Go Back

To Top

Release Notes

New features launched:

Rewards:

Rewards:

-

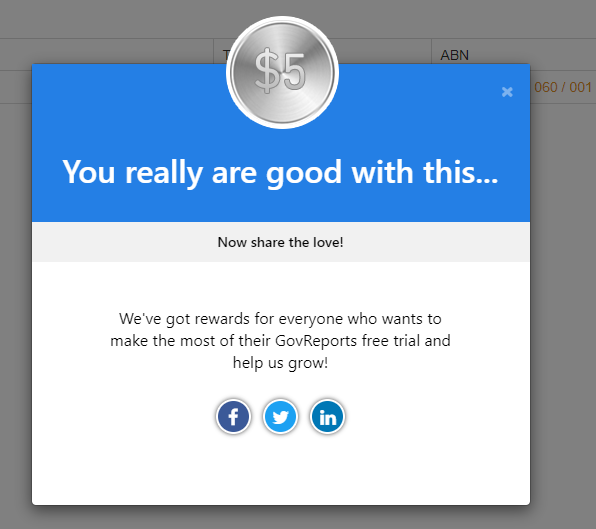

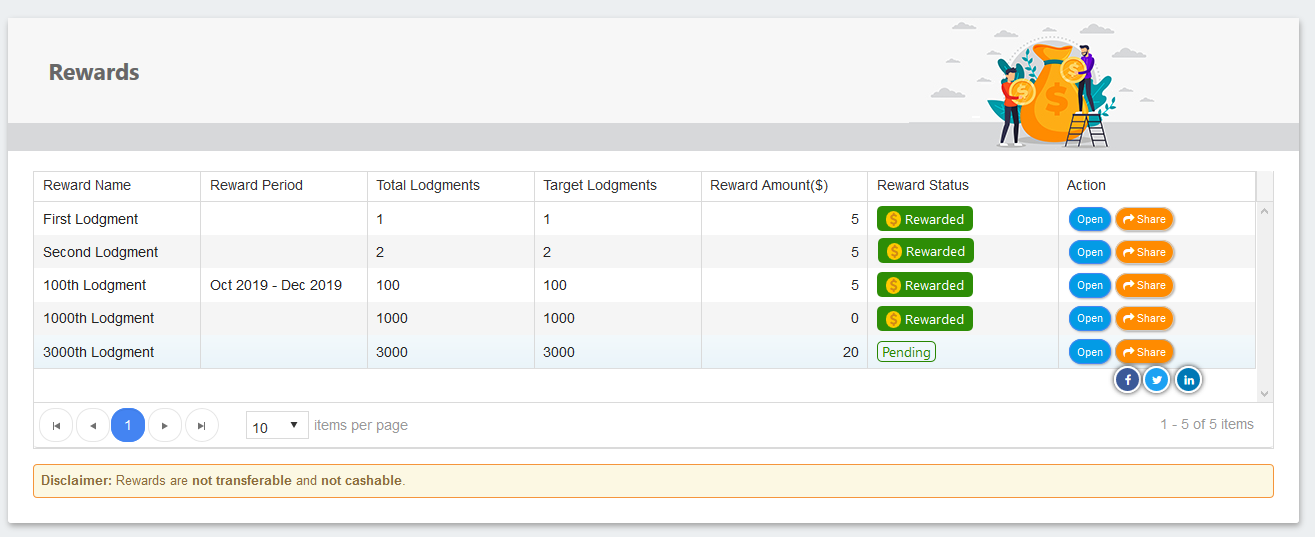

Rewards Program is introduced to encourage users to tap into new released features and or promoting increased activities with their account

-

Rewards with random lodgment volume, new feature access and or sequence of system usage.

-

Window pop-up will be displayed when reward criteria is matched

-

Account holders can then share their accomplishment on social media and be rewarded accordingly

New features launched:

-

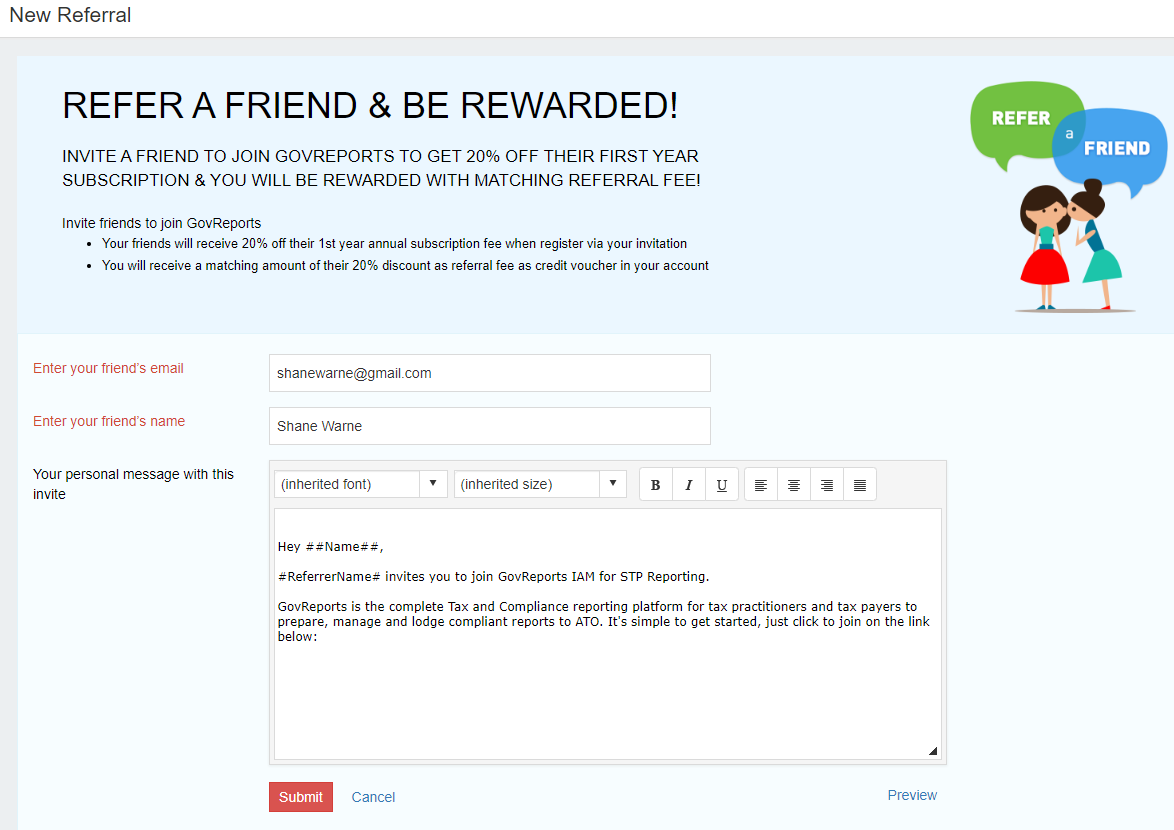

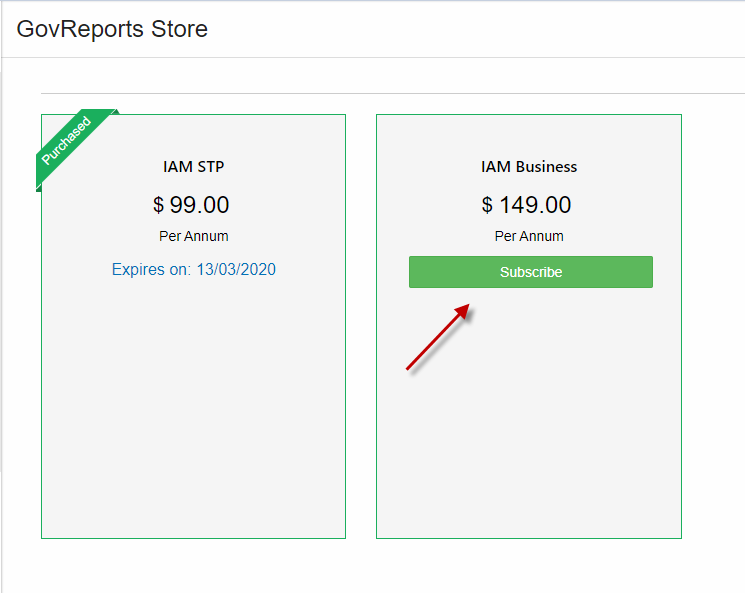

Refer a Friend Option: In IAM, users can refer their friend to use either IAM STP or IAM Business Packages. The Referee will get 20% discount in their first subscription and the Referrer will get the matching amount added to their account as credits.

-

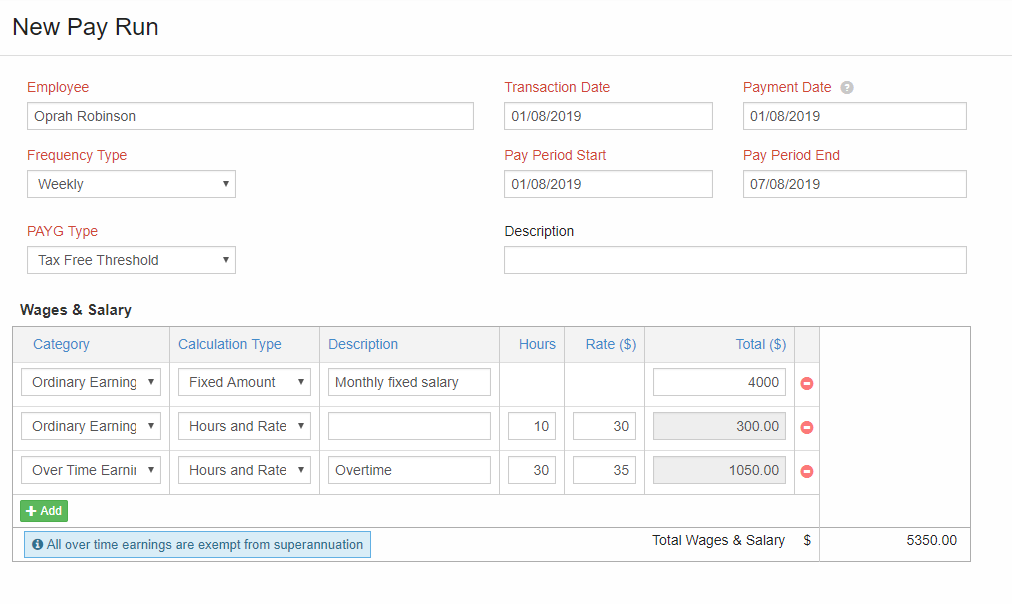

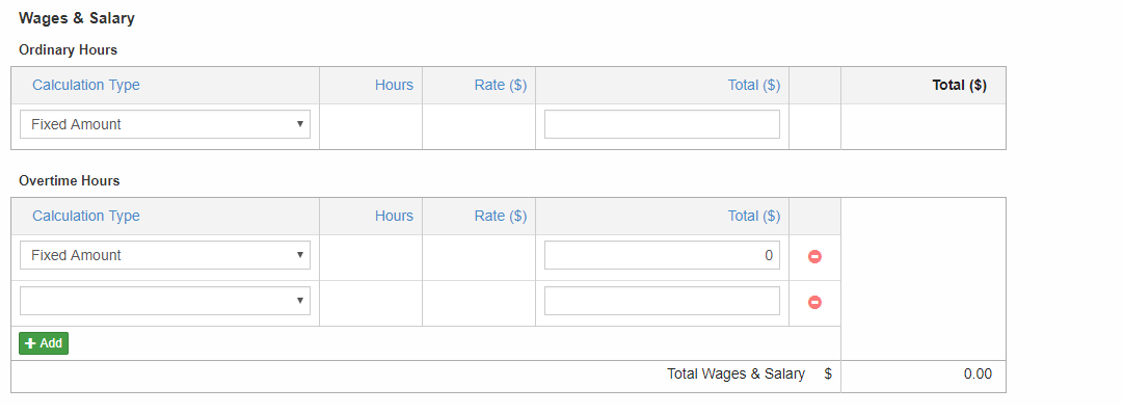

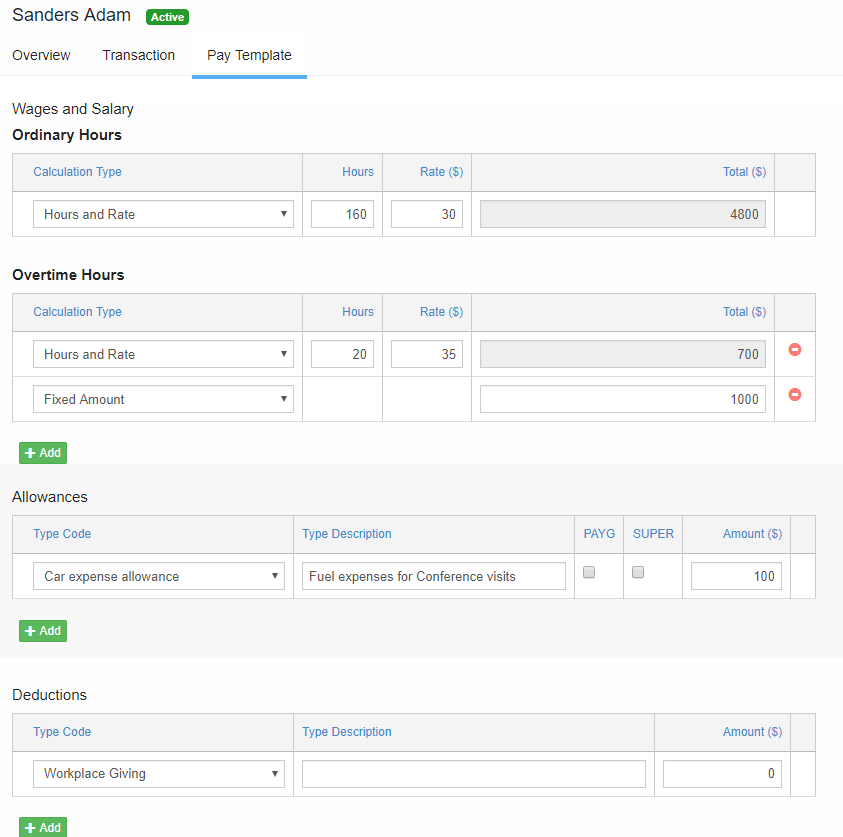

Multiple Ordinary and Overtime hours: Multiple entries on Ordinary hours and Overtime hours can be entered by clicking on "Add" button. Users can choose between Ordinary or Overtime hours. The default "Calculation Type" is given as "Fixed Amount" which can also be switched to "Hours and Rate".

-

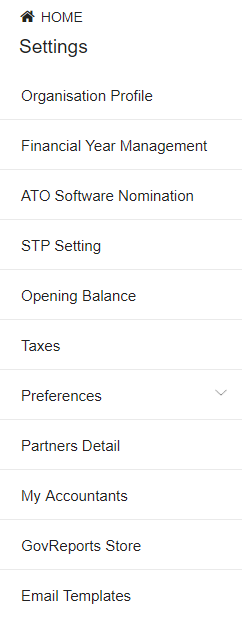

Settings index page: The settings index page has been re-organized with certain new settings and in a new order of display.

-

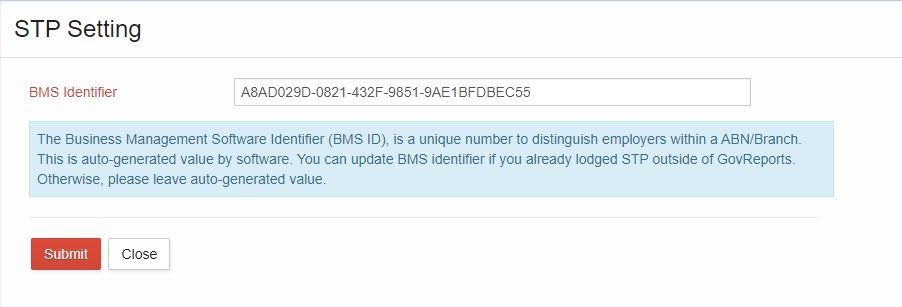

STP Setting: If a different software provider was used for previous STP lodgments, users can update the BMS ID under STP settings and start making the lodgments.

-

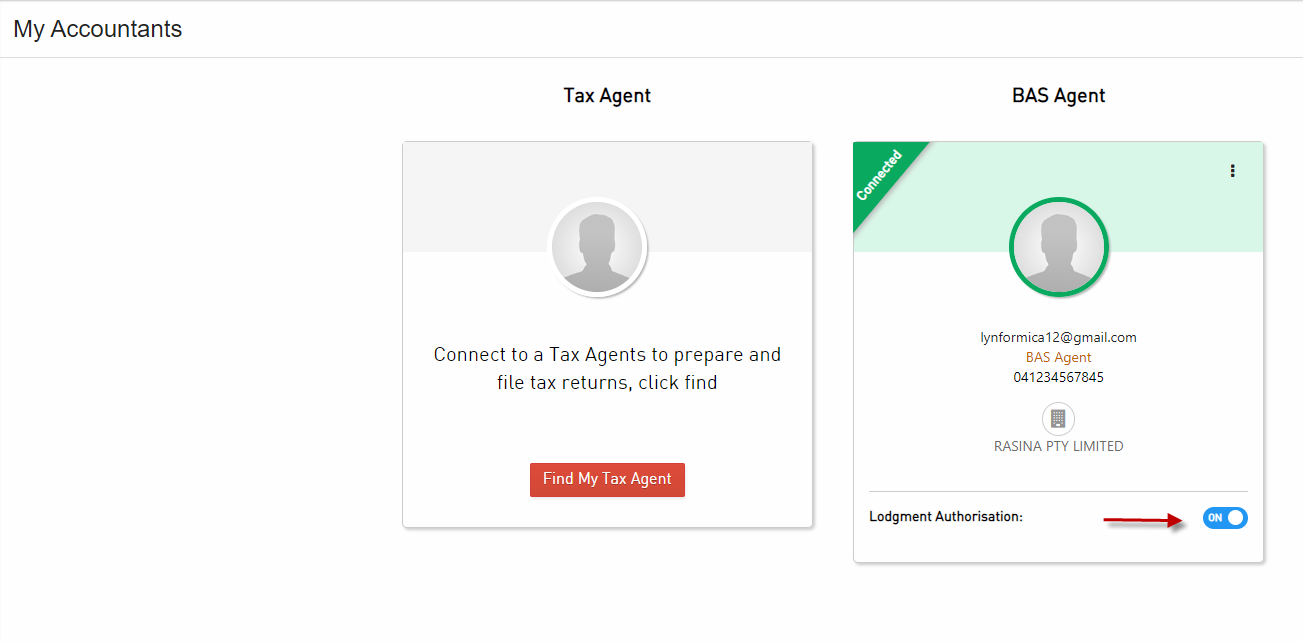

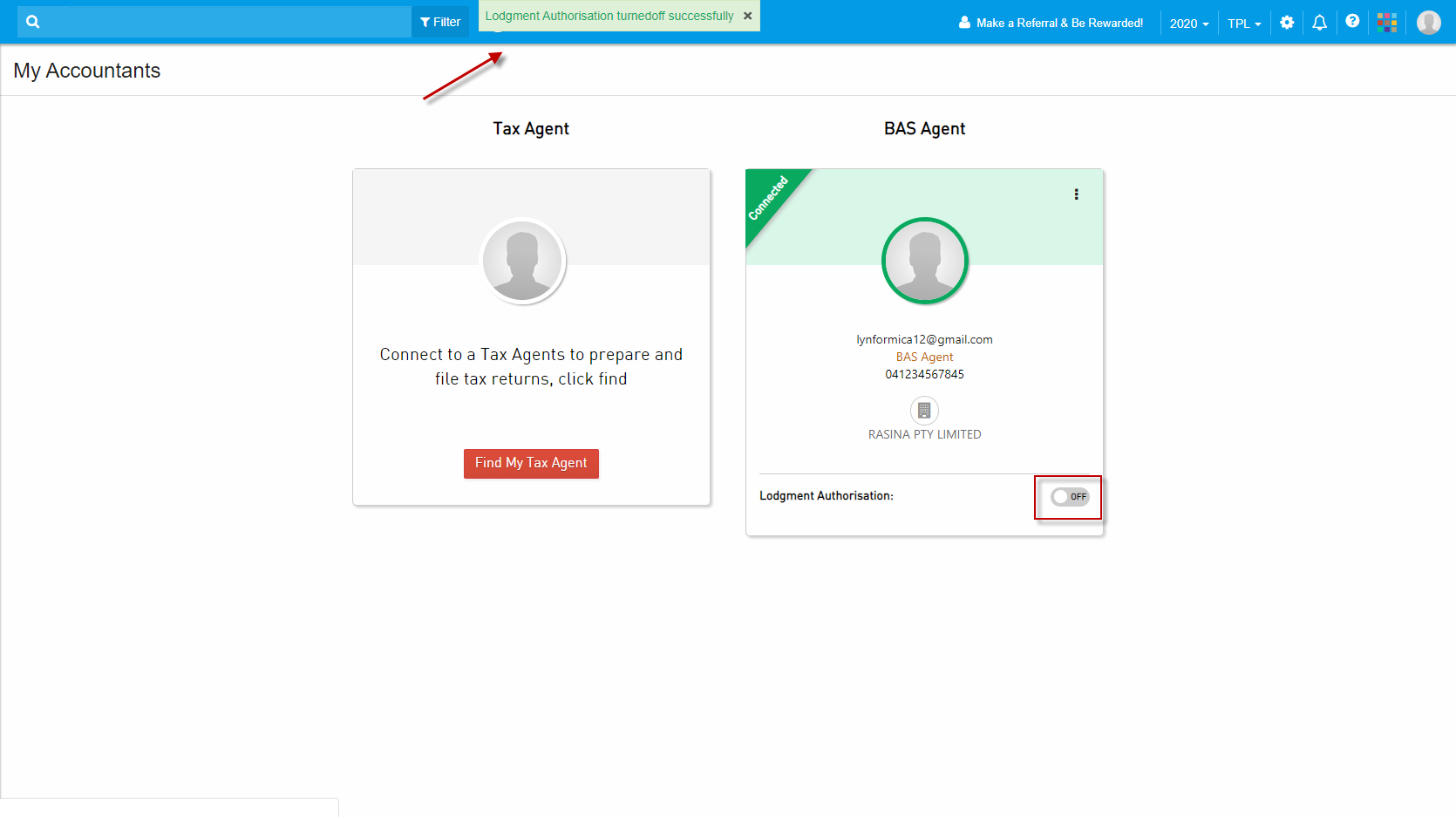

Lodgment Authorization setting: For businesses engaging Accountants, by default the "Lodgment Authorization" is set to "On". This lets the business to authorize the report prepared by their Accountant every time. There is a toggle button to turn this "Off". Once this option is set, Accountants can lodge the reports directly without waiting for the authorization from the business.

-

"My Subscription" label has been replaced by "GovReports Store".

-

The look of "Notes" and "Others" tabs in New Pay Run screen has been changed.

New features launched:

-

Ordinary hours and Overtime hours: "New Pay run" window has been updated. The information entered in an employee's pay slip has been expanded, splitting the work hours into Ordinary hours and Overtime hours with different calculation types for wages. Also, additional overtime hours can be added whenever necessary.

-

Calculation types for Wages and Salary: The calculation types for Wages and Salary are of 2 types, Fixed amount or Hourly rate. If Hourly rate is selected as the calculation type, there is an option to enter number of hours and rate per hour so that the total wages is calculated automatically by the system.

-

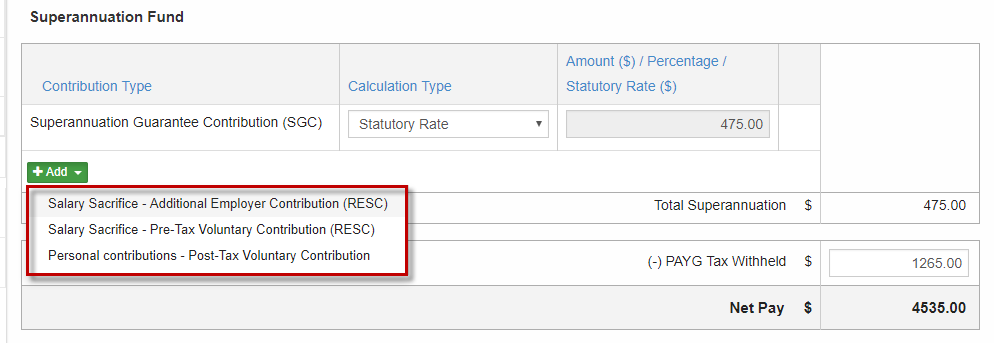

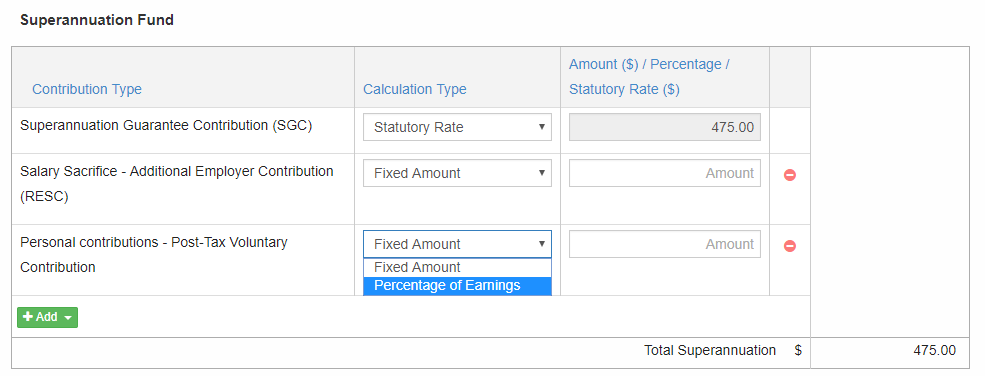

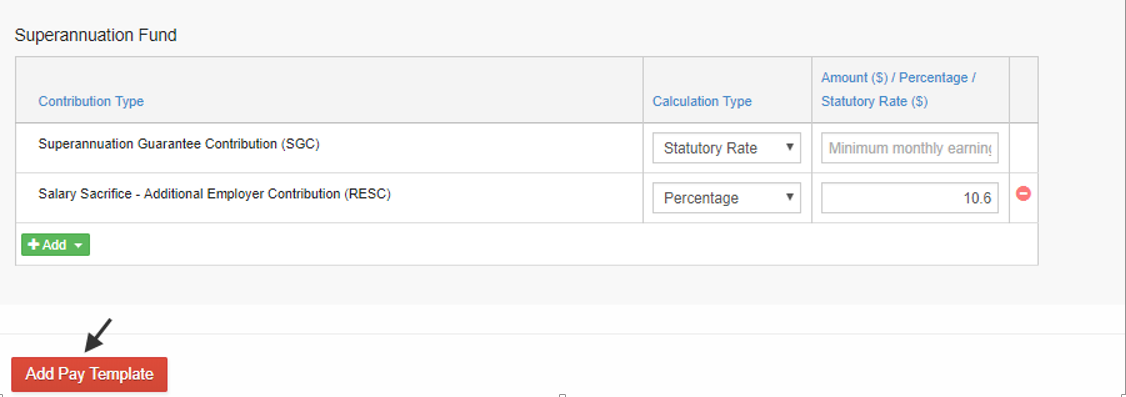

Additional ‘Super' fields: "New Pay Run" window also has been updated based on user input to include different Super fields as Superannuation Guarantee Contribution (SGC), Salary Sacrifice- Additional Employer Contribution (RESC), Salary Sacrifice- Pre-Tax Voluntary Contribution (RESC) and Personal contributions -Post-Tax Voluntary Contribution/

-

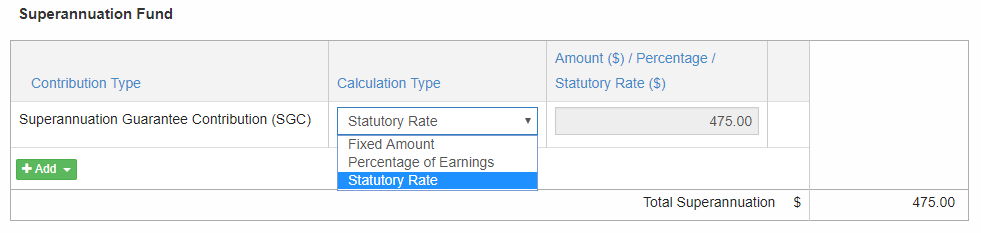

Calculation types for Supernnuation Guarantee Contribution (SGC): The calculation types for regular Superannuation Guarantee Contribution had been added of 3 types namely Fixed amount, Percentage of earnings and Statutory Rate. Statutory Rate is the default percentage of 9.5%. It is set as the default calculation type for Superannuation Guarantee Contribution (SGC).

-

Calculation types for additional ‘Super' fields: For Salary sacrifice- Additional employer contribution, Salary sacrifice- Pre-tax voluntary contribution and Post-tax voluntary contribution, the calculation type can be set as either Fixed amount or Percentage of earnings.

-

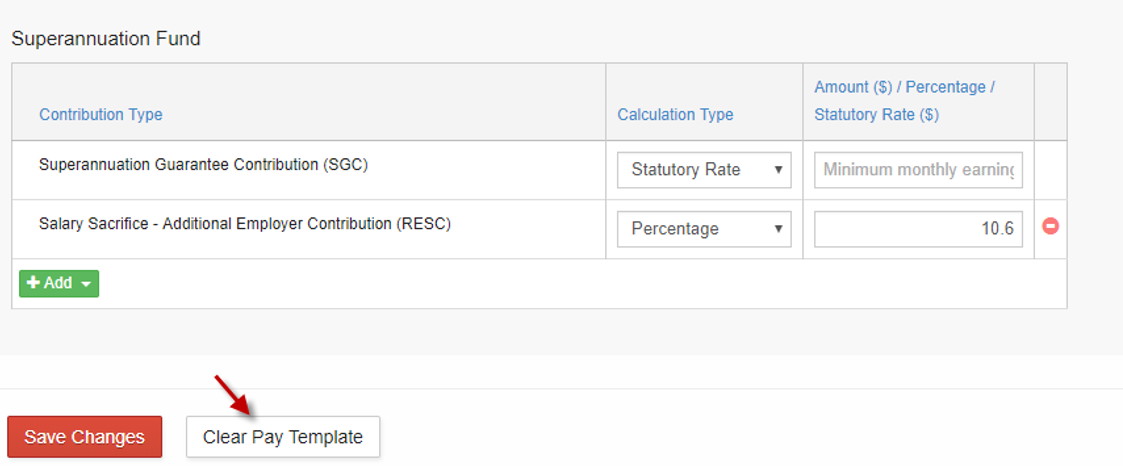

Pay Template: Pay template option is available to create predefined fields for individual employees. It can be used to set overtime hours, hourly rate, commonly used allowances of an employee (if any) and Superannuation options mentioned above. This minimizes the data feed.

Pay template can be added or removed whenever required.

-

Superannuation Summary Report: Since the Superannuation has been split to different categories namely Superannuation Guarntee Contribution (SGC), Salary Sacrifice – Additional Employer Contribution (RESC), Salary Sacrifice – Pre-tax voluntary contribution and Post-tax voluntary contribution, this report gives the consolidated information to report the Super fund

-

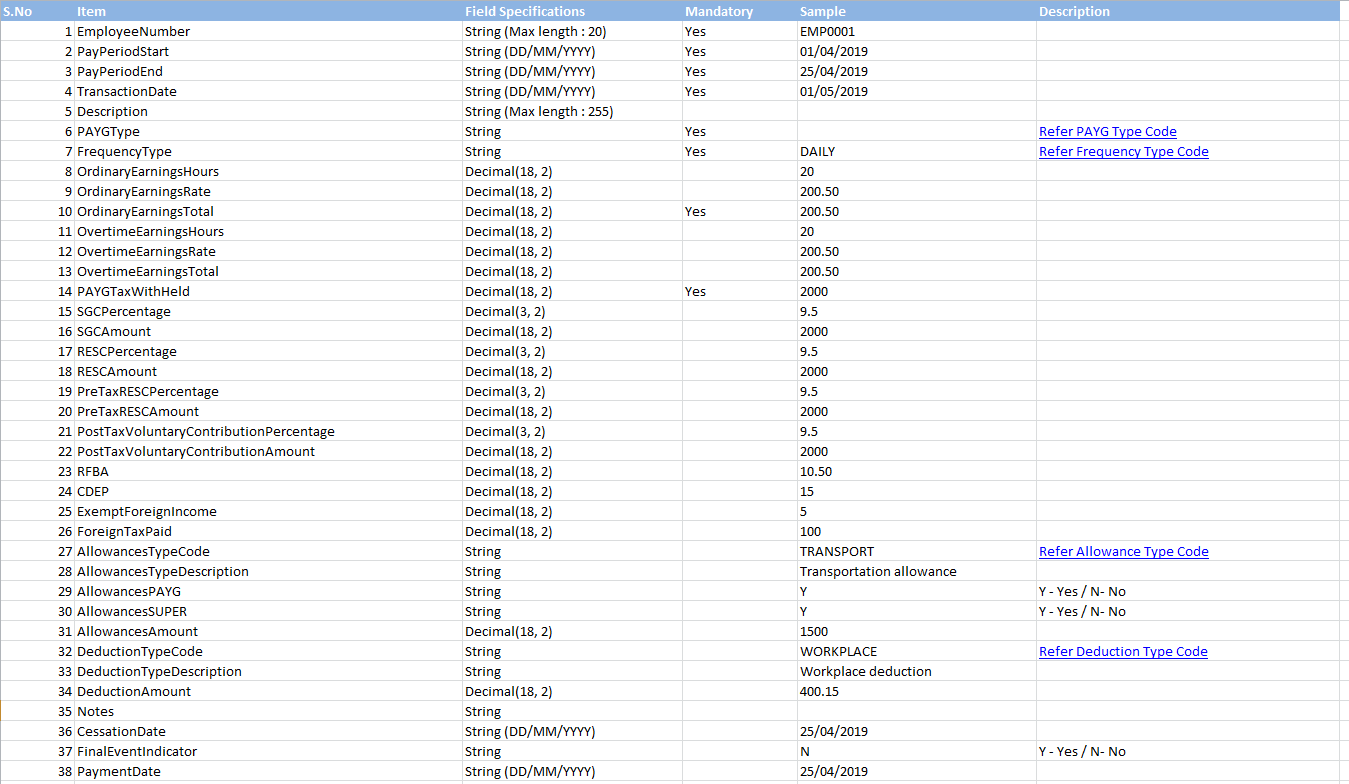

Import CSV: New columns are added to support latest updates.

-

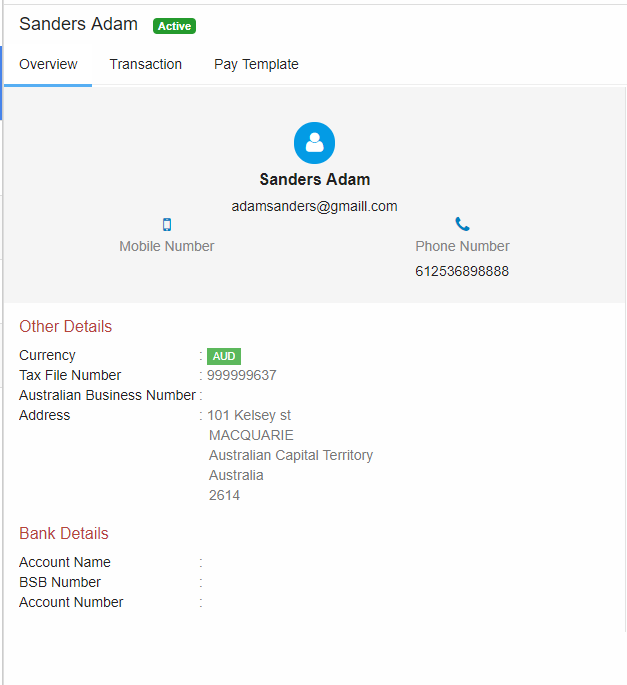

Employee overview: The look and feel of "Employee Overview" page has been changed

New features

Updates

-

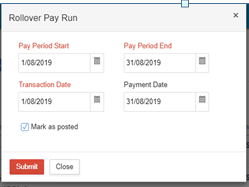

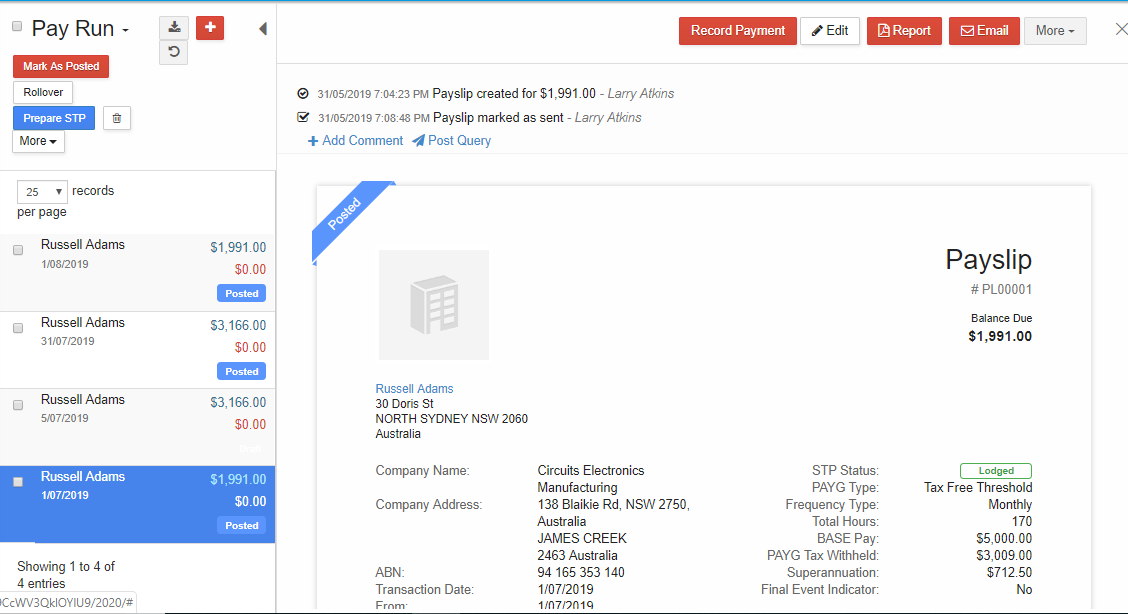

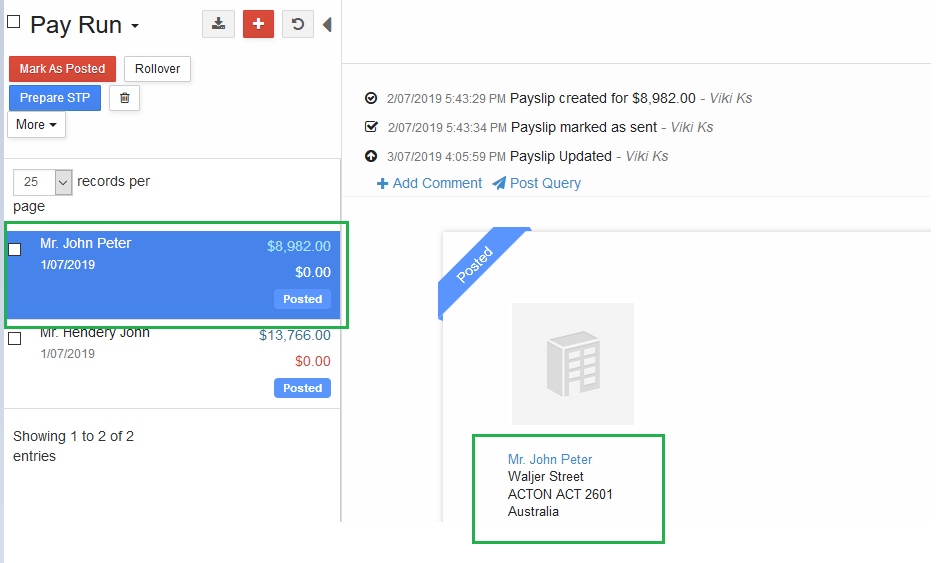

Rollover can be used to replicate the selected payruns and minimize the data entry requirement. For subsequent pay slips with the same Gross, PAYG and Super figures, users will only need to input the Payroll start and end date, Transaction date and Payment date and immediately creates subsequent payruns for the selected employees for quick payroll preparation.

- If the figures in the payrun are varied, users will have to edit and update the specific rollover payrun.

-

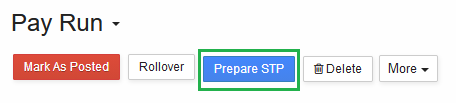

Prepare STP function button is enabled as a short cut to prepare STP report after the payrun is created and payslip is received by employee. Instead of going to Reports for STP Payroll Events, Prepare STP is the quicker access to convert payruns and generate STP reports for ATO lodgment. This short cut process requires for you to select the employee payruns and click "Prepare STP" tab ready for lodgement .

-

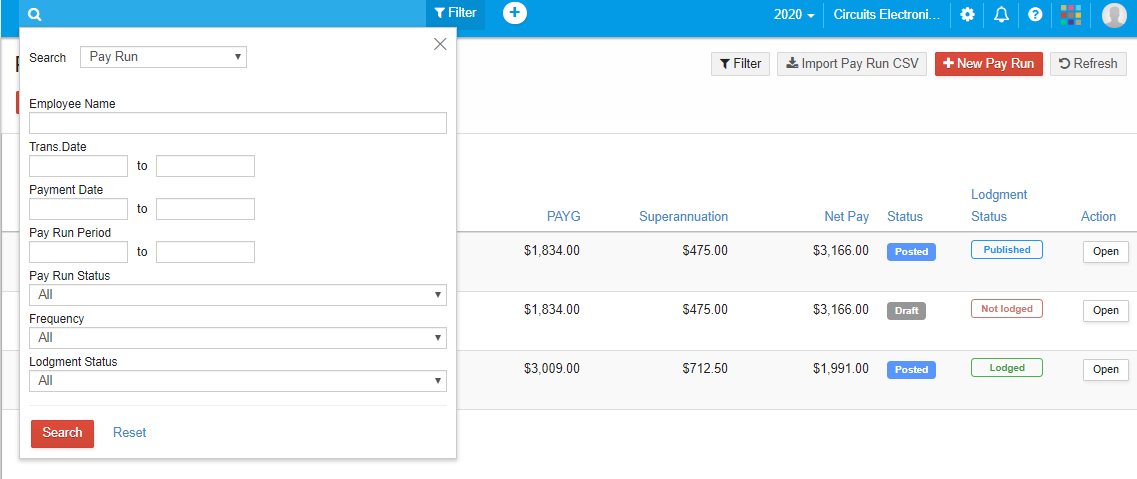

Filter function tab is enabled for users to locate a particular pay slips using search payrun labeled criteria or categories. It can be based on a single category or more to track down to a single payrun.

-

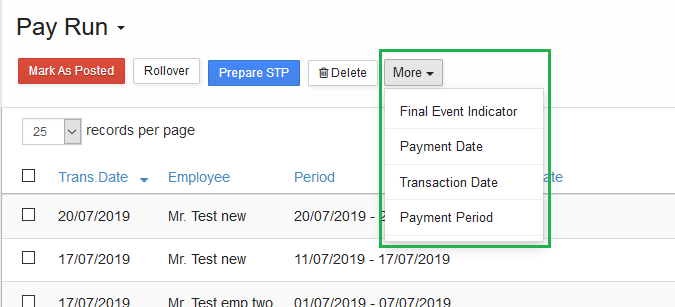

Bulk updates featured function can be used to update "Final Event Indicator", "Payment date", "Transaction date" and "Period" for a single pay slip or as bulk payruns. The featured function helps cut down workflow by enabling user to quickly update the date if entered incorrectly with a single click. Simply select the payruns to update the incorrected fields.

- Payment date is now a field which must be completed in the Payrun.

Updates

-

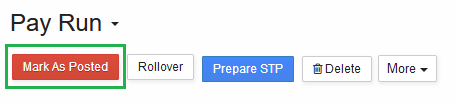

Mark as Posted:

replaces the field label "Mark as Sent" to resolve misunderstanding from users that it is a Fair Work Requirement of payslips received by employees and not as an ATO lodgement activity.

-

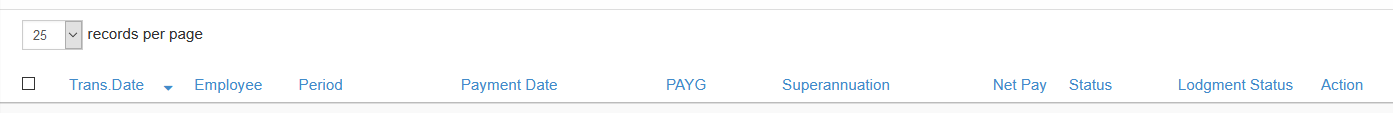

More features

in Payrun view list now incorporating Date, Employee, Period, PAYG, Super, Net Pay, Statuses, Lodgment Status.

- Latest records on top, last added or recently added payrun is positioned on the top of the payruns list to facilitate users to locate and identify from the list, the previous lodged payruns and the newly created payruns to process for STP preparation and lodgment.

- Default records size per page is set at 25 as the default count to help users in navigating between pages to locate a payruns.

- Date on payrun add screen has been rename as "Transaction date".

-

Action buttons

all links/button will have label text to better understanding and move to top right.

- New look for Payrun page

-

Selected items in list are highlighted in blue for easier selection identification.

-

New features launched:

- Business owner invite accountants to their business

- Accountants invite business owner to access their business data

- Accountant pay for subscription and get discount

- Client authorization via DA or direct for accountant prepared reports

- Business owner request accountant to review and lodge reports

- New dashboard for IAM STP businesses

- Help Center

- Left navigation menu structure updated

-

New features launched:

- Standalone application for STP

- Lodgment facility included for STP, Activity Statement & Tax returns

- My lodgments

- ATO software nomination

- Google authenticator for two factor authentication

-

New package introduced:

- IAM - STP

- IAM Business

- Trial enabled for packages