Go Back

Salary Sacrifice

- Salary Sacrifice arrangement is when employees agree to forgo part of their future entitlement to salary or wages.

- The types of salary sacrifice benefits are fringe benefits, exempt benefits and super.

- Fringe benefits include cars, property and expense payments like child care and loan repayments.

- Exempt benefits include a general work related item like portable electronic device, or a briefcase

- Employer can pay the salary sacrifice amount to the super fund of the employee

-

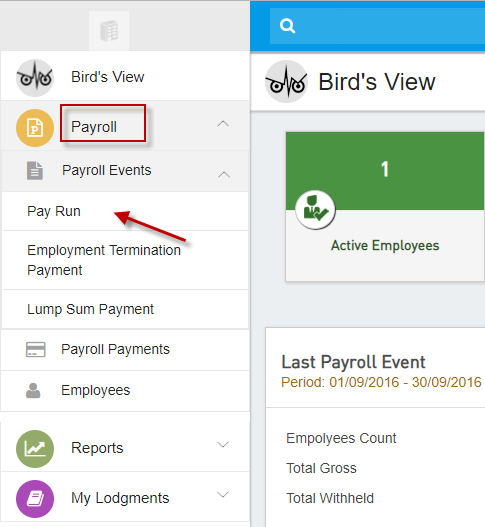

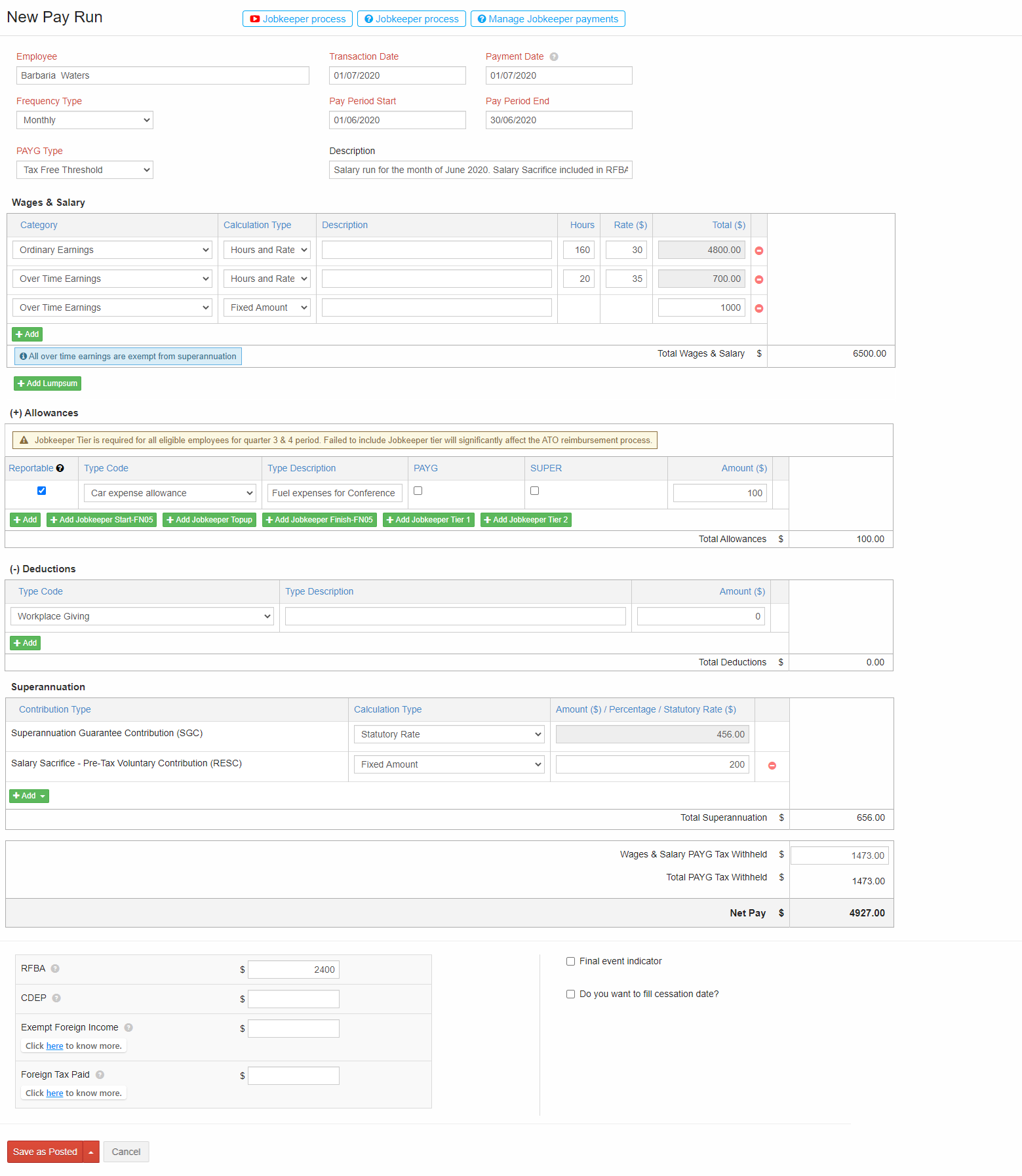

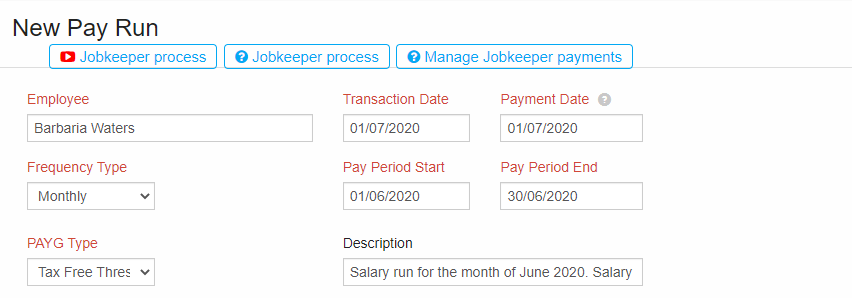

From the menu bar on the left, click on Payroll- > Payroll Events- > Pay Run

- Click on the plus sign on the top right corner to add a New Pay run

- Select the employee payroll page for payroll entries

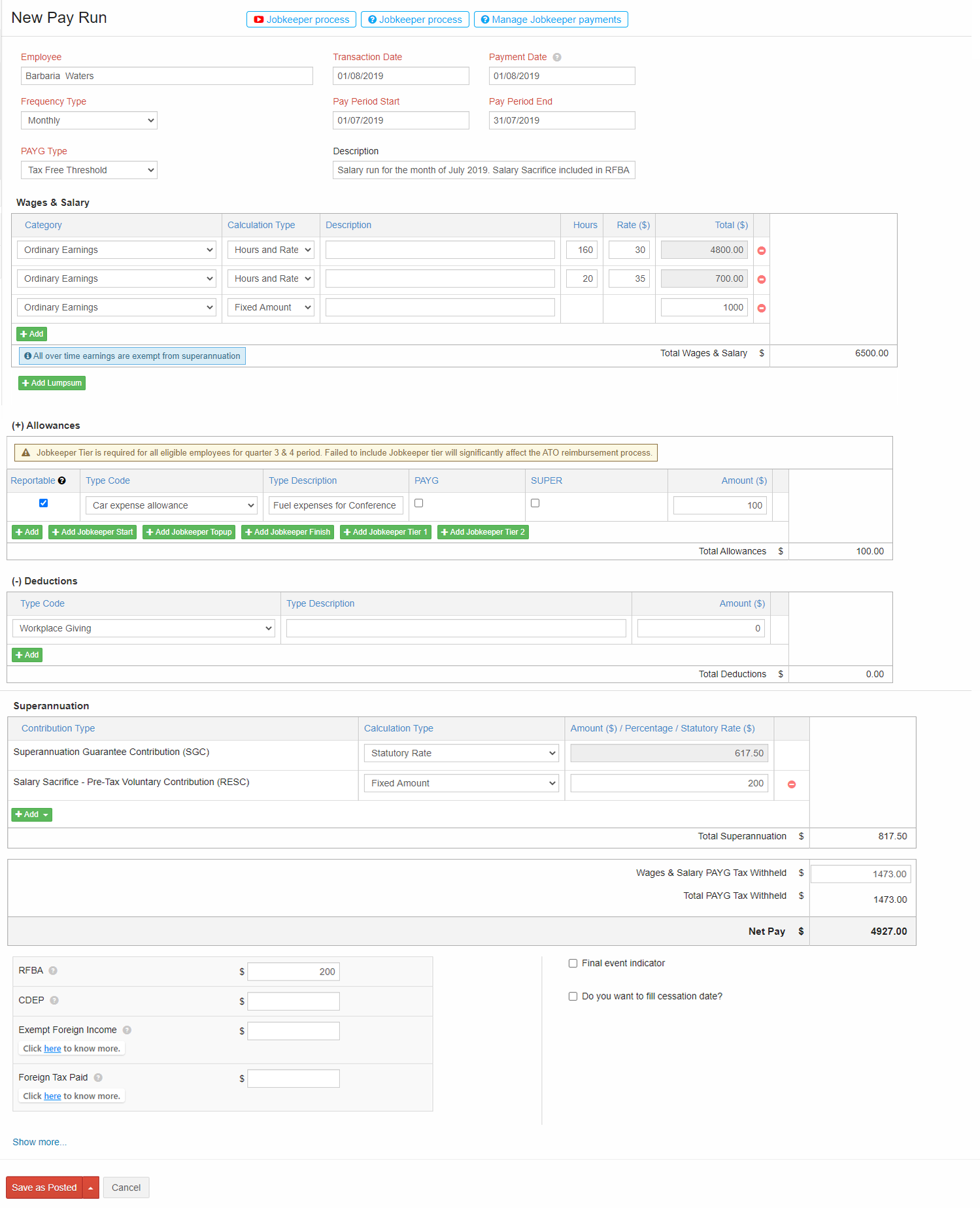

- You can enter the Salary Sacrifice Fringe Benefit amount in RFBA or Super amount in RESC column

- How to report fringe benefits in Reportable Fringe Benefit Amount [RFBA] and super amount in Reportable Employer Super Contribution [RESC] in STP Payroll Events?

-

You can report RFBA and RESC in payroll event in three different scenarios-

- Report Salary Sacrifice amount in every payroll event

- Report Salary Sacrifice amount Year to Date (YTD) figures in the last payroll event of the Financial year

- Report salary sacrifice amount as an Update Event

- Let's see an example of first 2 scenarios given above

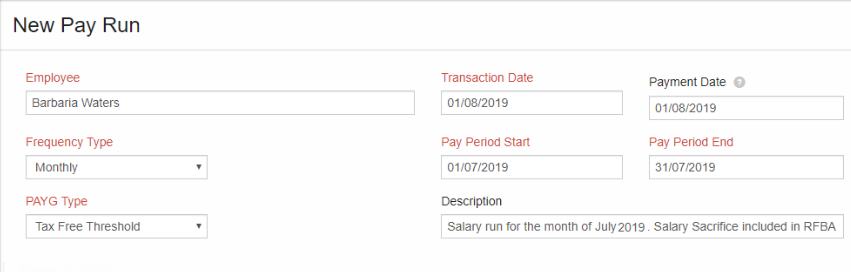

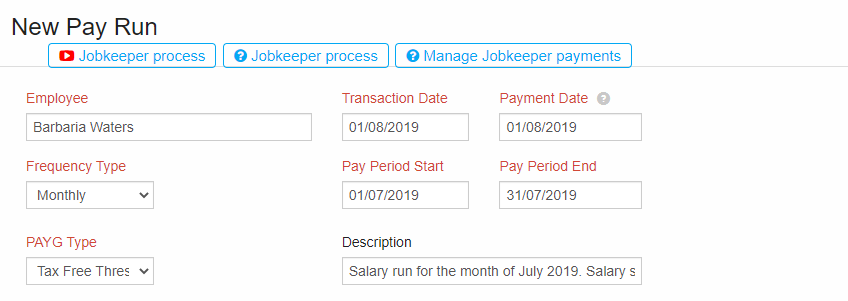

- For example, the employee "Barbaria Waters" has a monthly salary of $6000 of which $200 is subjected to Salary Sacrifice.

- Financial year starts from July 2019 to June 2020

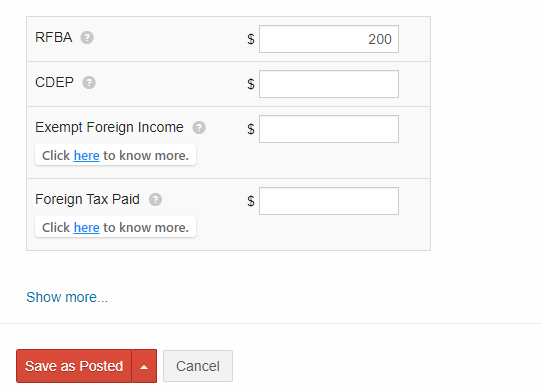

- Scenario 1 : - Report Salary Sacrifice amount RFBA in every Payroll Event.

-

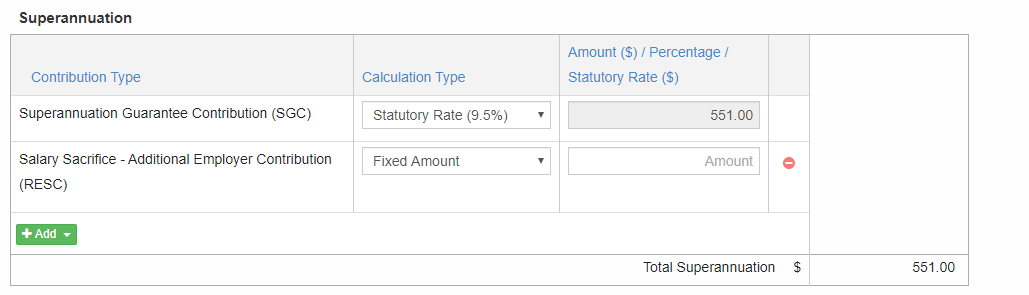

Payroll event 1 :

The pay is run for the month of July 2019 and paid on August 1, 2019.

-

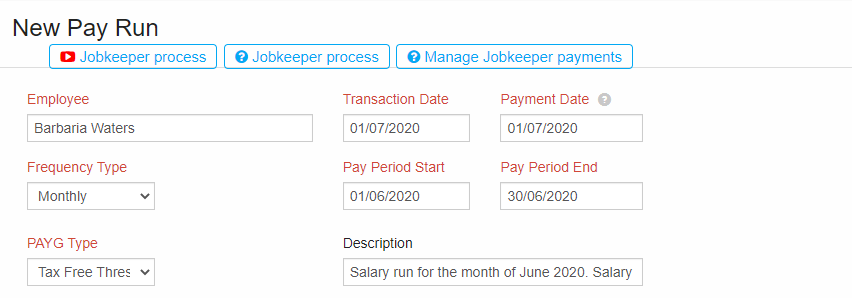

Payroll event 12:

The pay is run for the month of June 2020 and paid on July 1, 2020. This is the last Payroll event for the Financial Year 2019 to 2020.

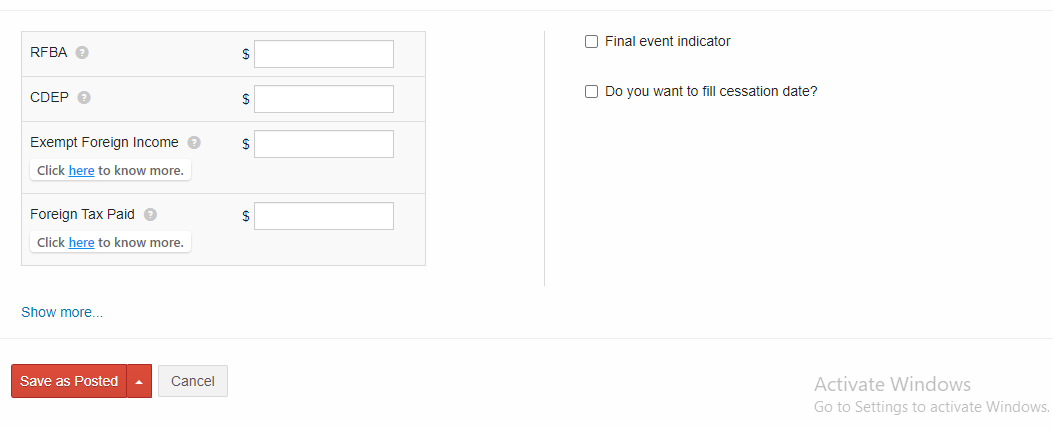

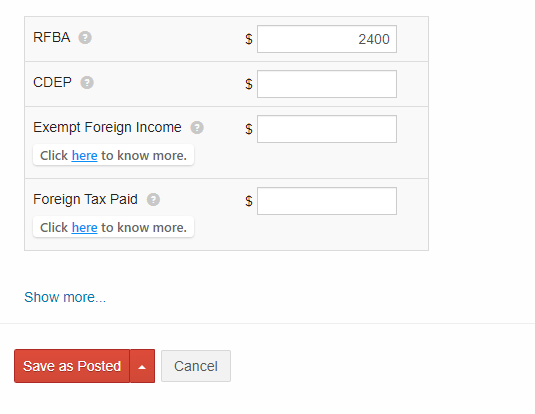

- Scenario 2 :- Report Salary Sacrifice RFBA, Year to Date figures in the last payroll event of the Financial Year.

- Include Salary Sacrifice RFBA Year to Date figures only in the last payroll event. $200 per month for 12 months is $2400.

-

Payroll event 1:

The pay is run for the month of July 2019 and paid on August 1, 2019 -

Since the RFBA amount is reported only at the last Payroll event, all the Payroll events from 1st month to 11th month does not report RFBA amount.

-

Payroll event 12:

The pay is run for the month of June 2020 and paid on July 1, 2020. This is the last payroll event for the financial year 2019 to 2020 and hence, the RFBA amount is reported in this pay event for the whole financial year.

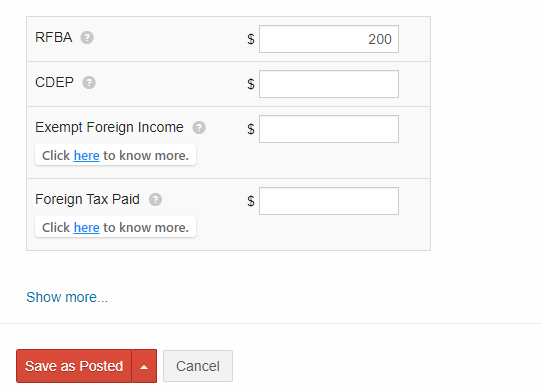

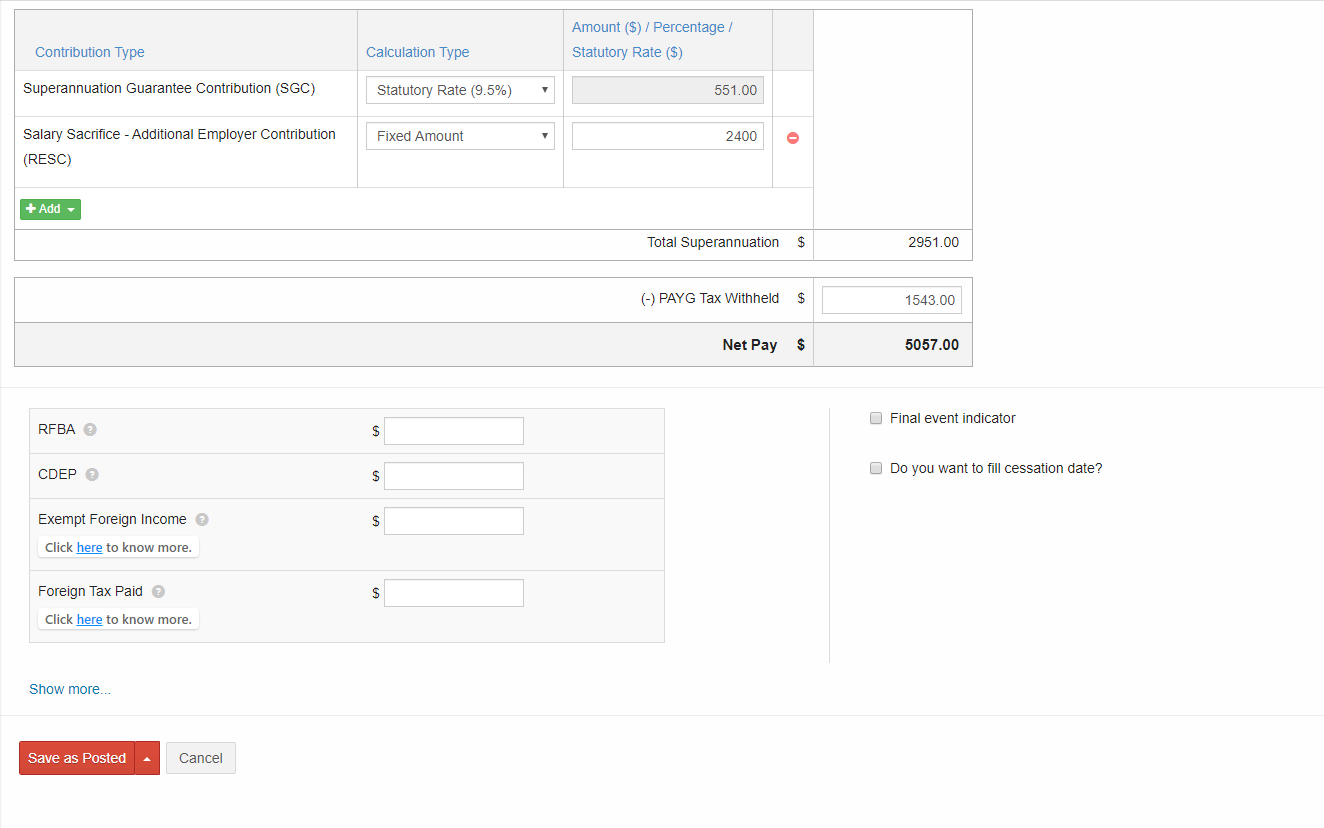

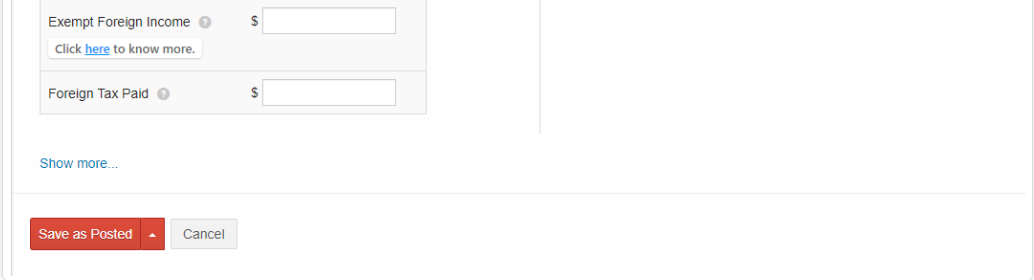

- After entering all the necessary fields, click on "Save as Posted". Thus the fringe benefit amount is calculated.

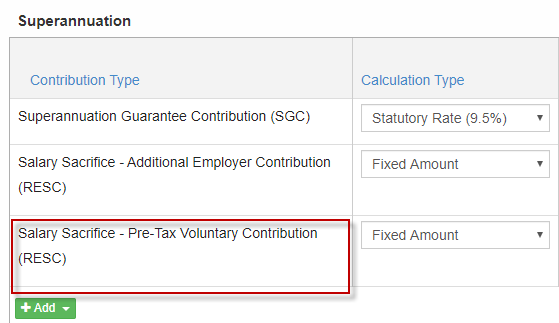

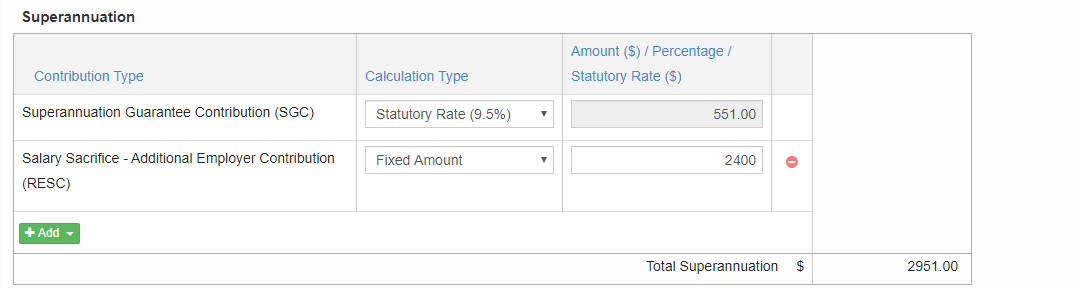

- Salary Sacrificed super contributions under an effective salary sacrifice arrangement are considered to be employer contributions. This can be reported in the Pay event in one among the two fields, Additional employer contribution RESC or Pre-Tax voluntary contribution RESC. RESC stands for Reportable Employer Super Contribution.

-

Additional Employer Contribution is when you as an employer, decide to deduct RESC from the employee's pay. The calculation type can be "Fixed Amount" or "Percentage of Earnings".

-

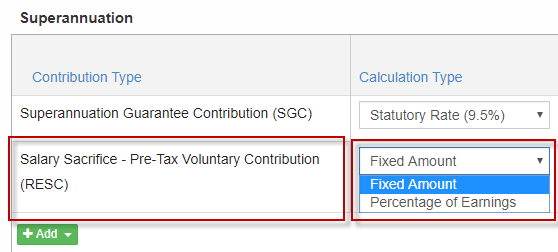

The second category is Salary Sacrifice - Pre-tax voluntary contribution. This is requested by employee to deduct RESC when getting paid. It provides the option to reduce PAYG.

- An employee can have his or her salary sacrifice arrangement on any one among the above two options in a single payroll event.

- Let's see how to report salary sacrifice RESC amount in the above 2 scenarios

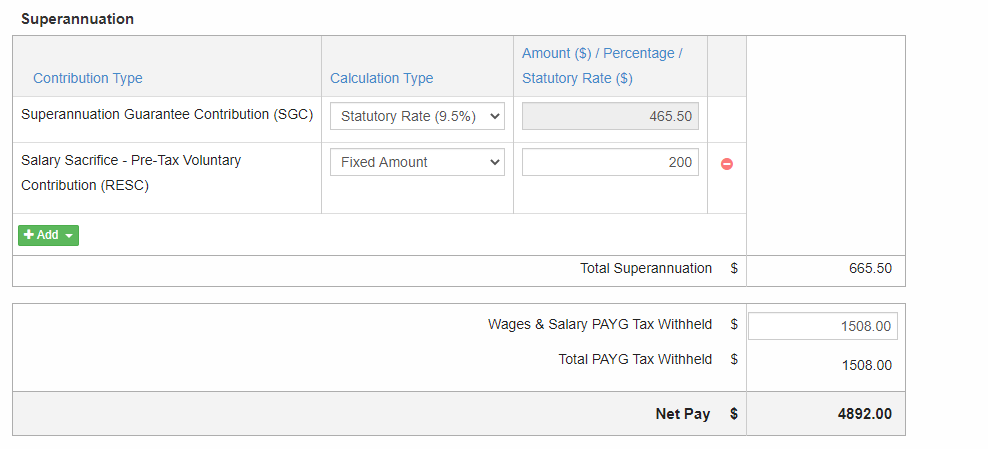

- Enter the amount under the field "RESC" with the required "calculation type". It could be a fixed amount or a percentage of earnings.

- Scenario 1: Report salary sacrifice amount RESC in every payroll event.

-

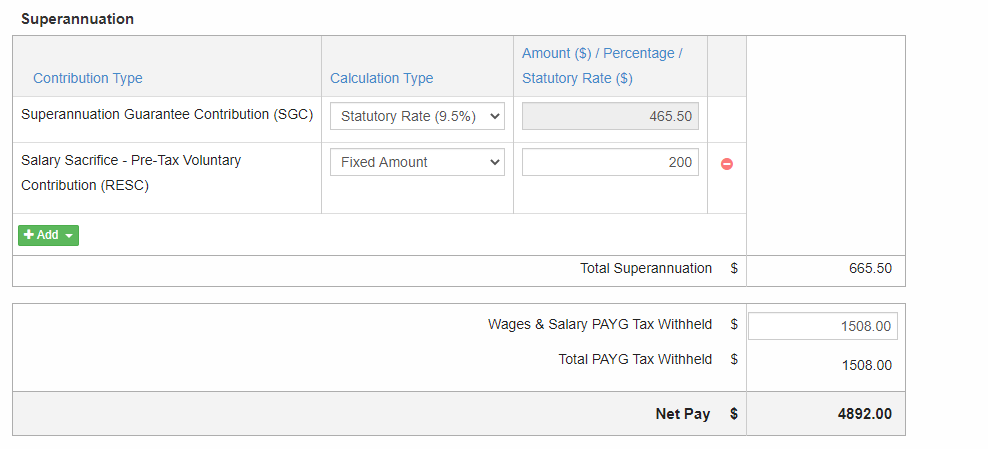

Payroll event 1: The pay is run for the month of July 2019 and paid on August 1, 2019.

-

Payroll event 12:

The pay is run for the month of June 2020 and paid on July 1, 2020. This is the last payroll event for the financial year 2019 to 2020

- Scenario 2 : Report Salary Sacrifice RESC, year to date figures in the last Payroll event of the financial year.

- Include Salary Sacrifice RESC Year to Date figures only in the last Payroll event. $200 per month for 12 months is $2400.

-

Payroll event 1:

The pay is run for the month of July 2019 and paid on August 1, 2019

-

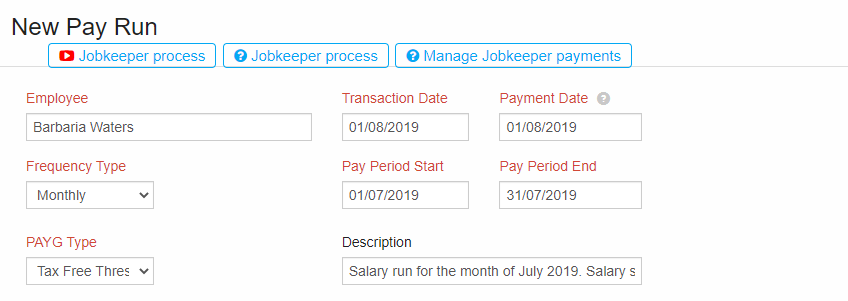

Since the RESC amount is reported only at the last Payroll event, all the Payroll events from 1st month to 11th month does not report RESC amount.

-

Payroll event 12:

The pay is run for the month of June 2020 and paid on July 1, 2020.

-

This is the last Payroll event for the financial year 2019 to 2020 and hence, the RESC amount is reported in this pay event for the whole financial year.

- Click on "Save as Posted" to save the pay run

- This way, you can add Salary Sacrifice arrangement amount either as a Fringe Benefit under RFBA field or as Superannuation amount under RESC field.