Settings

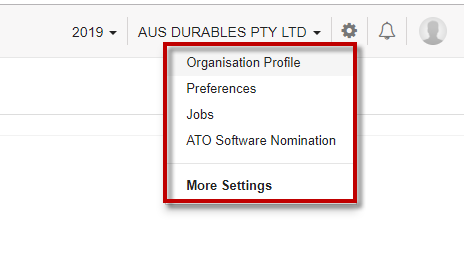

There are 9 different components in Settings- Organization Profile

- Preferences

- Opening Balance

- Taxes

- Jobs

- Email Templates

- Subscription

- Accountants

- ATO Software Nomination

I.Organization Profile Top

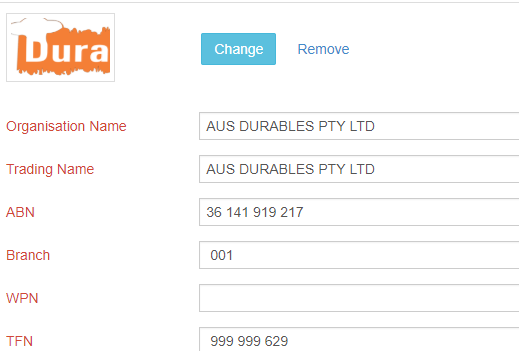

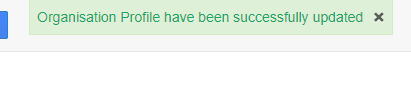

Organization profile is the collection of basic business information like ABN, the organization name, the trading name, industry it belongs to, contact details like address, phone number and email.

While setting up your account, the ABN, Organization name, Business structure, Industry Type and starting Financial Year are filled.

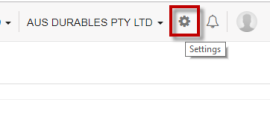

You can customize additional profile information from the "Settings" menu on the top right corner after you log in

From Settings menu Click on "Organization Profile".

Here you can add or edit all your organization details in the given fields, add logo, account number, etc.

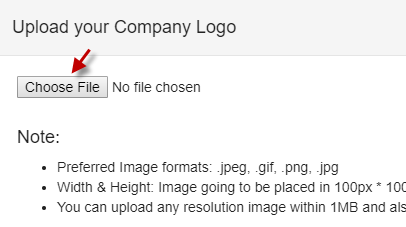

You can add logo for your business as this logo will be used in your sales invoices and pay slips.

Choose the logo from your computer and save it.

You can see the logo of your business on the top left corner.

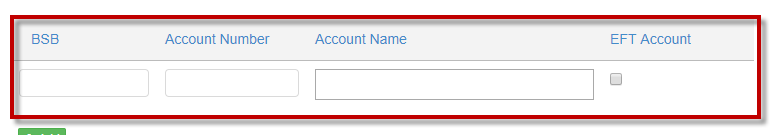

If necessary, add the Account details and click on Save.

II.Preferences: Top

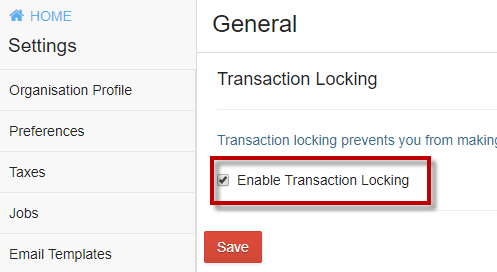

From Settings, Click on Preferences- > General

If you want to send the pdf with the link while emailing invoices or estimates to customers, you can have this box checked on

If you want to mention any discount option in your invoices or estimates, you can select the mode of discounts. It can be either on an item level or on invoice level

You can also add any additional freight or adjustments by checking the appropriate boxes.

·Transaction locking is effective when you want to limit the payslip, sales or purchases entries within a particular financial year only. This prevents any clerical errors in entering a date belonging to a different financial year

Click on Preferences- > Estimate.

If you want automatically convert accepted estimates to invoices, you can select the appropriate button. By default, automatic conversions doesn't happen. If you want to automate conversion of accepted estimates to invoices and send it to the customers, you can click on "yes, save and send"

Enter the terms and conditions and customer notes if necessary and the same can be included in your estimates

Click on Preferences- > Invoices

If you wish to enable editing an invoice after it is being sent, you can check the box

When you enable "Show bank details in invoice", your bank details along with the account number, BSB number or account name has to be entered so that these information will be available in the invoices sent to customers

Any terms and conditions and customer notes entered here will be included in your invoices

Click on Preferences- > Credit notes

This is used to enter any customer notes and terms and conditions required for Credit Notes.

Click on Preferences- > Delivery Note Settings

You map the appropriate fields here in case of a Delivery Note

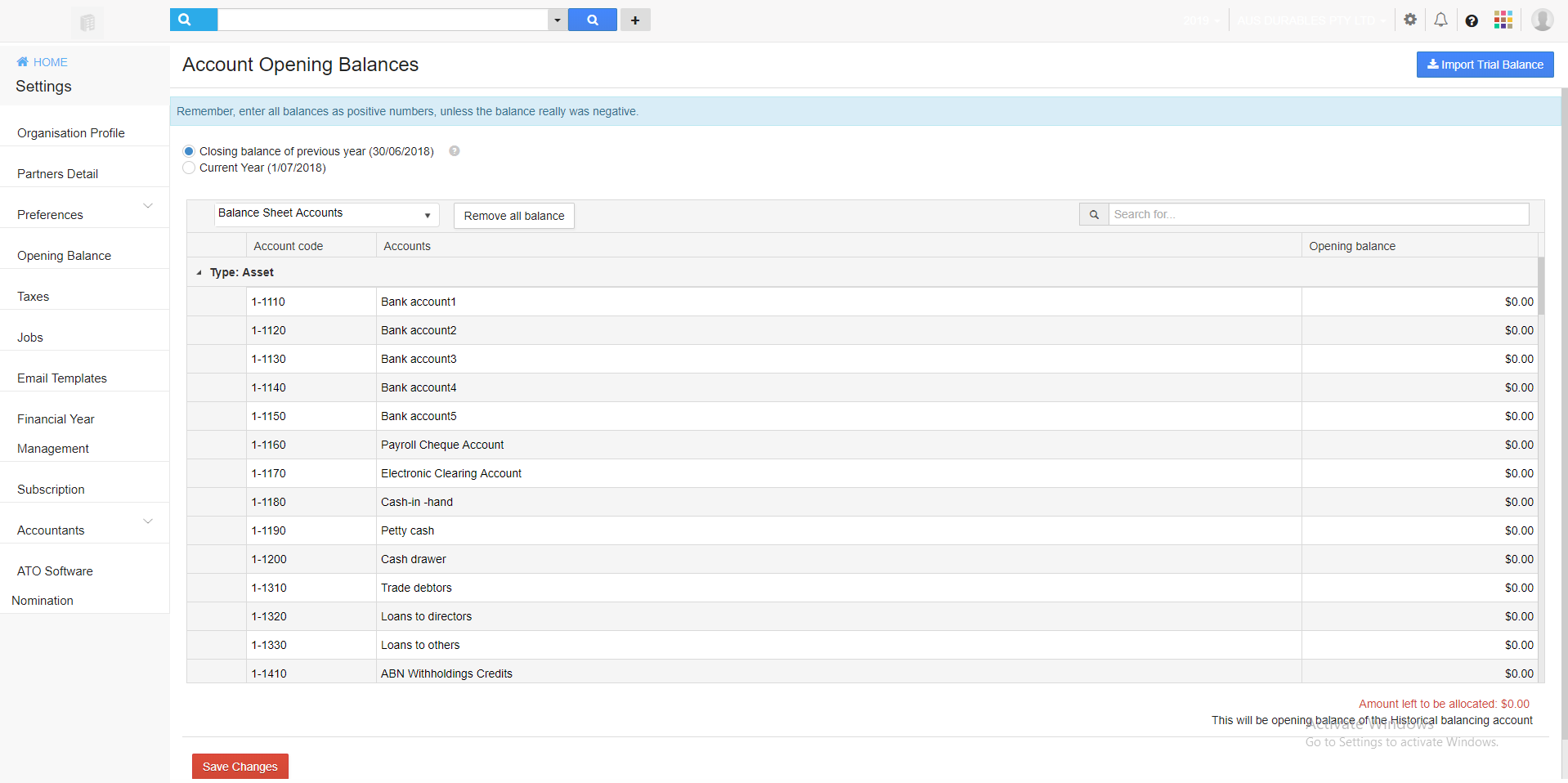

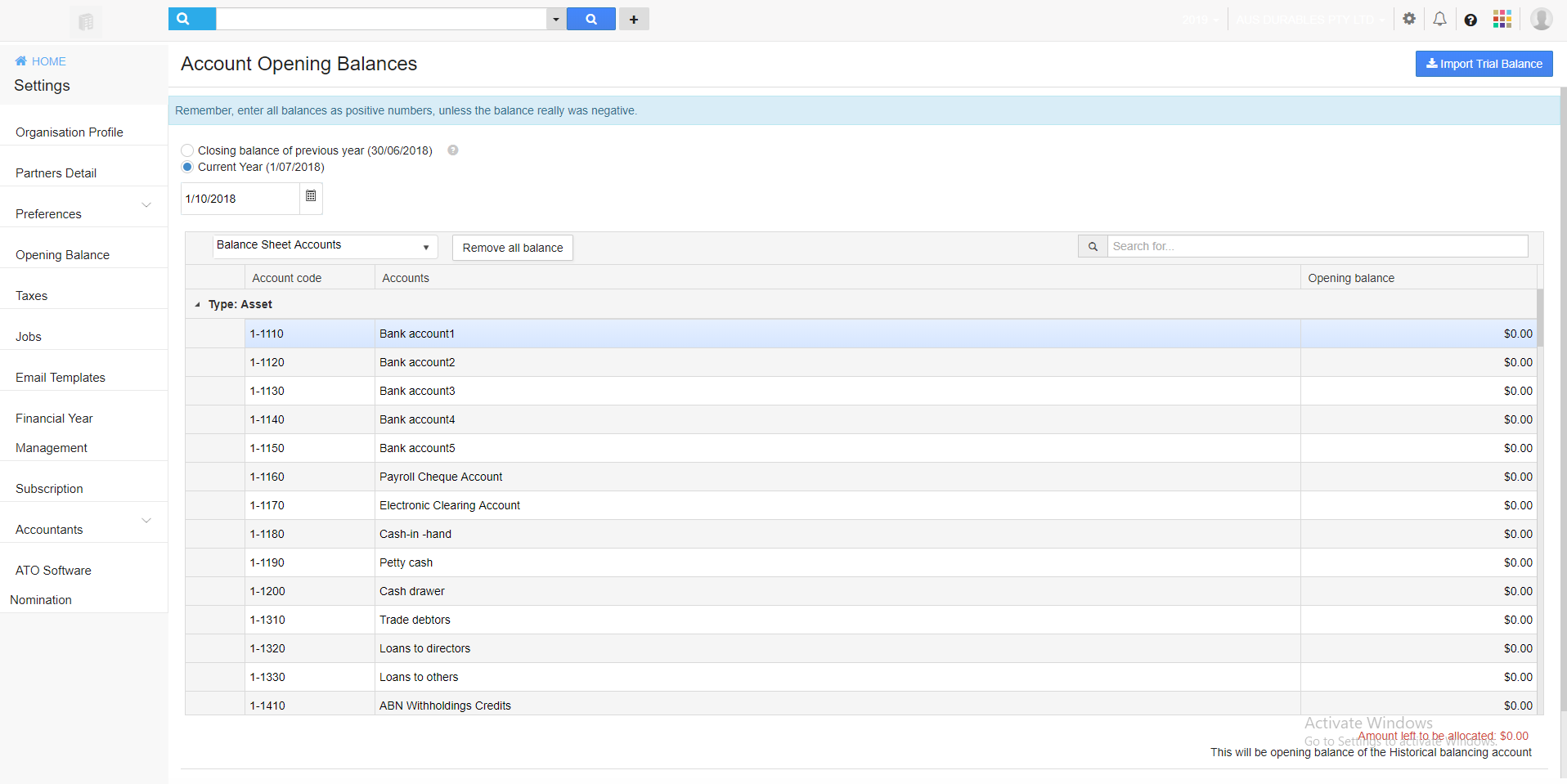

III. Opening Balance:

Financial Year is from July to June.

This settings menu allows you to see the Closing balance of previous Financial year as of June 30 and also Current year accounts starting from July 1.

For current year accounts, you can select the date from when you want to view to Accounts details. By default it is set to July 1

Click on any of the radio button above and you can see Profit Loss accounts and Balance Sheet accounts for that particular selection made.

There is also an option called "Remove Balance" where the selected Account Balances will be deleted. Please execute caution while using "Remove Balance".

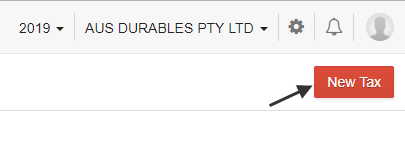

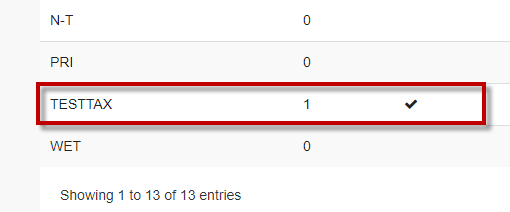

IV. Taxes: Top

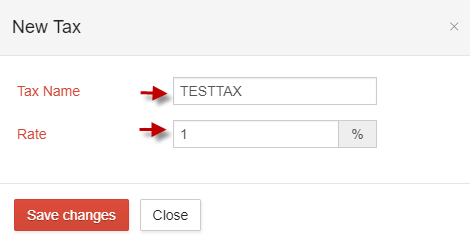

You can set any new tax which is not updated in GovReports and apply that particular tax by giving it a name and tax percentage.

In Taxes screen You can see that there are already 12 different taxes in the system. Click on "New Tax".

Before adding any new taxes, please make sure it is approved by the Government for your business to use on the type of transaction with your customers.

For example, let us try adding a New Tax called "CGT". It is the abbreviation of Capital Gains Tax.

You can see the newly added tax in the list. The taxes are displayed in alphabetical order of their names.

The taxes not available in the system and added by yous are editable and you can edit the Tax name or percentage.

V.Jobs: Top

You can have a list of jobs for your reference pertinent to your business.

You can add a "New Job" and provide the job type. It can be one among Business, Assets or Property.

The job created will be added under the list of "Jobs".

This option will be useful when viewing Account statements to track the expenses with respect each kind of Job.

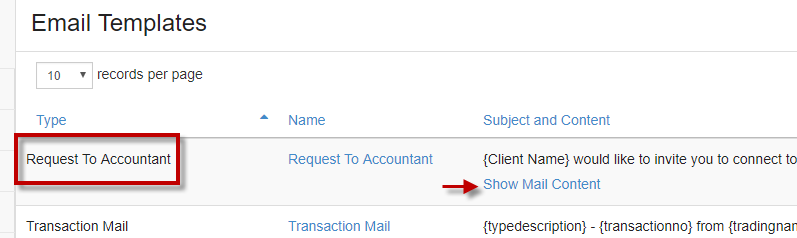

VI. Email Templates: Top

There are two email templates which could be used by your business.

1. Request of Account- for requesting an Accountant to support payroll preparation, reporting and lodgment.

2. Transaction Mail- used to send the email to customers or employees regarding a transaction or payslip.

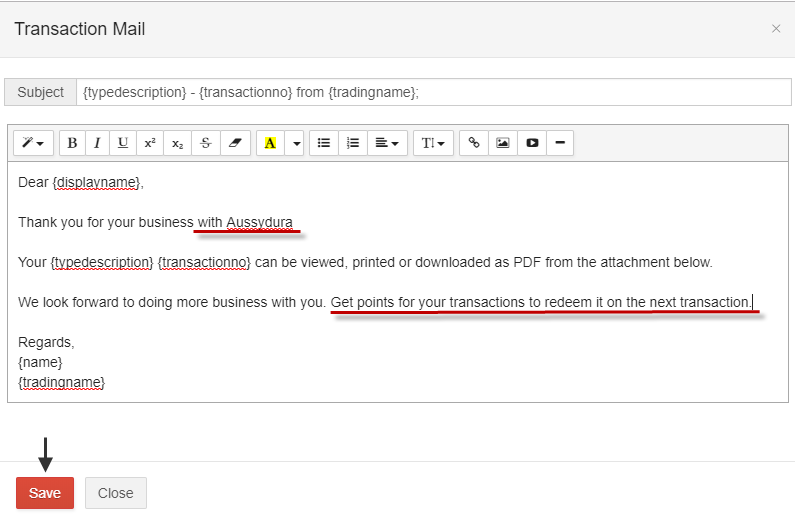

A template of the mail can be seen by clicking on "Show Mail Content". You can change the contents by adding any extra contents or deleting any unnecessary statements.

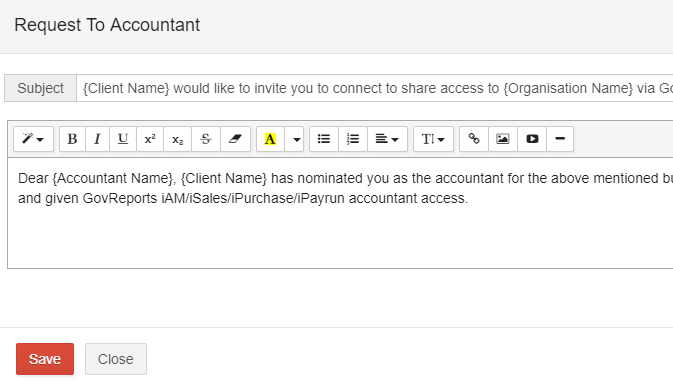

The following screenshot has the actual template of the mail.

Both the templates can be customized according to the needs of the business.

The saved email template can be used for future transactions.

Let’s see an example of a transaction email composed to a Sales customer.

Go to Sales- > Invoices. From the Sales register window, select the invoice to send an email.

When the invoice opens up, click on Email icon on the top.

The transaction email with the customized contents appear. Click on Send.

Your new customized transaction email has been sent to the customer.

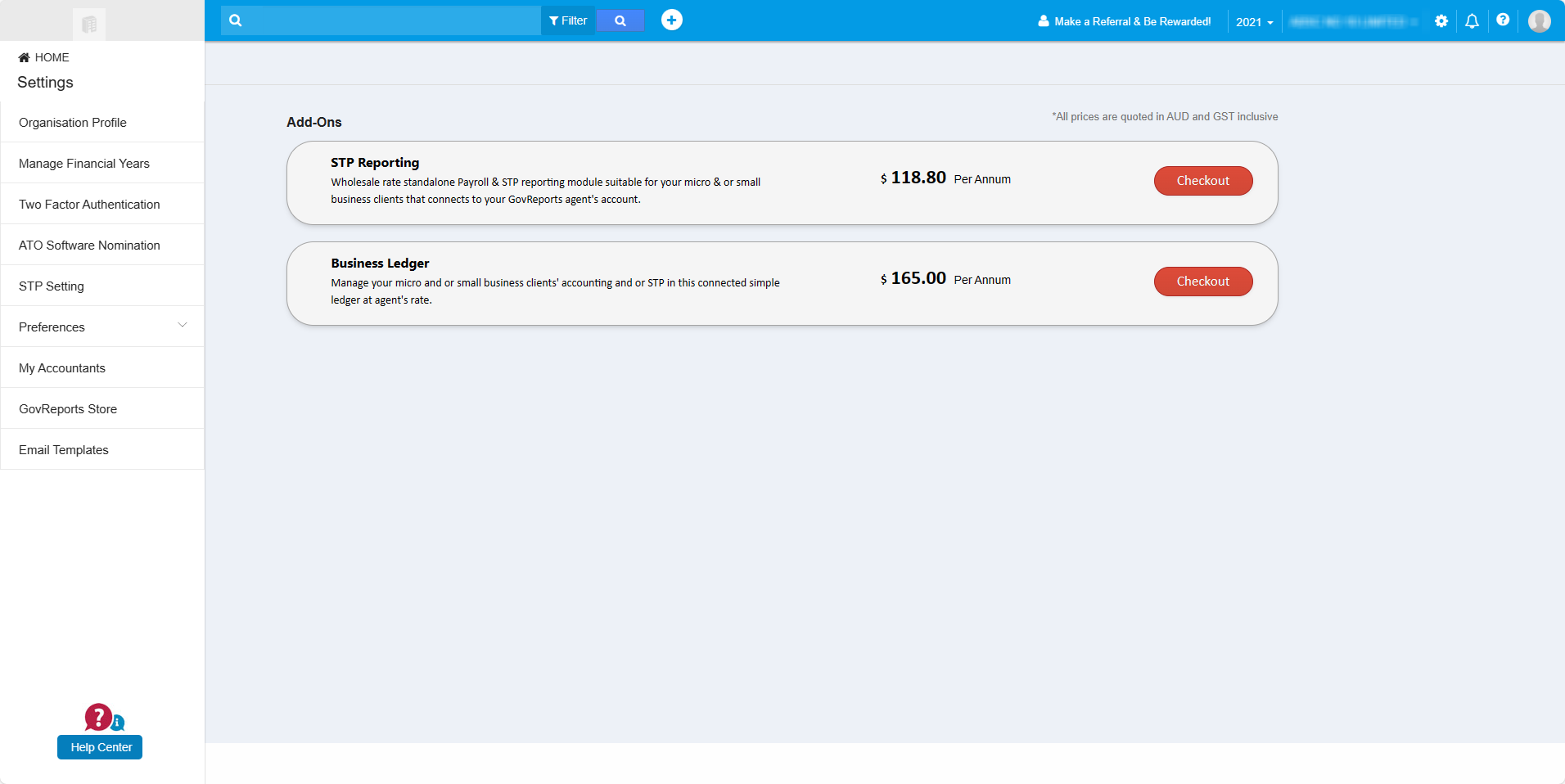

VII. Subscription: Top

Since you are in a trial version, there are 2 options for annual subscription.

STP Reporting - IAM is a simple standalone payroll application created to for micro and small business to prepare and lodge Single Touch Payroll direct to ATO. If you have less than 20 employees with simple payroll requirement, then GovReports STP Reporting is the right fit for you to meet Single Touch Payroll reporting obligation. You will have option to upload payrun events in CSV or simply manually enter the payroll details for simple payroll calculation and of course direct lodgment to ATO.

Business Ledger - A simple and easy to use business ledger built to meet micro and small business accounting and regulatory reporting needs. You will have options to upload data files for Sales, Expenses, Payroll events, receipts and or invoices, Bank Statements.. etc to create financial and compliant reports ready for direct lodgment. Reports available for lodgment include Activity Statements, Tax File Number Declaration, Single Touch Payroll & Business Tax Return. You may also engage your own tax or BAS agents to access and review your account and reports for lodgment if you need advice or that DIY is simply not your thing!

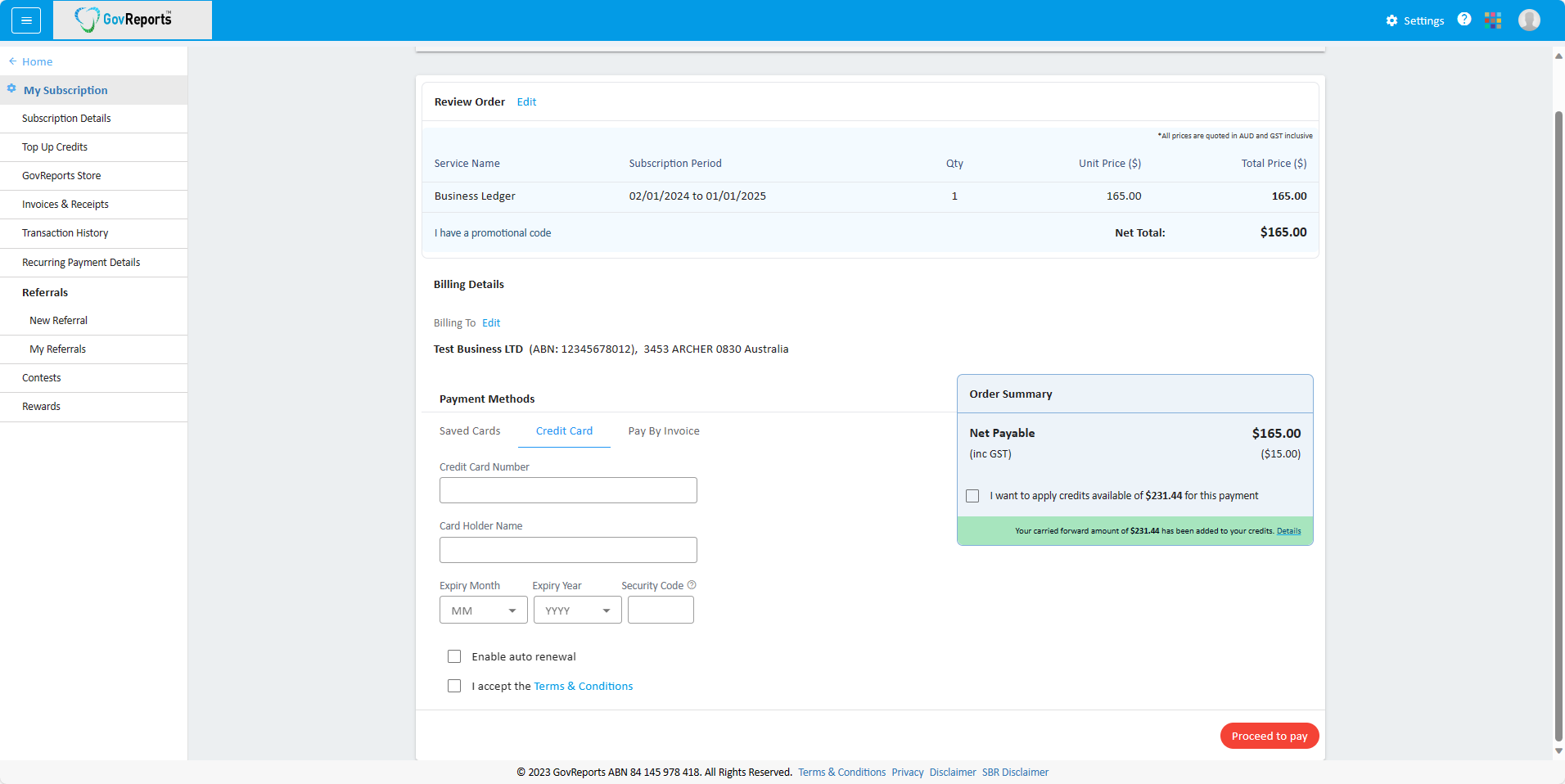

You can purchase the annual subscription

VIII. Accountants: Top

Your business payroll activities can be supported by an Accountant from our available list of Accountants. If your business doesn't have an Accountant assigned, you can request for an Accountant.

You can select an Accountant for your business to help with your payroll activities from GovReports authorized list of Accountants. You can also select them based on their location and proximity to your business.

Click on Accountants- > Request Accountants.

After reviewing their details, you can send an invitation for them to be your Accountant.

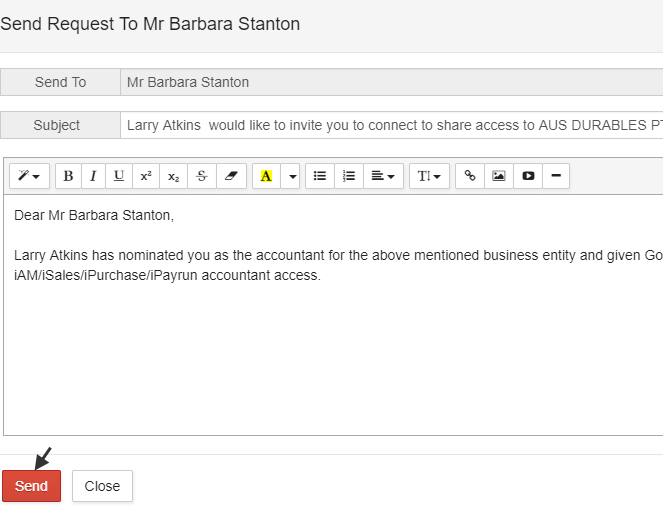

A default template is given. You can customize the email contents if you wish to send an invitation to the Accountant via Email.

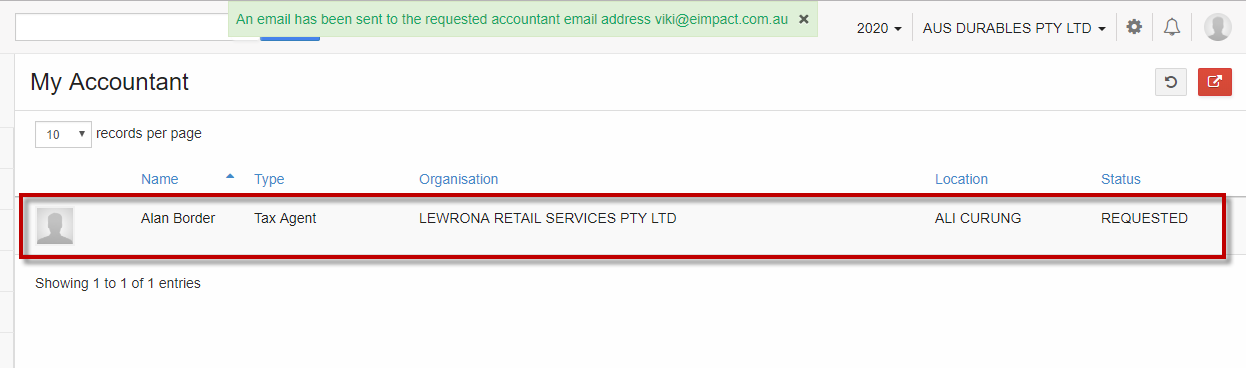

After sending the invitation, the "My Accountant" screen appears and you can see that Accountant under your list of Accountants in "Requested" status waiting for approval from their side.

In case, if you add another Accountant, you will have an option to terminate the already engaged or requested Accountant. This option is useful when you wish to change your Accountant. Click on Accountants- > Request for Accountants.

There will be a pop-up box asking for a confirmation to terminate the engaged or requested Accountant.

When you click "Ok", your existing Accountant will be terminated and invitation is sent to the new Accountant.

The Accountant list has a new Accountant in "Requested" status.

IX. ATO Software Nomination: Top

GovReports is a software used to lodge reports to ATO. So when your business is using GovReports as an authorized service provider for lodgments, the software ID of GovReports must be sent to ATO for its own record. This is known as ATO Software Nomination. In this setting, business can get a unique Software ID for their business to let ATO know that they are using authorized service provider, GovReports.

You must note down the Software ID, and use any one of the 2 methods to do the authentication either via Telephone or by clicking on "Access Manager from ATO portal" link.

The link redirects to this webpage https://blog.govreports.com.au/register-govreports-as-your-cloud-online-software-provider-with-the-ato/

Thus these 8 categories of settings can be used appropriately to your business.