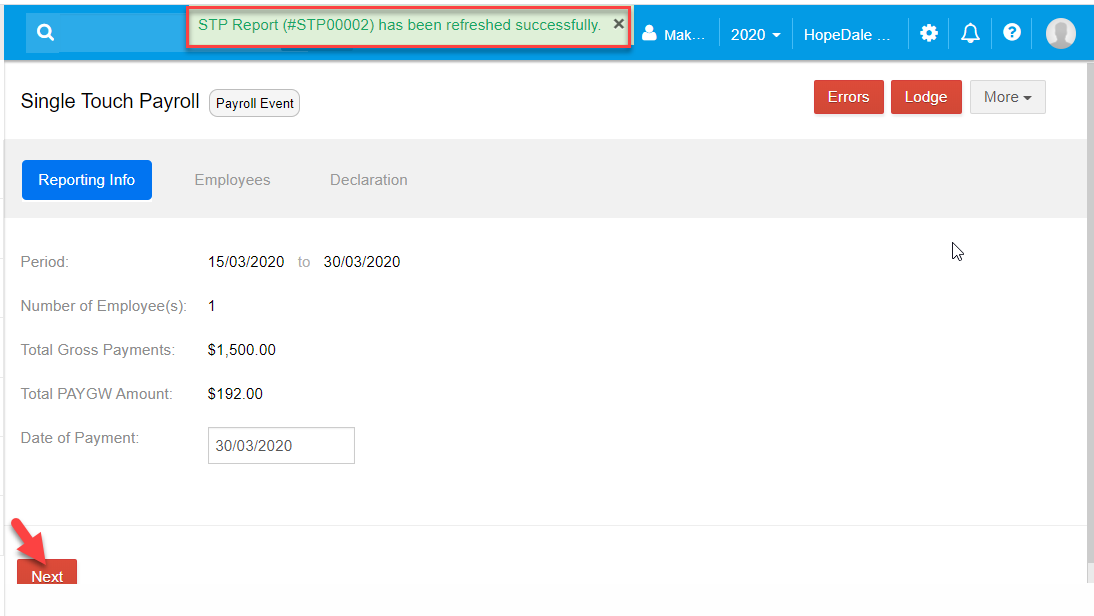

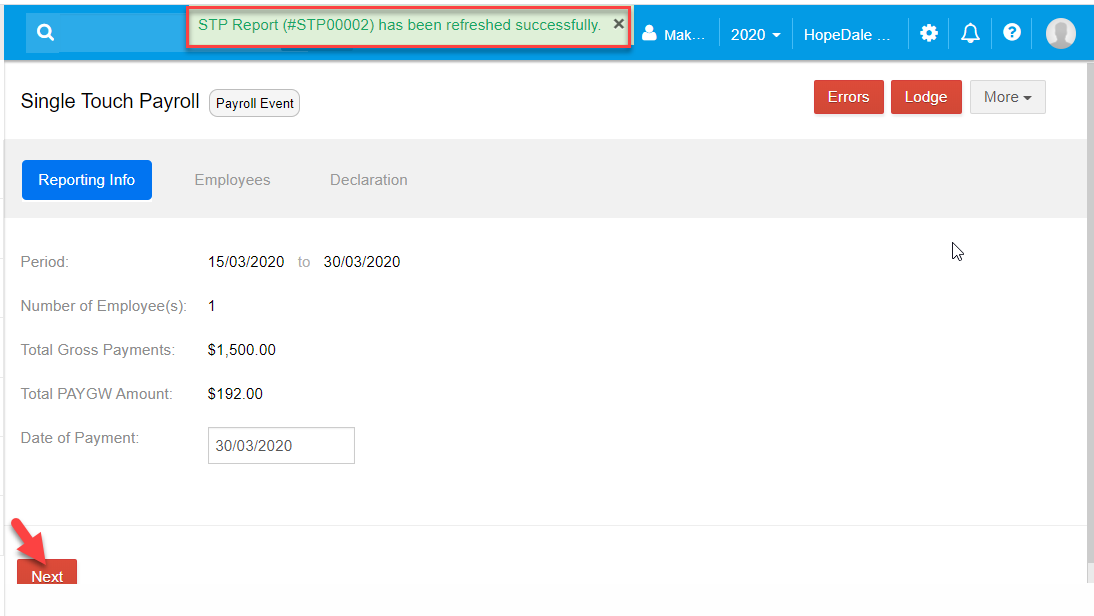

15. Once the report is refreshed, the recently updated Jobkeeper Allowance figures will be added to the report. You can see that the Jobkeeper allowance topup amount has been added to the Total Gross Payments as the checkbox on "Reportable" under Allowances was ticked when creating the pay slip. Select “Next”

16. Verify the Employee Gross and Allowances pay figures and select "Next".

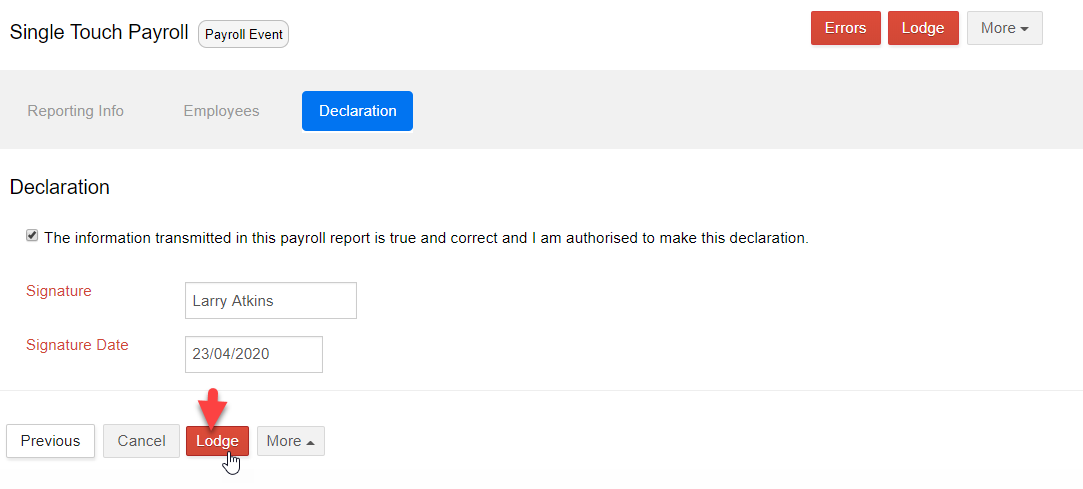

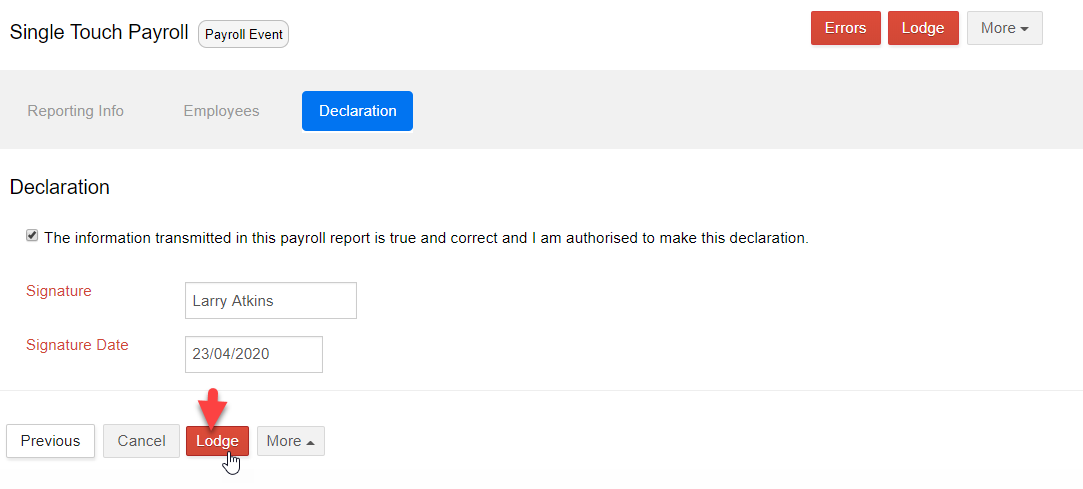

17. Make a declaration and lodge

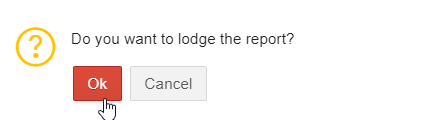

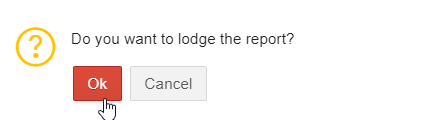

18. Confirm to proceed making the lodgment.

19. Thus, the earlier lodgments that missed Jobkeeper allowances can be updated.

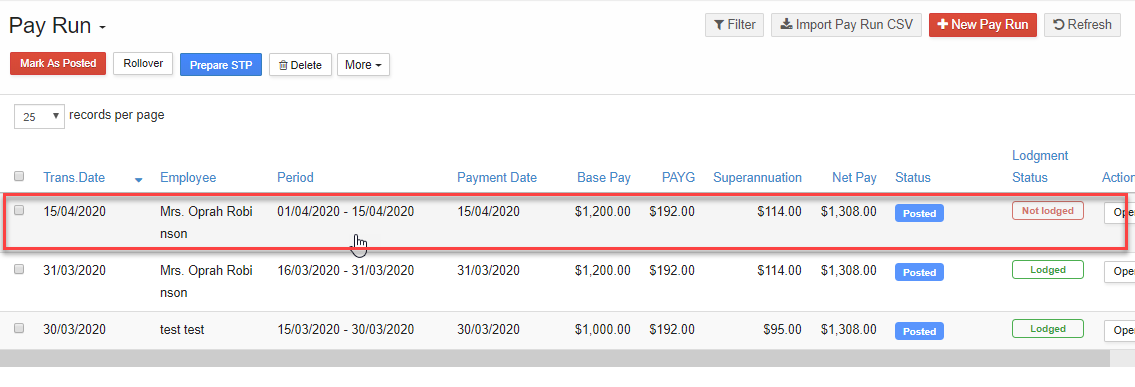

1. You can "Rollover" the previous payslip of your Employee to create a payslip with Jobkeeper payments.

2. For example, if you have reported Jobkeeper payments for the previous fortnight for an employee, you can "Rollover" that payslip which will include the same Gross and Jobkeeper Topup Allowances.

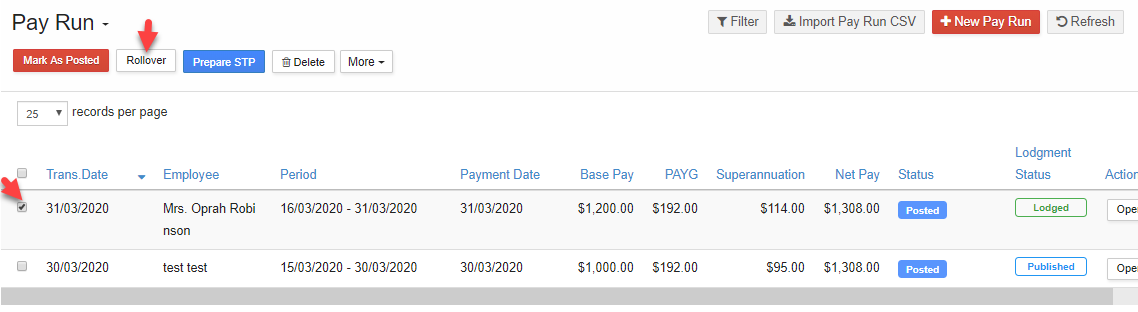

3. Tick the previously lodged payslip and select "Rollover".

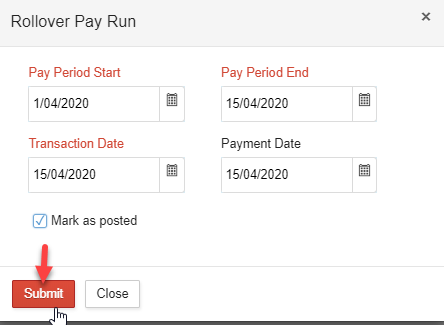

4. Enter the payroll Start, End, Payment and Transaction Date and select "Submit". Make sure the checkbox on "Mark as Posted" is ticked.

5. The new payslip is createdby using "Rollover".

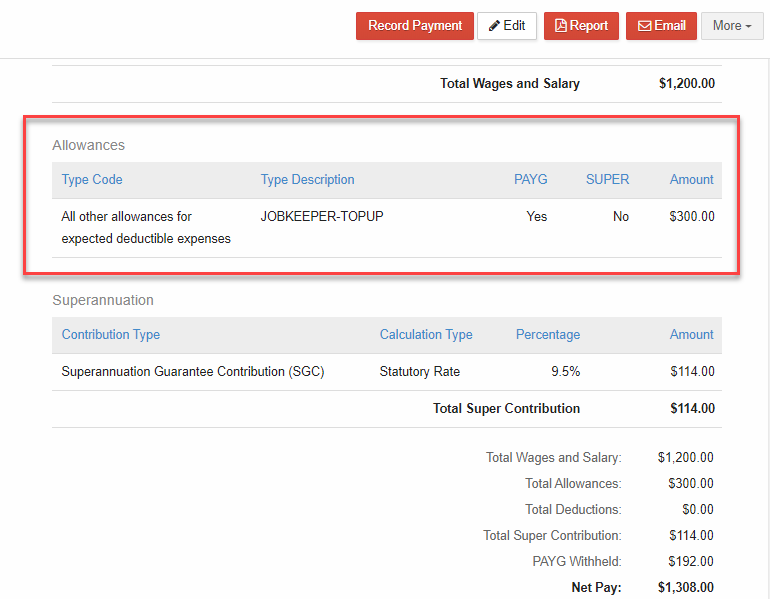

6. Open the payslip. You can see that the "Jobkeeper Topup" has been added with the same gross pay.

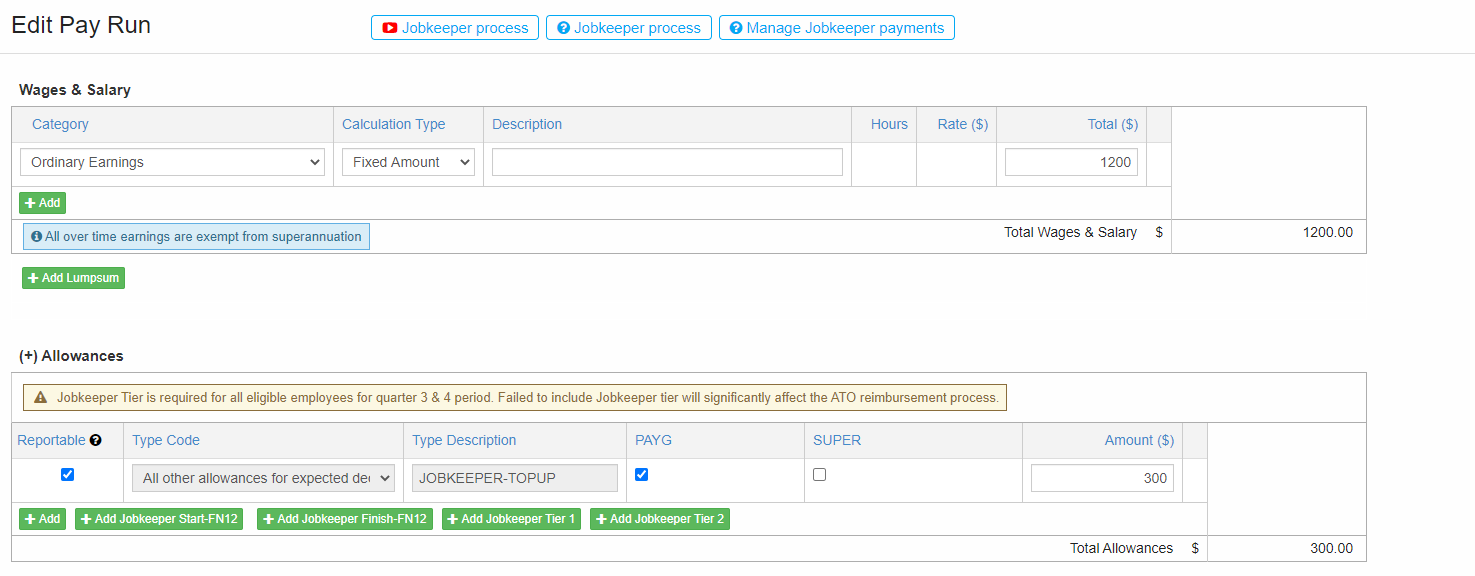

7. You can select "Edit" on the top right corner. You will see the Jobkeeper Topup added for FN02.

8. Thus based on the payrun period, the system will automatically bring the appropriate Fortnight allowance pay as directed by the ATO.

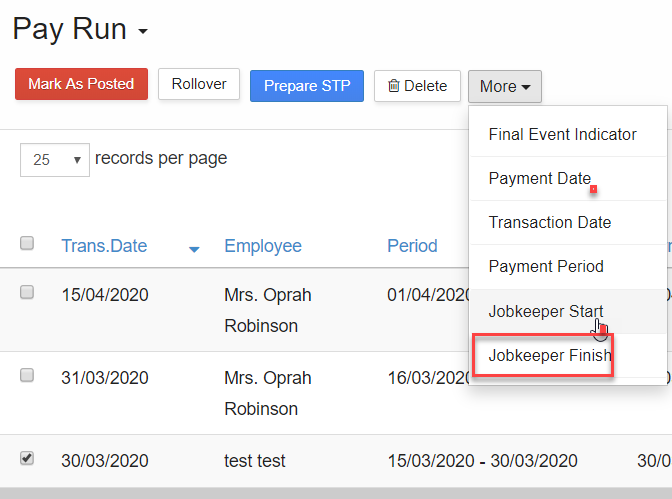

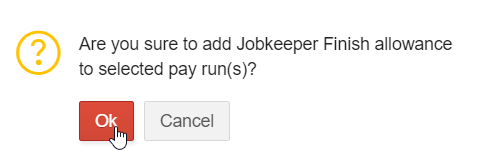

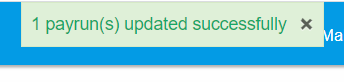

1. It is used to update JobKeeper Start & JobKeeper Finish. In the Pay Run screen, tick the employee payslips and select More button on top. It will have "Jobkeeper Start" and "JobKeeper Finish"

2. If the employee is starting to receive his/her first allowance from you, you can tick the payslip and

select More -> Jobkeeper Start.

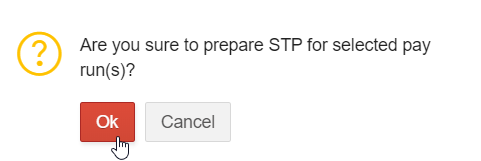

3. You will get a confirmation message. Select "Ok" to update the payslip(s) with Jobkeeper Start allowance.

4. You will get the confirmation message as follows

5. If any of your employees leave the company, you can update the last payslip with Jobkeeper Finish.

6. You will get a confirmation message. Select "Ok" to update the payslip(s) with Jobkeeper Finish allowance.

7. You will get the confirmation message as follows

8. Employee payslip edit- You can also Edit individual employee to update JobKeeper Start, JobKeeper Top Up & JobKeeper Finish

Regardless of the frequency of regular pay cycles or out of cycle pay periods, or the pay period start and end dates, the $1,500 per fortnight applies to the paydays (payrun period) within the defined fortnights and from which fixed fortnight the payment applies. Special rules apply for payments within the month of April and for employees receiving monthly pay.

The JobKeeper payment period commenced from Monday 30 March 2020 and will apply for 13 full fortnights until Sunday 27 September 2020. The ATO will reimburse participating employers monthly in arrears $1,500 for each full fortnight per eligible employee paid by the employer.

JobKeeper payment is before tax and you can choose whether or not to pay superannuation on the top-up amount.

..

.

.

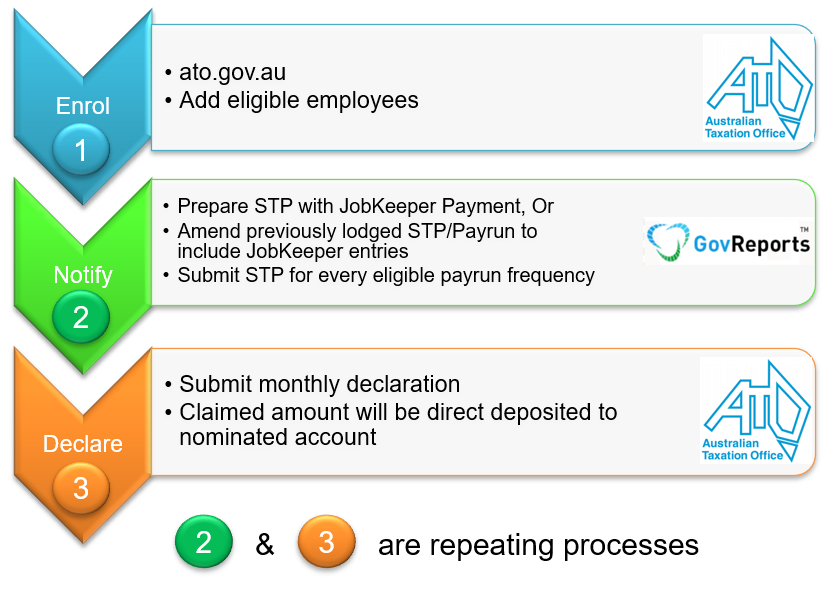

JobKeeper Payment (JK)- IAM

Jobkeeper Terms

JobKeeper Start

JOBKEEPER-START-FNXX where "XX" refers to the fortnightly periods from which the payment first started. For example, JOBKEEPER-START-FN01 to indicate the payment applies from the 1st (30/03 to 12/04) of the 13 JobKeeper fortnights. It indicates the first JobKeeper fortnightly period for which the subsidy is payable.

JobKeeper Finish

JOBKEEPER-FINISH-FNXX where "XX" refers to the first fortnightly period to which the payment no longer applies. For example, if an employee ceases working on 04/06, then JOBKEEPER-FINISH-FN06 indicates the 6th of 13 JobKeeper fortnights was the first fortnight for which the subsidy will not be reimbursed to the employer. The allowance amount should be reported as zero. It indicates any exit of eligibility or termination of the employee.

JobKeeper Topup

JOBKEEPER-TOPUP The JobKeeper payment is a minimum amount of $1,500 per fortnight. It applies equitably to all employees, regardless of any factor. Some employees may receive no additional top-up as they are paid in excess of these amounts. Others may only see a small top-up, whilst some may see a substantial increase in their pay. It cannot apply to terminated employees. The top-up payment must be passed onto the employee and this will be visible in the STP Pay Event reports.

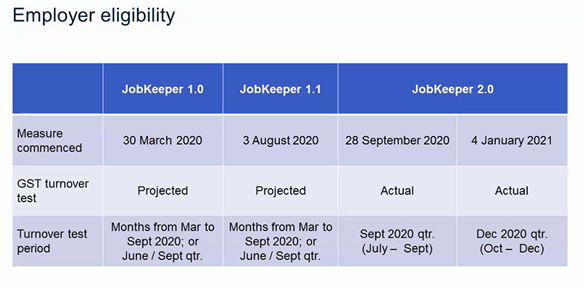

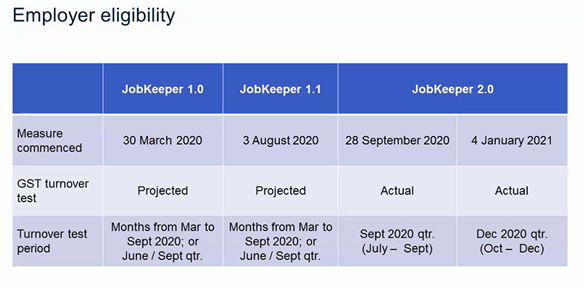

JobKeeper Tier

ATO has introduced tier rates for eligible employees

- Tier 1- eligible employees and eligible business participants who worked for 80 hours or more in the four weeks of pay periods

- Tier 2- eligible employees and eligible business participants work less than 80 hours per fortnight.

https://www.ato.gov.au/General/JobKeeper-Payment/payment-rates/

Add Jobkeeper tier for all eligible employees and eligible business participants under allowances section

What you need to do?

From 28 September 2020, you must do all of the following:

- work out if the tier 1 or tier 2 rate applies to each of your eligible employees and/or eligible business participants and/or eligible religious practitioners

- notify ATO and your eligible employees and/or eligible business participants and/or eligible religious practitioners what payment rate applies to them

-

during 28 September 2020 to 3 January 2021 – ensure your eligible employees are paid at least

- $1,200 per fortnight for tier 1 employees

- $750 per fortnight for tier 2 employees

-

during 4 January 2021 to 28 March 2021 – ensure your eligible employees are paid at least

- $1,000 per fortnight for tier 1 employees

- $650 per fortnight for tier 2 employees

What doesn't change

To claim for fortnights in the JobKeeper extension:

- You don't need to re-enrol for the JobKeeper extension if you are already enrolled for JobKeeper for fortnights before 28 September.

- You don’t need to reassess employee eligibility or ask employees to agree to be nominated by you as their eligible employer if you are already claiming for them before 28 September.

-

You don't need to meet any further requirements if you are claiming for an eligible business participant, other than those that applied from the start of JobKeeper relating to

- holding an ABN, and

- declaring assessable income and supplies.

Prepare STP

To prepare STP payroll events with JobKeeper payment entries by preparing the payslip

1. From the menu bar on the left, go to Payroll -> Payroll Events -> Pay Run

2. Select "New Pay Run" on the top right corner

3. Complete the Employee Basic details and Wage details :

Wages and Salary details with gross payment must be entered. In this case, the frequency type is "Fortnightly".

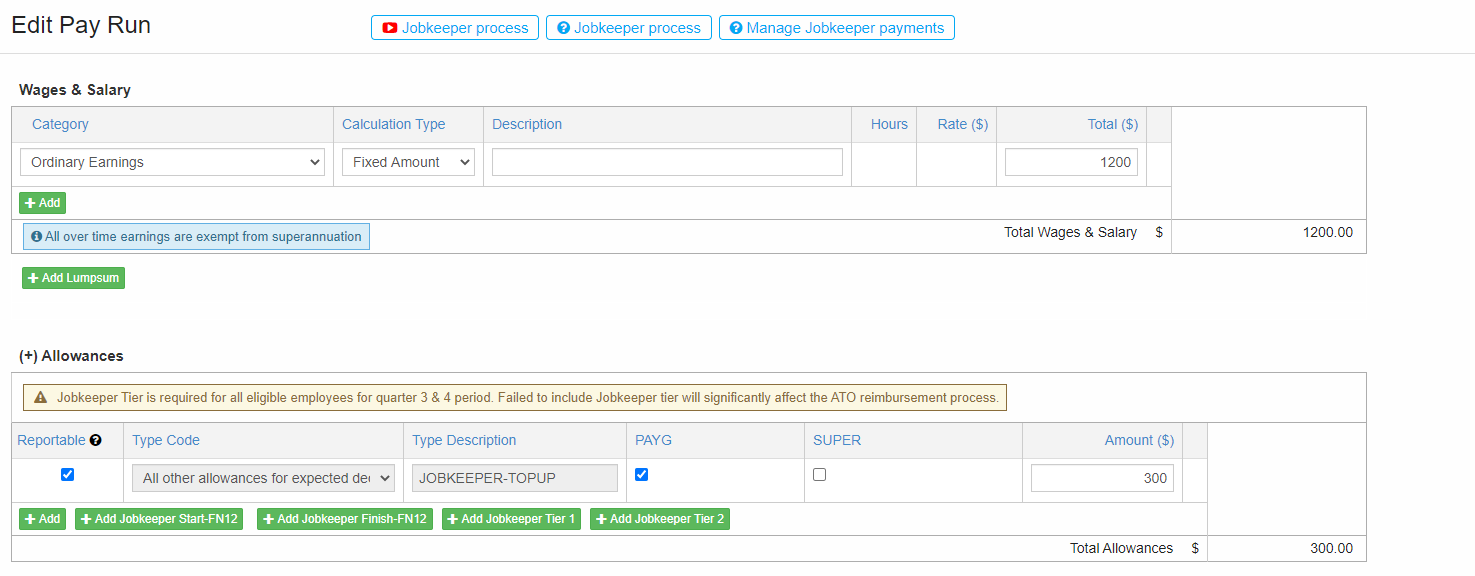

4. Enter the "Allowances" which includes "JobKeeper Allowances".

- Select "Add Jobkeeeper Start-FN01" to start adding the Jobkeeper allowances for this employee.

- Jobkeeper Start FN01 will be updated with value "0" which cannot be edited.

-

If the employee's base/gross salary is less than the prescribed salary (according to the "Frequency Type"), you must add the Top-up amount. Select "Add Jobkeeper Topup" You can see that the checkbox on PAYG and Reportable are ticked. It means that the entered top-up amount is added to the Total gross payment and the corresponding PAYG is calculated and added in Total PAYG.

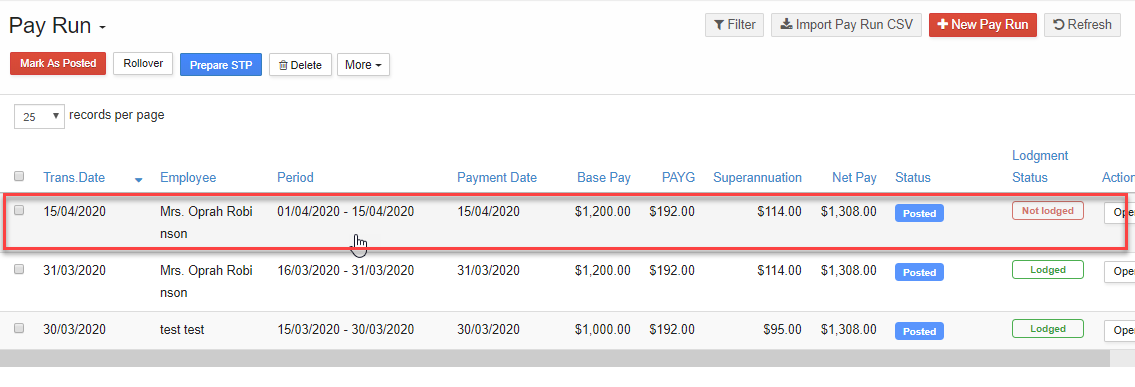

Ticking the “Reportable” checkbox means that the Allowance amount will be included in generating STP and Activity Statement reports. Untick items are maintained for payroll purposes only and not for reporting. - You can see that PAYG for this allowance is ticked by default. You can subject to "Super" if necessary. Enter the

Top-up required. (In this case, the pay is of "Fortnight" frequency. The base salary is $1200 which is $300 short of the prescribed gross salary of $1500 per fortnight.)

6. Confirm lodging the payslip.

7. Review "Reporting Info" and select "Next".You can see that the Jobkeeper allowance topup amount has been added to the Total Gross Payments as the checkbox on "Reportable" under Allowances was ticked when creating the pay slip.

8. Verify the Employee payslips included and select "Next"

9. Make a Declaration and Lodge.

10. Confirm to make the lodgment.

STP - Full File Replacement:

1. For the payslips you have already lodged but missed to add Jobkeeper payments, you can do Full File Replacement.

2. Go to My Lodgments -> History

3. Click "Open" on the lodgment report which consists of payslips you wish to add Jobkeeper allowances. On the top right corner, select "Full File Replacement".

4. Confirm to make "Full file Replacement".

5. The report will be moved to "Saved Reports" in "Draft" format.

6. You can view the payslips involved in the lodgment by clicking the "Report" button.

7. You can see the employee wage details and allowances, if any.

8. Now, to add Jobkeeper allowances, go to Payroll -> Payroll Events -> Pay Run. The payslips involved will have the lodgment status as "Published".

9. Open the payslip you wish to add Jobkeeper allowances. Click "Edit" on the top right corner.

10. Confirm to edit the payslip.

11. Click "Add Jobkeeper Start-FN01" and "Add Jobkeeper Topup"

12. Enter the Jobkeeper Topup amount as required. You can see that the checkbox on PAYG and Reportable are ticked. It means that the entered top-up amount is added to the Total gross payment and the corresponding PAYG is calculated and added in Total PAYG. Ticking the "Reportable" checkbox means that the allowance amount will be added to the Total gross payment figure in reporting info while generating the report.Untick items are maintained for payroll purposes only and not for reporting.

13. After the payslip has been updated, go to My Lodgments -> Saved Reports. Open the report that has been moved from History due to Full file Replacement. Select "Edit" on the top right corner.

14. On the top right corner, select More -> Refresh

15. Once the report is refreshed, the recently updated Jobkeeper Allowance figures will be added to the report. You can see that the Jobkeeper allowance topup amount has been added to the Total Gross Payments as the checkbox on "Reportable" under Allowances was ticked when creating the pay slip. Select “Next”

16. Verify the Employee Gross and Allowances pay figures and select "Next".

17. Make a declaration and lodge

18. Confirm to proceed making the lodgment.

19. Thus, the earlier lodgments that missed Jobkeeper allowances can be updated.

STP Rollover

1. You can "Rollover" the previous payslip of your Employee to create a payslip with Jobkeeper payments.

2. For example, if you have reported Jobkeeper payments for the previous fortnight for an employee, you can "Rollover" that payslip which will include the same Gross and Jobkeeper Topup Allowances.

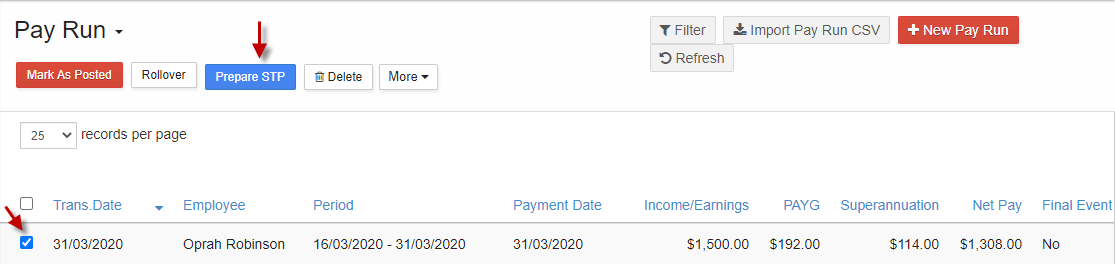

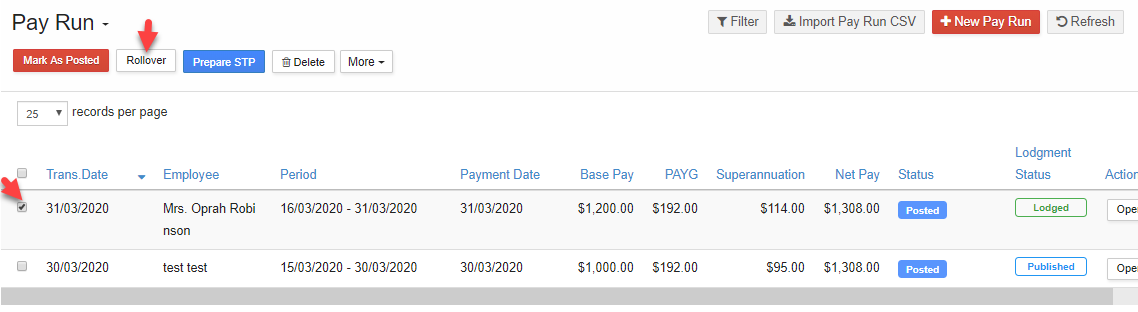

3. Tick the previously lodged payslip and select "Rollover".

4. Enter the payroll Start, End, Payment and Transaction Date and select "Submit". Make sure the checkbox on "Mark as Posted" is ticked.

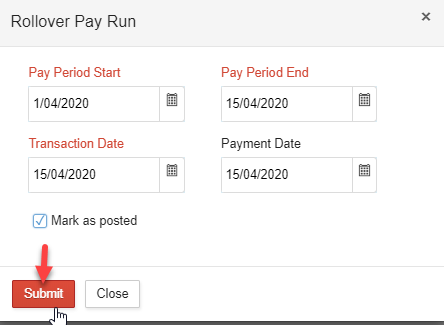

5. The new payslip is createdby using "Rollover".

6. Open the payslip. You can see that the "Jobkeeper Topup" has been added with the same gross pay.

7. You can select "Edit" on the top right corner. You will see the Jobkeeper Topup added for FN02.

8. Thus based on the payrun period, the system will automatically bring the appropriate Fortnight allowance pay as directed by the ATO.

STP - Bulk Update:

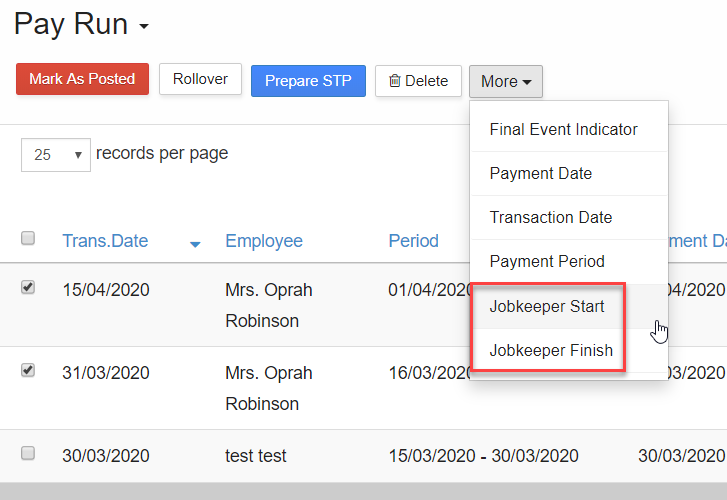

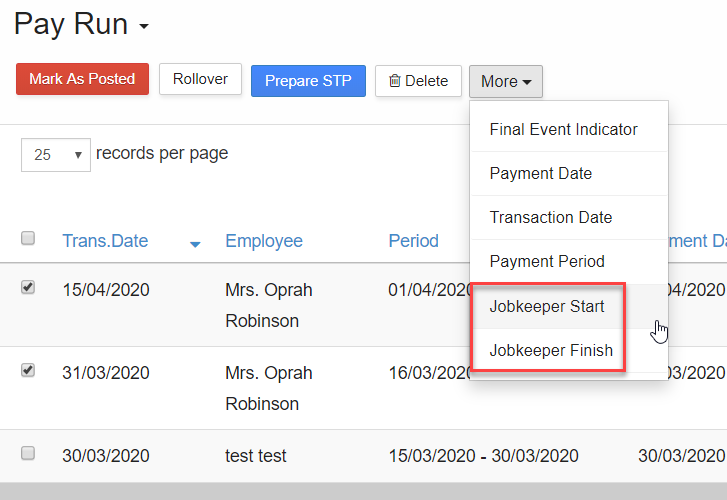

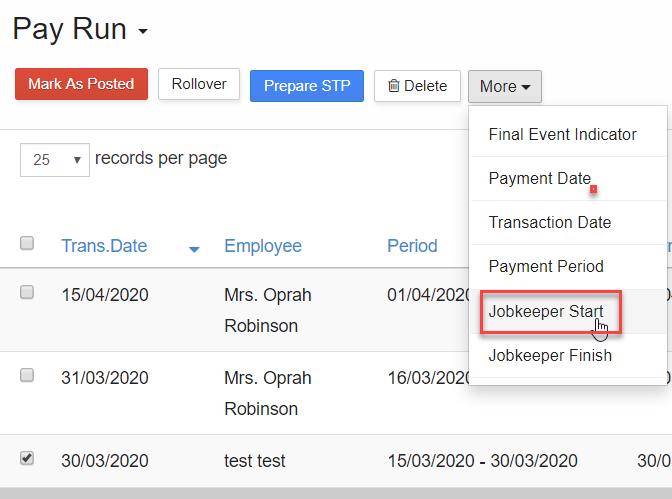

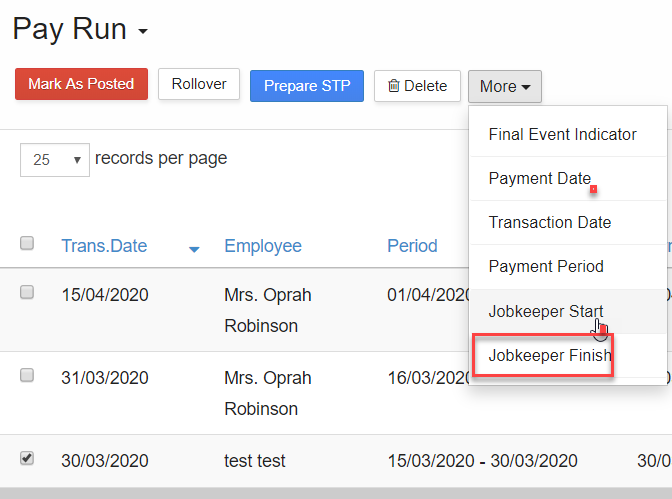

1. It is used to update JobKeeper Start & JobKeeper Finish. In the Pay Run screen, tick the employee payslips and select More button on top. It will have "Jobkeeper Start" and "JobKeeper Finish"

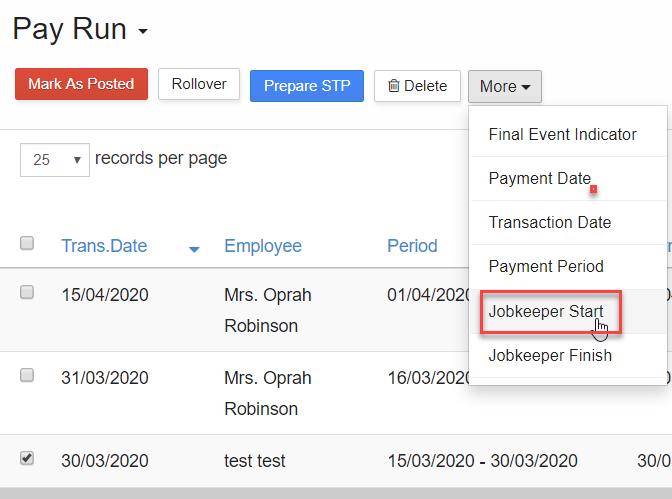

2. If the employee is starting to receive his/her first allowance from you, you can tick the payslip and

select More -> Jobkeeper Start.

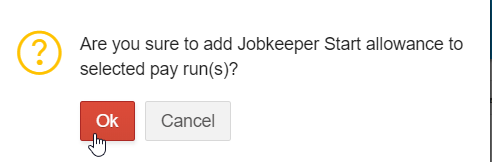

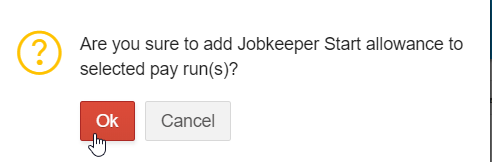

3. You will get a confirmation message. Select "Ok" to update the payslip(s) with Jobkeeper Start allowance.

4. You will get the confirmation message as follows

5. If any of your employees leave the company, you can update the last payslip with Jobkeeper Finish.

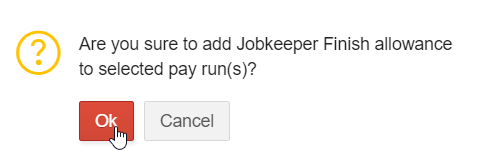

6. You will get a confirmation message. Select "Ok" to update the payslip(s) with Jobkeeper Finish allowance.

7. You will get the confirmation message as follows

8. Employee payslip edit- You can also Edit individual employee to update JobKeeper Start, JobKeeper Top Up & JobKeeper Finish

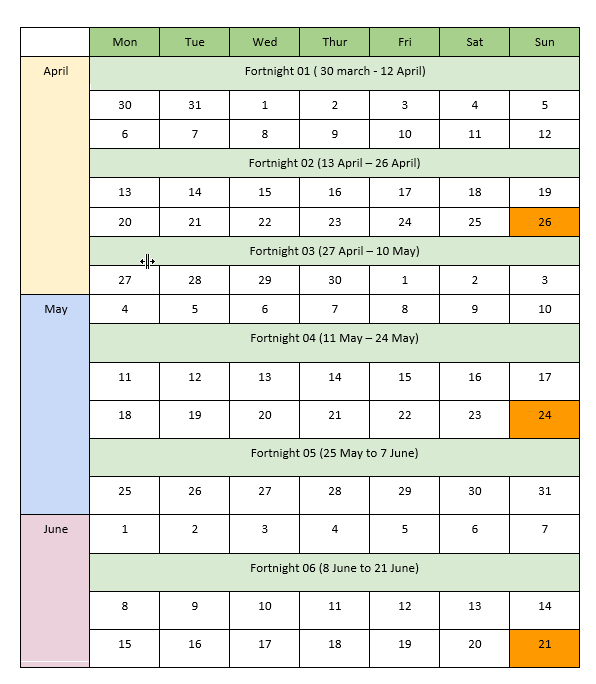

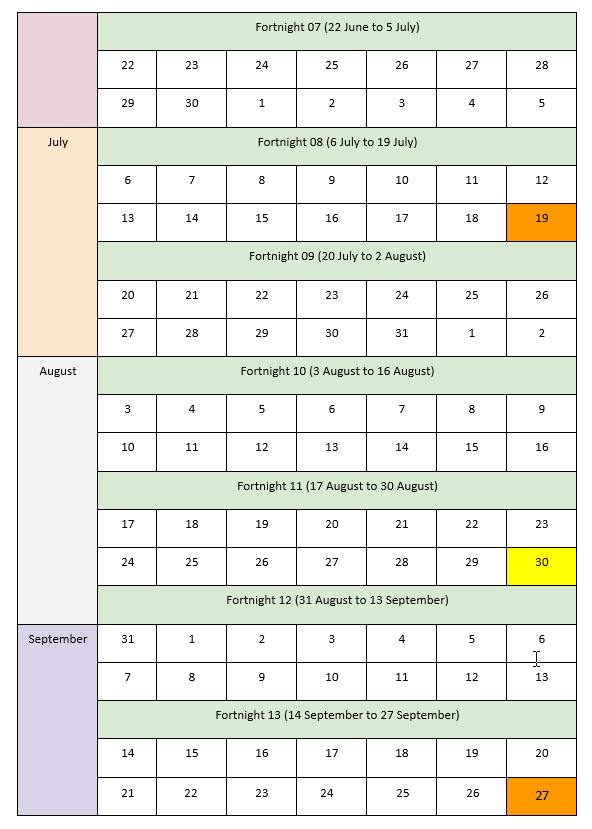

JobKeeper reporting periods

| FN | Dates | Start allowance | Finish Allowance |

|---|---|---|---|

| 01 | 30/03/2020 - 12/04/2020 | JOBKEEPER-START-FN01 | JOBKEEPER-FINISH-FN01 |

| 02 | 13/04/2020 - 26/04/2020 | JOBKEEPER-START-FN02 | JOBKEEPER-FINISH-FN02 |

| 03 | 27/04/2020 - 10/05/2020 | JOBKEEPER-START-FN03 | JOBKEEPER-FINISH-FN03 |

| 04 | 11/05/2020 - 24/05/2020 | JOBKEEPER-START-FN04 | JOBKEEPER-FINISH-FN04 |

| 05 | 25/05/2020 - 07/06/2020 | JOBKEEPER-START-FN05 | JOBKEEPER-FINISH-FN05 |

| 06 | 08/06/2020 - 21/06/2020 | JOBKEEPER-START-FN06 | JOBKEEPER-FINISH-FN06 |

| 07 | 22/06/2020 - 05/07/2020 | JOBKEEPER-START-FN07 | JOBKEEPER-FINISH-FN07 |

| 08 | 06/07/2020 - 19/07/2020 | JOBKEEPER-START-FN08 | JOBKEEPER-FINISH-FN08 |

| 09 | 20/07/2020 - 02/08/2020 | JOBKEEPER-START-FN09 | JOBKEEPER-FINISH-FN09 |

| 10 | 03/08/2020 - 16/08/2020 | JOBKEEPER-START-FN10 | JOBKEEPER-FINISH-FN10 |

| 11 | 17/08/2020 - 30/08/2020 | JOBKEEPER-START-FN11 | JOBKEEPER-FINISH-FN11 |

| 12 | 31/08/2020 - 13/09/2020 | JOBKEEPER-START-FN12 | JOBKEEPER-FINISH-FN12 |

| 13 | 14/09/2020 - 27/09/2020 | JOBKEEPER-START-FN13 | JOBKEEPER-FINISH-FN13 |

| 14 | 28/09/2020 - 11/10/2020 | JOBKEEPER-START-FN14 | JOBKEEPER-FINISH-FN14 |

| 15 | 12/10/2020 - 25/10/2020 | JOBKEEPER-START-FN15 | JOBKEEPER-FINISH-FN15 |

| 16 | 26/10/2020 - 08/11/2020 | JOBKEEPER-START-FN16 | JOBKEEPER-FINISH-FN16 |

| 17 | 09/11/2020 - 22/11/2020 | JOBKEEPER-START-FN17 | JOBKEEPER-FINISH-FN17 |

| 18 | 23/11/2020 - 06/12/2020 | JOBKEEPER-START-FN18 | JOBKEEPER-FINISH-FN18 |

| 19 | 07/12/2020 - 20/12/2020 | JOBKEEPER-START-FN19 | JOBKEEPER-FINISH-FN19 |

| 20 | 21/12/2020 - 03/01/2021 | JOBKEEPER-START-FN20 | JOBKEEPER-FINISH-FN20 |

| 21 | 04/01/2021 - 17/01/2021 | JOBKEEPER-START-FN21 | JOBKEEPER-FINISH-FN21 |

| 22 | 18/01/2021 - 31/01/2021 | JOBKEEPER-START-FN22 | JOBKEEPER-FINISH-FN22 |

| 23 | 01/02/2021 - 14/02/2021 | JOBKEEPER-START-FN23 | JOBKEEPER-FINISH-FN23 |

| 24 | 15/02/2021 - 28/02/2021 | JOBKEEPER-START-FN24 | JOBKEEPER-FINISH-FN24 |

| 25 | 01/03/2021 - 14/03/2021 | JOBKEEPER-START-FN25 | JOBKEEPER-FINISH-FN25 |

| 26 | 15/03/2021 - 28/03/2021 | JOBKEEPER-START-FN26 | JOBKEEPER-FINISH-FN26 |

Payroll cycles

Regardless of the frequency of regular pay cycles or out of cycle pay periods, or the pay period start and end dates, the $1,500 per fortnight applies to the paydays (payrun period) within the defined fortnights and from which fixed fortnight the payment applies. Special rules apply for payments within the month of April and for employees receiving monthly pay.

| Pay frequency | JK Payment | Calculation |

|---|---|---|

| Weekly | 750 | 1500 / 2 |

| Fortnightly | 1500 | 1500 X 1 |

| Twice a month | 1625 | 1500 X 26 / 24 |

| Monthly (average) | 3250 | 1500 X 26 /12 |

Subsidy duration and periods

The JobKeeper payment period commenced from Monday 30 March 2020 and will apply for 13 full fortnights until Sunday 27 September 2020. The ATO will reimburse participating employers monthly in arrears $1,500 for each full fortnight per eligible employee paid by the employer.

Manage Employees for JobKeeper payment

Employees are being paid less than the JobKeeper payment

Pay full JobKeeper payment to all eligible employees. You'll pay them their current pay plus top-up amount to bring their taxable gross up to the JobKeeper payment amount.

JobKeeper payment is before tax and you can choose whether or not to pay superannuation on the top-up amount.

Scenario:

- Nick is permanent part time employee on a salary $1,000 per fortnight before tax and who continues working for the employer

Reporting for fortnight 01

- Add other allowance as description as 'JOBKEEPER-START-FN01' and amount as 0 (zero)

- Add another allowance with other type, description as 'JOBKEEPER-TOPUP' and payment as $500 (as a cumulative YTD amount)

Reporting for fortnight 02

- Add another allowance with other type, description as 'JOBKEEPER-TOPUP' and payment $500 (the system will automatically calculate the cumulative YTD amount)

Reporting for fortnight 03

- Add another allowance with other type, description as 'JOBKEEPER-TOPUP' and payment as $500 (the system will automatically calculate the cumulative YTD amount)

..

.

Reporting for fortnight 13

- Add another allowance with other type, description as 'JOBKEEPER-TOPUP' and payment as $500 (the system will automatically calculate the cumulative YTD amount)

Employees are being paid more than the JobKeeper payment

Pay them as normal and report to ATO via STP.

Scenario:

- Adam is permanent full-time employee on a salary $3,000 per fortnight before tax and who continues working for the employer

Reporting for fortnight 01

- Add other allowance as description as 'JOBKEEPER-START-FN01' and amount as 0 (zero)

- Report $3000 as normal

Reporting for fortnight 02

- Report $3000 as normal

.

Reporting for fortnight 13

- Add other allowance as description as 'JOBKEEPER-FINISH-FN13' and amount as 0 (zero)

- Report $3000 as normal

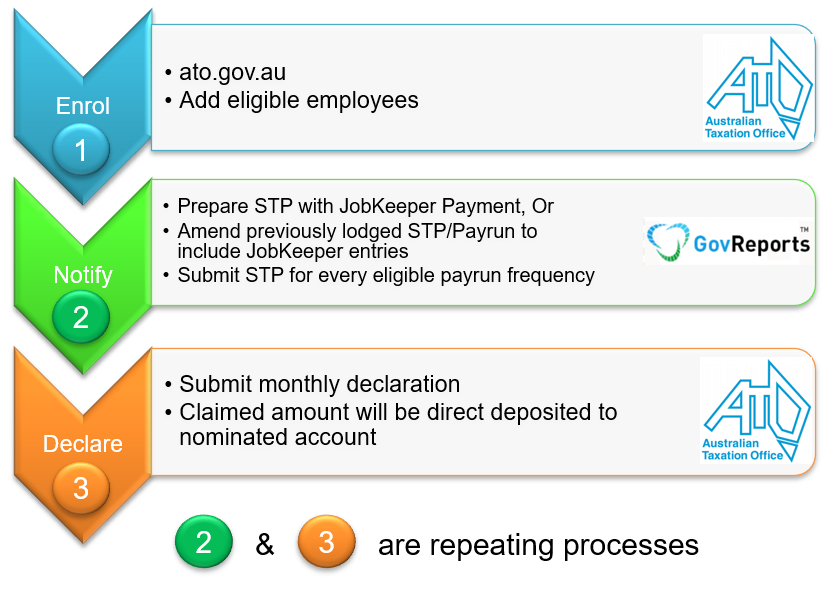

Claim Cycle

Employers will be required to notify the ATO of all eligible employees for which they wish to claim the JobKeeper payment after the last day of the last full fortnight in the calendar month. Employers will also be required to complete a monthly declaration online.

| Mon | Tue | Wed | Thur | Fri | Sat | Sun | |

|---|---|---|---|---|---|---|---|

| October | Fortnight 14 (28 September to 11 October) | ||||||

| 28 | 29 | 30 | 1 | 2 | 3 | 4 | |

| 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

| Fortnight 15 (12 October to 25 October) | |||||||

| 12 | 13 | 14 | 15 | 16 | 17 | 18 | |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 | |

| Fortnight 16 (26 October to 8 November) | |||||||

| 26 | 27 | 28 | 29 | 30 | 31 | 1 | |

| November | |||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

| Fortnight 17 (9 November to 22 November) | |||||||

| 9 | 10 | 11 | 12 | 13 | 14 | 15 | |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 | |

| Fortnight 18 (23 November to 6 December) | |||||||

| 23 | 24 | 25 | 26 | 27 | 28 | 29 | |

| December | |||||||

| 30 | 1 | 2 | 3 | 4 | 5 | 6 | |

| Fortnight 19 (7 December to 20 December) | |||||||

| 7 | 8 | 9 | 10 | 11 | 12 | 13 | |

| 14 | 15 | 16 | 17 | 18 | 19 | 20 | |

| Fortnight 20 (21 December to 3 January) | |||||||

| 21 | 22 | 23 | 24 | 25 | 26 | 27 | |

| 28 | 29 | 30 | 31 | 1 | 2 | 3 | |

| January | Fortnight 21 (4 January to 17 January) | ||||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 | |

| Fortnight 22 (18 January to 31 January) | |||||||

| 18 | 19 | 20 | 21 | 22 | 23 | 24 | |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 | |

| February | Fortnight 23 (1 February to 14 February) | ||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 | |

| Fortnight 24 (15 February to 28 February) | |||||||

| 15 | 16 | 17 | 18 | 19 | 20 | 21 | |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 | |

| March | Fortnight 25 (01 March to 14 March) | ||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 | |

| Fortnight 26 (15 March to 28 March) | |||||||

| 15 | 16 | 17 | 18 | 19 | 20 | 21 | |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 | |

| End of Subsidy Fortnights |

|||||||

JobKeeper Extension

The JobKeeper scheme has been extended from 28 September 2020 until 28 March 2021.

The extension periods are:

The extension periods are:

- Extension 1: from 28 September 2020 to 3 January 2021

- Extension 2: from 4 January 2021 to 28 March 2021

Update to reporting JobKeeper eligibility through STP

We have identified occurrences of employers who have incorrectly reported JOBKEEPER-FINISH-FN13 for their employees. Reporting this will end date employees for JobKeeper from 13 September.

What you need to do:

For employers eligible for the JobKeeper Extension and wishing to maintain employee eligibility, a relevant Tier will need to be provided for each employee.

No further action is required if JOBKEEPER-FINISH-FN14 has been reported by employers that are not eligible for the JobKeeper Extension.

Note: For employers that are not eligible for the JobKeeper Extension, no finish code is required for their employees.

What you need to do:

- If JOBKEEPER-FINISH-FN13 has been reported incorrectly, this can be corrected by reporting JOBKEEPER-START-FN13 through STP.

For employers eligible for the JobKeeper Extension and wishing to maintain employee eligibility, a relevant Tier will need to be provided for each employee.

No further action is required if JOBKEEPER-FINISH-FN14 has been reported by employers that are not eligible for the JobKeeper Extension.

Note: For employers that are not eligible for the JobKeeper Extension, no finish code is required for their employees.